-

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

Golden Pips Generator - DMA HACK with Hooman

1 × $62.00

Golden Pips Generator - DMA HACK with Hooman

1 × $62.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00 -

×

Lazy Emini Trader Master Class

1 × $15.00

Lazy Emini Trader Master Class

1 × $15.00 -

×

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

Trend Trading My Way with Markay Latimer

1 × $15.00

Trend Trading My Way with Markay Latimer

1 × $15.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

LT Pulse and LT Trend/Ultra

1 × $23.00

LT Pulse and LT Trend/Ultra

1 × $23.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Rocking Wall Street with Gary Marks

1 × $6.00

Rocking Wall Street with Gary Marks

1 × $6.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00 -

×

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Profit Before Work System with John Piper

1 × $6.00

Profit Before Work System with John Piper

1 × $6.00 -

×

Carolyn Boroden Package

1 × $15.00

Carolyn Boroden Package

1 × $15.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

How To Write High Converting Copy with Tej Dosa

1 × $6.00

How To Write High Converting Copy with Tej Dosa

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00 -

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

San Jose Options - Iron Condor & Butterfly Options Trading Videos

1 × $15.00

San Jose Options - Iron Condor & Butterfly Options Trading Videos

1 × $15.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

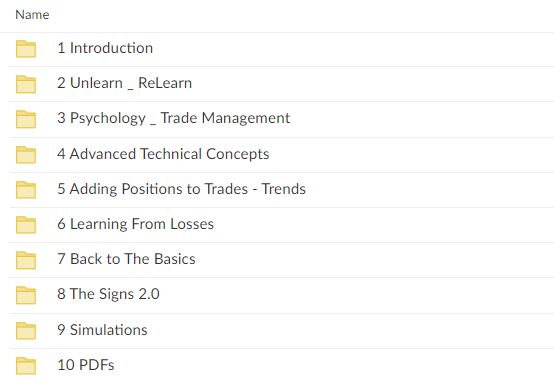

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.