-

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Investments (6th Ed.)

1 × $6.00

Investments (6th Ed.)

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Mission Million Money Management Course

1 × $31.00

Mission Million Money Management Course

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Momentum Options Trading Course with Eric Jellerson

1 × $272.00

Momentum Options Trading Course with Eric Jellerson

1 × $272.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Swinging For The Fences

1 × $15.00

Swinging For The Fences

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

1 × $6.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00 -

×

Trading System Development 101,102,103

1 × $6.00

Trading System Development 101,102,103

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Strategies with Larry Sanders

1 × $6.00

Trading Strategies with Larry Sanders

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Overnight Trading with Nightly Patterns

1 × $5.00

Overnight Trading with Nightly Patterns

1 × $5.00 -

×

Volume Profile Trading Strategy with Critical Trading

1 × $15.00

Volume Profile Trading Strategy with Critical Trading

1 × $15.00 -

×

AnswerStock with Timothy Sykes

1 × $5.00

AnswerStock with Timothy Sykes

1 × $5.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

TopTradeTools - Trend Breakout Levels

1 × $15.00

TopTradeTools - Trend Breakout Levels

1 × $15.00 -

×

Random Walk Trading - J.L.Lord - Option Greeks for Profit

1 × $15.00

Random Walk Trading - J.L.Lord - Option Greeks for Profit

1 × $15.00 -

×

Intern. Applications Of U S Income Tax Law Inbound And Outbound Transactions with Ernest R.Larkins

1 × $6.00

Intern. Applications Of U S Income Tax Law Inbound And Outbound Transactions with Ernest R.Larkins

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

Forex Strategy Course with Angel Traders

1 × $6.00

Forex Strategy Course with Angel Traders

1 × $6.00 -

×

Options University - FX Technical Analysis

1 × $6.00

Options University - FX Technical Analysis

1 × $6.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Introduction to Amibroker with Howard B.Bandy

1 × $6.00

Introduction to Amibroker with Howard B.Bandy

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Profiletraders - Market Profile Day Trading

1 × $15.00

Profiletraders - Market Profile Day Trading

1 × $15.00 -

×

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00 -

×

Debt Capital Markets in China with Jian Gao

1 × $6.00

Debt Capital Markets in China with Jian Gao

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00 -

×

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

The Bollinger Bands Swing Trading System 2004 with Larry Connors

1 × $6.00

The Bollinger Bands Swing Trading System 2004 with Larry Connors

1 × $6.00 -

×

Options For Gold, Oil and Other Commodities

1 × $6.00

Options For Gold, Oil and Other Commodities

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Create A Forex Trading Cash Money Machine

1 × $54.00

Create A Forex Trading Cash Money Machine

1 × $54.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

License to Steal with John Carlton

1 × $6.00

License to Steal with John Carlton

1 × $6.00 -

×

Professional Trader Training Course (Complete)

1 × $23.00

Professional Trader Training Course (Complete)

1 × $23.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Manage By The Greeks 2016 with Sheridan

1 × $6.00

Manage By The Greeks 2016 with Sheridan

1 × $6.00 -

×

Imperial FX Academy

1 × $5.00

Imperial FX Academy

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Gannline. Total School Package

1 × $6.00

Gannline. Total School Package

1 × $6.00 -

×

Graphs, Application to Speculation with George Cole

1 × $6.00

Graphs, Application to Speculation with George Cole

1 × $6.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00 -

×

CalendarMAX with Hari Swaminathan

1 × $15.00

CalendarMAX with Hari Swaminathan

1 × $15.00 -

×

The Next Great Bubble Boom: How to Profit from the Greatest Boom in History with Harry S.Dent

1 × $6.00

The Next Great Bubble Boom: How to Profit from the Greatest Boom in History with Harry S.Dent

1 × $6.00 -

×

Beginner Options Trading Class with Bill Johnson

1 × $6.00

Beginner Options Trading Class with Bill Johnson

1 × $6.00 -

×

Learning How to Successfully Trade the E-mini & S&P 500 Markets

1 × $6.00

Learning How to Successfully Trade the E-mini & S&P 500 Markets

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Objective Evaluation of Indicators with Constance Brown

1 × $6.00

Objective Evaluation of Indicators with Constance Brown

1 × $6.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

The Best of the Professional Traders Journal: Options Trading and Volatility Trading with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal: Options Trading and Volatility Trading with Larry Connors

1 × $6.00 -

×

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Growing Rich with Growth Stocks: Wall Street's Top Money Managers Reveal the 12 Rules for Investment Success - Kirk Kazanjian

1 × $6.00

Growing Rich with Growth Stocks: Wall Street's Top Money Managers Reveal the 12 Rules for Investment Success - Kirk Kazanjian

1 × $6.00 -

×

Advanced Symmetrics Mental Harmonics Course

1 × $15.00

Advanced Symmetrics Mental Harmonics Course

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00

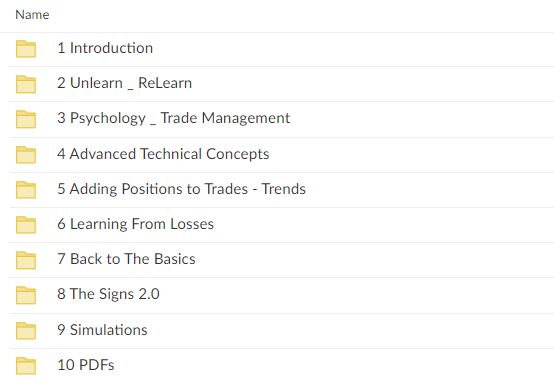

Unlearn and Relearn with Market Fluidity

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 13.35 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Unlearn and Relearn with Market Fluidity” below:

Transform Your Trading Mindset: Unlearn and Relearn with Market Fluidity

Introduction to Market Fluidity

Unlock your trading potential by embracing the revolutionary concept of Market Fluidity. This approach challenges traders to unlearn traditional methods and relearn through a dynamic understanding of market movements.

What is Market Fluidity?

Market Fluidity is a unique trading philosophy that emphasizes the importance of adapting to the ever-changing market conditions rather than sticking rigidly to static trading strategies.

Why Adopt Market Fluidity?

Adopting Market Fluidity can significantly enhance your trading effectiveness by promoting flexibility and responsiveness to market signals.

Core Principles of Market Fluidity

Embracing Change

- Understand the necessity of evolving your trading strategies to stay relevant in fluid markets.

The Power of Adaptation

- Learn how to quickly adjust your strategies based on real-time market data.

Overcoming Mental Barriers

- Strategies to let go of outdated beliefs and practices that hinder trading success.

Unlearning Traditional Concepts

Breaking from Conventions

- Challenge and critically evaluate traditional trading dogmas that may no longer be effective.

Myth-Busting in Trading

- Debunk common trading myths that can lead to costly mistakes.

The Importance of Behavioral Flexibility

- How embracing change can lead to better trading decisions.

Relearning Through Market Fluidity

Dynamic Strategy Development

- Crafting strategies that evolve with market conditions.

- Implementing responsive tactics that capitalize on market trends.

Continuous Learning and Growth

- Emphasize the importance of ongoing education and staying informed about market dynamics.

Integrating New Tools and Techniques

- How to incorporate modern trading tools and analytics into your strategies.

Practical Application of Market Fluidity

Case Studies

- Real-world examples of traders who successfully applied Market Fluidity principles.

Live Market Analysis

- Demonstrations of how to analyze and respond to live market conditions.

Building a Fluid Trading Plan

- Steps to create a flexible and adaptive trading plan.

Advanced Concepts in Market Fluidity

Understanding Market Sentiment

- Techniques to gauge and utilize market sentiment for trading decisions.

Leveraging Economic Indicators

- How economic indicators can inform more fluid trading strategies.

The Role of Psychological Resilience

- Developing the mental toughness required to implement a fluid trading approach.

Market Fluidity Success Stories

Testimonials and Success Rates

- Stories from traders who have embraced Market Fluidity and transformed their trading careers.

Insights from the Creators

- Expert insights from the founders of the Market Fluidity approach.

Continuous Adaptation and Success

- How continual learning and adaptation lead to sustained trading success.

Conclusion

Market Fluidity is not just a trading strategy but a transformative approach that requires traders to constantly learn, adapt, and evolve. By unlearning outdated methods and relearning how to interpret and respond to the market with agility, traders can significantly enhance their performance and stay competitive in the dynamic trading environment.

FAQs

- What exactly does it mean to “unlearn and relearn” in trading?

- It involves letting go of obsolete trading practices and adopting new, adaptive strategies based on current market conditions.

- How can a trader start implementing Market Fluidity?

- Begin by critically assessing current strategies, staying updated with market trends, and being open to changing tactics as needed.

- Is Market Fluidity suitable for novice traders?

- Yes, it’s designed for all levels of traders who are willing to adopt a flexible and dynamic approach to trading.

- What are the key benefits of adopting Market Fluidity?

- Increased adaptability to market changes, improved decision-making processes, and enhanced potential for profitability.

- How often should trading strategies be reviewed and adjusted in Market Fluidity?

- Continuously, as part of an ongoing process to align strategies with current market behaviors and outcomes.

Be the first to review “Unlearn and Relearn with Market Fluidity” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.