-

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00 -

×

Stock Cycles with Michael Alexander

1 × $6.00

Stock Cycles with Michael Alexander

1 × $6.00 -

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

NJAT Trading Course with Not Just A Trade

1 × $6.00

NJAT Trading Course with Not Just A Trade

1 × $6.00 -

×

Evolved Traders with Riley Coleman

1 × $5.00

Evolved Traders with Riley Coleman

1 × $5.00 -

×

ChartEngineers Course

1 × $5.00

ChartEngineers Course

1 × $5.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Nora Bystra Legacy International Complete Course

1 × $6.00

Nora Bystra Legacy International Complete Course

1 × $6.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

The Internet Trading Course with Alpesh Patel

1 × $6.00

The Internet Trading Course with Alpesh Patel

1 × $6.00 -

×

Math for the Trades with LearningExpress

1 × $6.00

Math for the Trades with LearningExpress

1 × $6.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Professional Strategies For Trading The DAX

1 × $6.00

Professional Strategies For Trading The DAX

1 × $6.00 -

×

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00 -

×

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00 -

×

Introduction To The STRAT Course with Rob Smith

1 × $8.00

Introduction To The STRAT Course with Rob Smith

1 × $8.00 -

×

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Futures Foundation Program with SMS Capital

1 × $101.00

Futures Foundation Program with SMS Capital

1 × $101.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00 -

×

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

SOT Intermediate Course (May 2014)

1 × $23.00

SOT Intermediate Course (May 2014)

1 × $23.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00 -

×

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

TOP Momentum Bundle with Top Trade Tools

1 × $62.00

TOP Momentum Bundle with Top Trade Tools

1 × $62.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

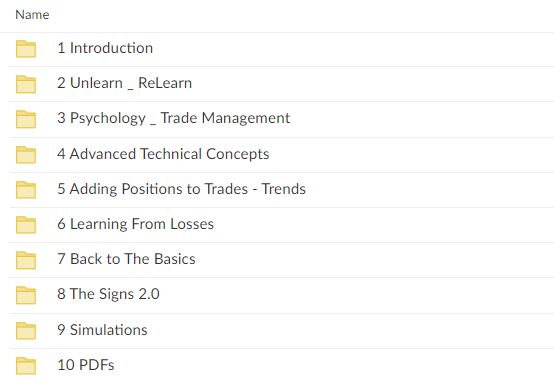

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.