-

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

SNR Trader Course with Ariff T

1 × $6.00

SNR Trader Course with Ariff T

1 × $6.00 -

×

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Tornado Trend Trading System with John Bartlett

1 × $6.00

Tornado Trend Trading System with John Bartlett

1 × $6.00 -

×

The Investors Guide to Active Asset Allocation with Martin Pring

1 × $6.00

The Investors Guide to Active Asset Allocation with Martin Pring

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

FX GOAT 3.0 (STRATEGIES) with FX GOAT FOREX TRADING ACADEMY

1 × $15.00

FX GOAT 3.0 (STRATEGIES) with FX GOAT FOREX TRADING ACADEMY

1 × $15.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

MACK - PATS Simple ES Scalping Strategy

1 × $15.00

MACK - PATS Simple ES Scalping Strategy

1 × $15.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

Rounded Bottom Breakout Multimedia Course

1 × $31.00

Rounded Bottom Breakout Multimedia Course

1 × $31.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00 -

×

Foundational Chart Analysis Series: Support / Resistance Techniques of Professional Traders 6 DVD Home Study Course

1 × $54.00

Foundational Chart Analysis Series: Support / Resistance Techniques of Professional Traders 6 DVD Home Study Course

1 × $54.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00 -

×

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00 -

×

Rocking Wall Street with Gary Marks

1 × $6.00

Rocking Wall Street with Gary Marks

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

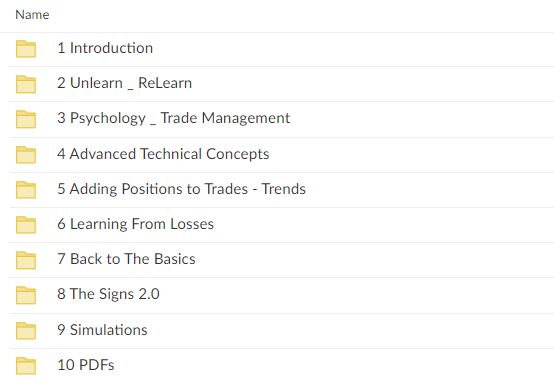

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.