-

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

SE ELITE COURSE with SE TRADINGX

1 × $5.00

SE ELITE COURSE with SE TRADINGX

1 × $5.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

Range Trading with D.Singleton

1 × $6.00

Range Trading with D.Singleton

1 × $6.00 -

×

How to Trade Stock Options Course

1 × $6.00

How to Trade Stock Options Course

1 × $6.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

RROP Course 2023

1 × $5.00

RROP Course 2023

1 × $5.00 -

×

Outperforming the Market with John Merrill

1 × $6.00

Outperforming the Market with John Merrill

1 × $6.00 -

×

Private Ephemeris 1941-1950

1 × $23.00

Private Ephemeris 1941-1950

1 × $23.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00 -

×

Read The Market RTM Master Trader Course + Journals

1 × $5.00

Read The Market RTM Master Trader Course + Journals

1 × $5.00 -

×

Forecast, Filings, & News with Jtrader

1 × $6.00

Forecast, Filings, & News with Jtrader

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Investing Under Fire with Alan R.Ackerman

1 × $6.00

Investing Under Fire with Alan R.Ackerman

1 × $6.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

Artificial Intelligence with Larry Pesavento

1 × $6.00

Artificial Intelligence with Larry Pesavento

1 × $6.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00 -

×

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00 -

×

Stock Market–Swing Trading Strategies for Wall Street with Bill Wermin

1 × $6.00

Stock Market–Swing Trading Strategies for Wall Street with Bill Wermin

1 × $6.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Learn Before you Loose

1 × $6.00

Learn Before you Loose

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00 -

×

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00 -

×

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00 -

×

Stonhill Forex 201 Advanced Course

1 × $5.00

Stonhill Forex 201 Advanced Course

1 × $5.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

Gold. Symmetrycs Trading Method with Joseph Rondione

1 × $6.00

Gold. Symmetrycs Trading Method with Joseph Rondione

1 × $6.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

How I Trade Options with Jon Najarian

1 × $4.00

How I Trade Options with Jon Najarian

1 × $4.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

Advanced Stock Trading Course + Strategies

1 × $15.00

Advanced Stock Trading Course + Strategies

1 × $15.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

Japanese Trading Systems with Tradesmart University

1 × $9.00

Japanese Trading Systems with Tradesmart University

1 × $9.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

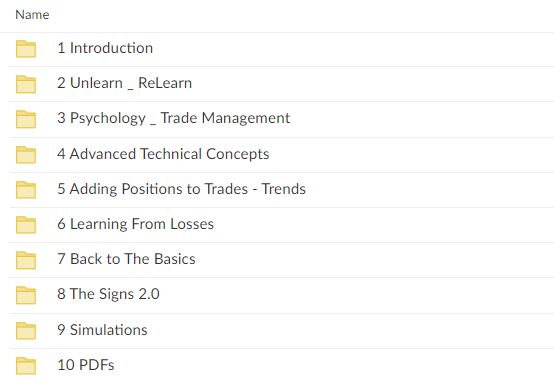

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.