-

×

PRICE ACTION MASTERY

1 × $39.00

PRICE ACTION MASTERY

1 × $39.00 -

×

The TradingKey Mastering Elliott Wave with Hubb Financial

1 × $6.00

The TradingKey Mastering Elliott Wave with Hubb Financial

1 × $6.00 -

×

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00 -

×

MTPredictor Education Video 10 Gb

1 × $23.00

MTPredictor Education Video 10 Gb

1 × $23.00 -

×

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

Dan Sheridan Volatility Class

1 × $6.00

Dan Sheridan Volatility Class

1 × $6.00 -

×

London Super Conference 2019

1 × $62.00

London Super Conference 2019

1 × $62.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00

Learn About Trading Options From a Real Wallstreet Trader with Corey Halliday & Todd parker

1 × $6.00 -

×

Hiden Collective Factors in Speculative Trading with Bertrand Roehner

1 × $6.00

Hiden Collective Factors in Speculative Trading with Bertrand Roehner

1 × $6.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

The New Trading For a Living with Alexander Elder

1 × $23.00

The New Trading For a Living with Alexander Elder

1 × $23.00 -

×

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00 -

×

Introduction to Stocks & Forex

1 × $15.00

Introduction to Stocks & Forex

1 × $15.00 -

×

Options Masterclass with WallStreet Trapper

1 × $13.00

Options Masterclass with WallStreet Trapper

1 × $13.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Traders Seminars – 7 CD

1 × $31.00

Traders Seminars – 7 CD

1 × $31.00 -

×

THE HARMONIC ELLIOTT WAVE VIDEO WEBINAR with Ian Copsey

1 × $23.00

THE HARMONIC ELLIOTT WAVE VIDEO WEBINAR with Ian Copsey

1 × $23.00 -

×

90 Minute Cycle withThe Algo Trader

1 × $5.00

90 Minute Cycle withThe Algo Trader

1 × $5.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00 -

×

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

Candlesticks Trading Course

1 × $31.00

Candlesticks Trading Course

1 × $31.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

FMG Online Course with FMG Traders

1 × $6.00

FMG Online Course with FMG Traders

1 × $6.00 -

×

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00 -

×

Algorithmic Rules of Trend Lines

1 × $23.00

Algorithmic Rules of Trend Lines

1 × $23.00 -

×

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

One Shot One Kill Trading with John Netto

1 × $6.00

One Shot One Kill Trading with John Netto

1 × $6.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

The Next Wealth Transfer Investing in Gold and Silver

1 × $6.00

The Next Wealth Transfer Investing in Gold and Silver

1 × $6.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

Ambush Trading Method on Wheat & Corn with Marco Mayer

1 × $4.00

Ambush Trading Method on Wheat & Corn with Marco Mayer

1 × $4.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

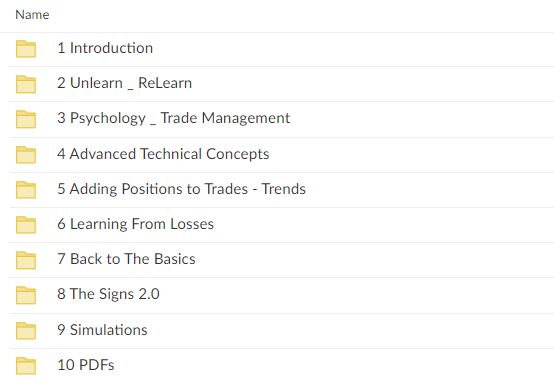

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.