-

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

FX Masterclass 2.0 with Uprise Academy

1 × $26.00

FX Masterclass 2.0 with Uprise Academy

1 × $26.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

Tradingology Home Study Options Course

1 × $23.00

Tradingology Home Study Options Course

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00 -

×

Monthly Mastermind

1 × $6.00

Monthly Mastermind

1 × $6.00 -

×

Complete Course of Astrology with George Bayer

1 × $6.00

Complete Course of Astrology with George Bayer

1 × $6.00 -

×

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00 -

×

Weekly Playbook Workshop #1

1 × $31.00

Weekly Playbook Workshop #1

1 × $31.00 -

×

RiskIllustrator By Charles Cottle - The Risk Doctor

1 × $31.00

RiskIllustrator By Charles Cottle - The Risk Doctor

1 × $31.00 -

×

Level II Profit System with Sammy Chua

1 × $6.00

Level II Profit System with Sammy Chua

1 × $6.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

How I Made One Million Dollars with Larry Williams

1 × $6.00

How I Made One Million Dollars with Larry Williams

1 × $6.00 -

×

Introduction to Position Sizing Strategies with Van Tharp Institute

1 × $6.00

Introduction to Position Sizing Strategies with Van Tharp Institute

1 × $6.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Understanding How To Trade Fractals

1 × $15.00

Understanding How To Trade Fractals

1 × $15.00 -

×

Transparent FX Course

1 × $6.00

Transparent FX Course

1 × $6.00 -

×

Volume Trader Course (SMART MONEY SYSTEM-in German)

1 × $139.00

Volume Trader Course (SMART MONEY SYSTEM-in German)

1 × $139.00 -

×

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

Play to Win with David La Piana & Michaela Hayes

1 × $6.00

Play to Win with David La Piana & Michaela Hayes

1 × $6.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00 -

×

Day Trading With Short Term Price Patterns and Opening Range Breakout

1 × $6.00

Day Trading With Short Term Price Patterns and Opening Range Breakout

1 × $6.00 -

×

Beginners Guide to How SimplerOptions Uses ThinkorSwim with Henry Gambell

1 × $15.00

Beginners Guide to How SimplerOptions Uses ThinkorSwim with Henry Gambell

1 × $15.00 -

×

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00 -

×

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Market Internals & Intraday Timing Webinar

1 × $6.00

Market Internals & Intraday Timing Webinar

1 × $6.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Theo Trade - 128 Course Bundle

1 × $93.00

Theo Trade - 128 Course Bundle

1 × $93.00 -

×

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00 -

×

US indices system with LaMartinatradingFx

1 × $10.00

US indices system with LaMartinatradingFx

1 × $10.00 -

×

Winning the Mental Game on Wall Street with John Magee

1 × $6.00

Winning the Mental Game on Wall Street with John Magee

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

Schwager on Futures: Managed Trading with Jack Schwager

1 × $4.00

Schwager on Futures: Managed Trading with Jack Schwager

1 × $4.00 -

×

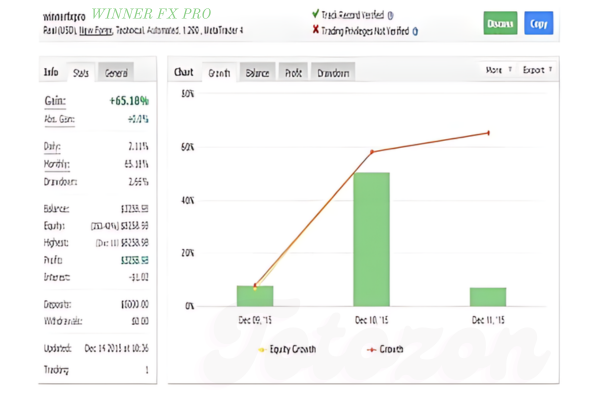

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

![The Art of Trading Covered Writes [1 video (AVI)] image](https://www.totozon.com/wp-content/uploads/2024/07/A-trader-analyzing-earnings-reports-on-a-computer-screen.png) Learn To Trade Earnings with Dan Sheridan

1 × $23.00

Learn To Trade Earnings with Dan Sheridan

1 × $23.00 -

×

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00 -

×

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

London Super Conference 2019

1 × $62.00

London Super Conference 2019

1 × $62.00 -

×

Ultimate Option Strategy Guide

1 × $31.00

Ultimate Option Strategy Guide

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00 -

×

Futures Foundation Program with SMS Capital

1 × $101.00

Futures Foundation Program with SMS Capital

1 × $101.00 -

×

Trend Hunter Strategy

1 × $5.00

Trend Hunter Strategy

1 × $5.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Strategy Class + Indicators

1 × $31.00

Strategy Class + Indicators

1 × $31.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Mark Sebastian – Gamma Trading Class

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

SKU: Ttz- 1421qWCAMlGb

Category: Forex Trading

Tags: Gamma Trading Class, Mark Sebastian, Options Pit

Gamma Trading Class by Mark Sebastian – Master Options

Introduction

In the world of options trading, understanding the nuances of gamma trading can significantly enhance your trading strategy. Mark Sebastian, a renowned expert in the field, offers an in-depth Gamma Trading Class that equips traders with the skills and knowledge to leverage gamma effectively. This article delves into the key concepts of gamma trading and provides insights from Mark Sebastian’s comprehensive course.

What is Gamma Trading?

Gamma trading involves managing the gamma of options positions. Gamma measures the rate of change of delta, which itself measures the rate of change of an option’s price relative to the underlying asset’s price.

Importance of Gamma

- Delta Management: Gamma helps in adjusting delta, which is crucial for maintaining a balanced options portfolio.

- Volatility Profits: High gamma positions can benefit from increased volatility.

Mark Sebastian’s Gamma Trading Class

Mark Sebastian’s Gamma Trading Class is designed to provide traders with advanced techniques and strategies for effectively trading options using gamma.

Course Overview

- Instructor: Mark Sebastian, a seasoned trader and founder of Option Pit.

- Duration: Comprehensive sessions covering various aspects of gamma trading.

- Format: Combination of live classes, recorded sessions, and practical exercises.

Key Concepts in Gamma Trading

Understanding Gamma

Gamma is a second-order Greek that indicates how much delta will change with a one-point move in the underlying asset.

Gamma and Delta Relationship

- Positive Gamma: Delta increases as the underlying asset price rises.

- Negative Gamma: Delta decreases as the underlying asset price rises.

Role of Volatility

Gamma is directly impacted by volatility. Higher volatility can increase the gamma of an options position, making it more sensitive to price changes.

Gamma Scalping

Gamma scalping involves continuously adjusting a delta-neutral position to profit from small price movements in the underlying asset.

Steps in Gamma Scalping

- Establish Delta-Neutral Position: Start with a position where the total delta is close to zero.

- Monitor Price Movements: Adjust the position as the underlying asset’s price changes.

- Lock in Profits: Take profits as small price movements occur, rebalancing the position to maintain delta neutrality.

Advanced Gamma Trading Strategies

1. Long Gamma Position

What is a Long Gamma Position?

A long gamma position benefits from increased volatility and rapid price movements in the underlying asset.

Benefits

- Profit from Volatility: Greater potential to profit from sharp price changes.

- Flexible Adjustments: Easier to adjust positions as the market moves.

2. Short Gamma Position

What is a Short Gamma Position?

A short gamma position benefits from low volatility and stable markets.

Benefits

- Steady Returns: Generates consistent returns in calm markets.

- Lower Risk: Reduced exposure to rapid price swings.

3. Gamma Neutral Strategies

What are Gamma Neutral Strategies?

Gamma neutral strategies aim to maintain a position where gamma is close to zero, minimizing the impact of price changes.

Benefits

- Reduced Volatility Risk: Less sensitivity to price movements.

- Stable Returns: More predictable performance in various market conditions.

Implementing Gamma Trading Techniques

Analyzing Market Conditions

Before implementing any gamma trading strategy, it’s crucial to analyze current market conditions, including volatility levels and potential price movements.

Selecting the Right Options

Choose options with appropriate gamma levels based on your market analysis and trading goals.

Regular Adjustments

Gamma trading requires regular monitoring and adjustments to maintain desired exposure and capitalize on market movements.

Tools and Resources

Option Pit

Option Pit, founded by Mark Sebastian, offers various tools and resources for traders looking to master gamma trading.

Trading Platforms

Utilize advanced trading platforms that provide detailed options analytics and real-time data to enhance your gamma trading strategies.

Case Studies

Case Study 1: Profiting from High Volatility

A trader implemented a long gamma strategy during a period of high market volatility, resulting in significant profits as the underlying asset experienced rapid price movements.

Case Study 2: Stability in Calm Markets

Another trader used a short gamma position in a stable market, generating consistent returns with minimal risk.

Conclusion

Mark Sebastian’s Gamma Trading Class offers invaluable insights and advanced strategies for traders looking to harness the power of gamma in options trading. By understanding and applying these techniques, you can enhance your trading performance, manage risks more effectively, and achieve consistent returns.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Mark Sebastian – Gamma Trading Class” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.