-

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

New Foundations for Auction Market Trading Course with Tom Alexander

1 × $54.00

New Foundations for Auction Market Trading Course with Tom Alexander

1 × $54.00 -

×

The Aime Workshop with Clay Marafiote

1 × $6.00

The Aime Workshop with Clay Marafiote

1 × $6.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

FXJake Webinars with Walter Peters

1 × $6.00

FXJake Webinars with Walter Peters

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

MQ Gravity Lines with Base Camp Trading

1 × $54.00

MQ Gravity Lines with Base Camp Trading

1 × $54.00 -

×

Scanning For Gold with Doug Sutton

1 × $6.00

Scanning For Gold with Doug Sutton

1 × $6.00 -

×

Learn Plan Profit – How To Trade Stocks

1 × $15.00

Learn Plan Profit – How To Trade Stocks

1 × $15.00 -

×

How to Profit in Gold with Jonathan Spall

1 × $6.00

How to Profit in Gold with Jonathan Spall

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Stock Trading Wizard

1 × $6.00

Stock Trading Wizard

1 × $6.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Tradezilla 2.0

1 × $5.00

Tradezilla 2.0

1 × $5.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

All in One Forex Course with VintagEducation

1 × $31.00

All in One Forex Course with VintagEducation

1 × $31.00 -

×

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

Simpler Options - Double Diagonals Class

1 × $6.00

Simpler Options - Double Diagonals Class

1 × $6.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Sell & Sell Short with Alexander Elder

1 × $6.00

Sell & Sell Short with Alexander Elder

1 × $6.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

The Complete Guide to Spread Trading

1 × $6.00

The Complete Guide to Spread Trading

1 × $6.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

Trading The E-Minis for a Living with Don Miller

1 × $6.00

Trading The E-Minis for a Living with Don Miller

1 × $6.00 -

×

Spotting Solid Short-Term Opportunities

1 × $6.00

Spotting Solid Short-Term Opportunities

1 × $6.00 -

×

Complete Series

1 × $31.00

Complete Series

1 × $31.00 -

×

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

Master Trader Course

1 × $23.00

Master Trader Course

1 × $23.00 -

×

George Bayer Soft 1.02

1 × $6.00

George Bayer Soft 1.02

1 × $6.00 -

×

Options For Gold, Oil and Other Commodities

1 × $6.00

Options For Gold, Oil and Other Commodities

1 × $6.00 -

×

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

NFTMastermind with Charting Wizards

1 × $5.00

NFTMastermind with Charting Wizards

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

PROPRIETARY TRADING PROGRAM with Bid Ask Trader

1 × $31.00

PROPRIETARY TRADING PROGRAM with Bid Ask Trader

1 × $31.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00 -

×

ICT Trading Models with The Prop Trader

1 × $5.00

ICT Trading Models with The Prop Trader

1 × $5.00 -

×

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00 -

×

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00 -

×

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

HOW TO TRADE GAPS

1 × $15.00

HOW TO TRADE GAPS

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

Sample Item Sets 2003 - CFA Level 3

1 × $6.00

Sample Item Sets 2003 - CFA Level 3

1 × $6.00 -

×

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00 -

×

Market Controller Course with Controller FX

1 × $5.00

Market Controller Course with Controller FX

1 × $5.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00 -

×

How the Stock Market Works with Ramon DeGennaro

1 × $5.00

How the Stock Market Works with Ramon DeGennaro

1 × $5.00 -

×

Dominate Stocks 2020 with J. Bravo

1 × $6.00

Dominate Stocks 2020 with J. Bravo

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00 -

×

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00 -

×

Investing in 401k Plans with Cliffsnotes

1 × $6.00

Investing in 401k Plans with Cliffsnotes

1 × $6.00 -

×

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Forex Strategy Course with Angel Traders

1 × $6.00

Forex Strategy Course with Angel Traders

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00 -

×

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00 -

×

Generating Consistent Profits On Smaller Accounts

1 × $23.00

Generating Consistent Profits On Smaller Accounts

1 × $23.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00 -

×

Edge Trading Group with Edge Elite

1 × $6.00

Edge Trading Group with Edge Elite

1 × $6.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

The 1st Leveraged ETF Trading Strategies Workshop

1 × $54.00

The 1st Leveraged ETF Trading Strategies Workshop

1 × $54.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

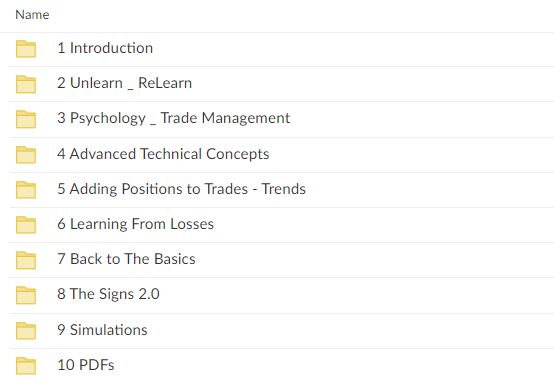

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.