-

×

Support Resistance

1 × $23.00

Support Resistance

1 × $23.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

FOREX CRASH COURSE - IYF - ONLINE SEMINAR

1 × $5.00

FOREX CRASH COURSE - IYF - ONLINE SEMINAR

1 × $5.00 -

×

Drewize Banks Course

1 × $5.00

Drewize Banks Course

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Lazy Gap Trader Course with David Frost

1 × $6.00

Lazy Gap Trader Course with David Frost

1 × $6.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00 -

×

Introduction to Macro Investing with Mike Singleton

1 × $31.00

Introduction to Macro Investing with Mike Singleton

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Quantitative Finance & Algorithmic Trading in Python with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading in Python with Holczer Balazs

1 × $4.00 -

×

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00 -

×

Duration Iron Condors Class: An Income Strategy for All Markets with Don Kaufman

1 × $6.00

Duration Iron Condors Class: An Income Strategy for All Markets with Don Kaufman

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Angel Capital How to Raise Early-Stage Private Equity Financing with Gerald A. Benjamin, Joel B. Margulis

1 × $6.00

Angel Capital How to Raise Early-Stage Private Equity Financing with Gerald A. Benjamin, Joel B. Margulis

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

Hustle Trading FX Course

1 × $10.00

Hustle Trading FX Course

1 × $10.00 -

×

Forex 201 - Advanced Strategies with Stonehill Forex

1 × $5.00

Forex 201 - Advanced Strategies with Stonehill Forex

1 × $5.00 -

×

Artificial Intelligence with Larry Pesavento

1 × $6.00

Artificial Intelligence with Larry Pesavento

1 × $6.00 -

×

The 5 Day Momentum Method

1 × $6.00

The 5 Day Momentum Method

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00 -

×

FX Utopia

1 × $6.00

FX Utopia

1 × $6.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00 -

×

Finding Top Secret Statagies with AlphaShark Trading

1 × $109.00

Finding Top Secret Statagies with AlphaShark Trading

1 × $109.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

Scalping is Fun Course with Peter Devaere

1 × $109.00

Scalping is Fun Course with Peter Devaere

1 × $109.00 -

×

The Dynamic Trend Confirmation Indicator with Alphashark

1 × $54.00

The Dynamic Trend Confirmation Indicator with Alphashark

1 × $54.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00 -

×

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Investing Under Fire with Alan R.Ackerman

1 × $6.00

Investing Under Fire with Alan R.Ackerman

1 × $6.00 -

×

Finding and Analyzing Stocks on your PC with Peter Worden

1 × $4.00

Finding and Analyzing Stocks on your PC with Peter Worden

1 × $4.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00 -

×

Candlesticks Trading Course

1 × $31.00

Candlesticks Trading Course

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00 -

×

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00 -

×

Part-Time Day Trading Courses

1 × $54.00

Part-Time Day Trading Courses

1 × $54.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

OrderFlows Trader Package, (Sep 2015)

1 × $54.00

OrderFlows Trader Package, (Sep 2015)

1 × $54.00 -

×

PowerWave Trading with Dar Wong

1 × $4.00

PowerWave Trading with Dar Wong

1 × $4.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

The BULLFx Forex Trading Course

1 × $5.00

The BULLFx Forex Trading Course

1 × $5.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

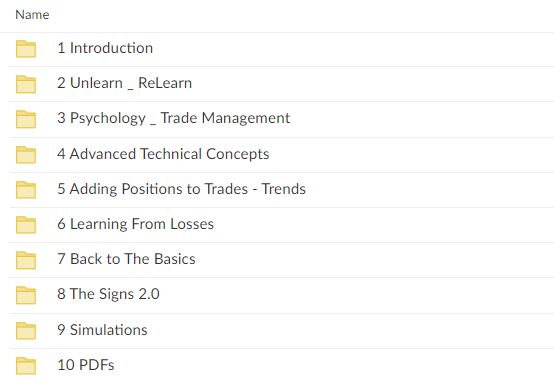

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.