-

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Algorithmic Trading Systems: Advanced Gap Strategies for the Futures Markets with David Bean

1 × $5.00

Algorithmic Trading Systems: Advanced Gap Strategies for the Futures Markets with David Bean

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Trader with Nikos Trading Academy

1 × $5.00

Advanced Trader with Nikos Trading Academy

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

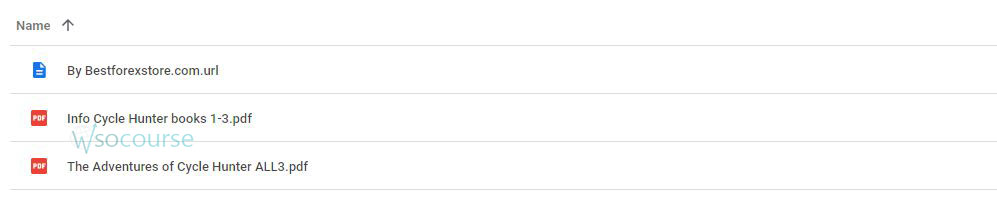

Cycle Hunter Books 1-3 with Brian James Sklenka

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Cycle Hunter Books 1-3 with Brian James Sklenka” below:

Cycle Hunter Books 1-3 with Brian James Sklenka

Introduction

In the fascinating series “Cycle Hunter Books” by Brian James Sklenka, readers are taken on a journey through the intricate world of market cycles. This trilogy not only enlightens traders about historical patterns but also equips them with strategies to anticipate and capitalize on financial market fluctuations.

Overview of the Series

Book 1: Understanding Market Cycles

The first installment lays the foundation, introducing the concept of market cycles and their significance in trading.

Book 2: Applying Cycle Theories

In the second book, Sklenka delves deeper, showing how to apply these theories in real-world trading scenarios.

Book 3: Mastering Market Timing

The final book focuses on refining the skills needed to accurately time the markets, a crucial ability for any trader.

Key Concepts Explained

The Nature of Market Cycles

- What Are Market Cycles? Repetitive patterns in market behavior that occur over various timeframes.

The Importance of Timing

- Why Timing Matters: Capturing the best entry and exit points maximizes profitability.

Tools and Techniques

Chart Analysis

Utilize charts to identify cycle patterns and predict future movements.

- Examples of Tools: Fibonacci retracement, Elliott Wave theory.

Statistical Methods

Apply statistical tools to validate cycle theories and enhance accuracy.

- Key Techniques: Regression analysis, standard deviation measurements.

Brian James Sklenka’s Insights

Historical Patterns

Sklenka emphasizes learning from past market behaviors to predict future trends.

Psychological Factors

Understanding the psychological drivers behind market movements is crucial for cycle analysis.

Practical Application

Case Studies

Real-world examples of how cycle theory has been successfully applied to profit from the markets.

Strategies for Traders

Specific strategies that can be employed based on cycle predictions.

Challenges and Solutions

Common Pitfalls

- Overreliance on Patterns: Caution against expecting historical patterns to repeat without fail.

- Solution: Combine cycle analysis with other trading indicators.

Adapting to Market Changes

- Challenge: Rapidly changing markets can render some cycle theories obsolete.

- Solution: Stay flexible and update strategies as market conditions evolve.

The Role of Technology

Technological Advancements

How modern technology can enhance the identification and analysis of market cycles.

Software and Tools

Recommendations for software that specializes in cycle analysis.

Enhancing Trading Discipline

Importance of Discipline

Sklenka stresses the need for strict discipline in following cycle-based trading strategies.

Building a Trading Plan

Steps to construct a robust trading plan that incorporates cycle theories.

Conclusion

“Cycle Hunter Books” by Brian James Sklenka provide a comprehensive guide to understanding and utilizing market cycles for trading success. These books are invaluable for traders looking to enhance their analytical skills and market timing.

Frequently Asked Questions:

- What is the main takeaway from the Cycle Hunter series?

- The series teaches traders how to recognize and exploit market cycles for better trading decisions.

- Can market cycle theories be applied to all financial markets?

- Yes, these theories are applicable across various asset classes including stocks, forex, and commodities.

- What is the most important tool for analyzing market cycles?

- Chart analysis tools, particularly those that incorporate time series analysis, are critical.

- How can a trader avoid common pitfalls in cycle analysis?

- By combining cycle analysis with other market indicators and maintaining a disciplined trading approach.

- What makes Brian James Sklenka’s approach unique?

- His focus on combining historical cycle patterns with psychological insights and practical trading strategies.

Be the first to review “Cycle Hunter Books 1-3 with Brian James Sklenka” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.