-

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Steve Nison Member Files

1 × $6.00

Steve Nison Member Files

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Acme

1 × $6.00

Acme

1 × $6.00 -

×

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00 -

×

Breakouts with Feibel Trading

1 × $5.00

Breakouts with Feibel Trading

1 × $5.00 -

×

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00 -

×

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

Surefire Trading Plans with Mark McRae

1 × $6.00

Surefire Trading Plans with Mark McRae

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Nature of Risk with Justin Mamis

1 × $6.00

The Nature of Risk with Justin Mamis

1 × $6.00 -

×

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00 -

×

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00 -

×

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Shawn Sharma Mentorship Program

1 × $34.00

Shawn Sharma Mentorship Program

1 × $34.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

The Whale Trade Workshop Plus One Week of Live Trading with Doc Severson

1 × $6.00

The Whale Trade Workshop Plus One Week of Live Trading with Doc Severson

1 × $6.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

The Complete Guide to Spread Trading

1 × $6.00

The Complete Guide to Spread Trading

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Learn Plan Profit – How To Trade Stocks

1 × $15.00

Learn Plan Profit – How To Trade Stocks

1 × $15.00 -

×

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00 -

×

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

Online Course - Why Wave Analysis Belongs in Every Trader's Toolbox with Jeffrey Kennedy - Elliott Wave

1 × $15.00

Online Course - Why Wave Analysis Belongs in Every Trader's Toolbox with Jeffrey Kennedy - Elliott Wave

1 × $15.00 -

×

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00 -

×

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The PPS Trading System with Curtis Arnold

1 × $6.00

The PPS Trading System with Curtis Arnold

1 × $6.00 -

×

RROP Course 2023

1 × $5.00

RROP Course 2023

1 × $5.00 -

×

Tradezilla 2.0

1 × $5.00

Tradezilla 2.0

1 × $5.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

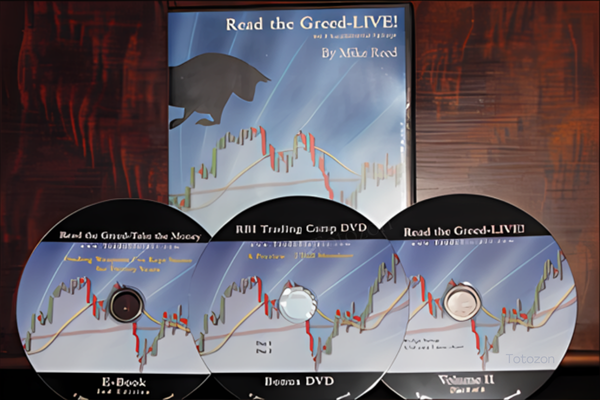

Read the Greed-Live! Course

1 × $15.00

Read the Greed-Live! Course

1 × $15.00 -

×

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

Blank Check Trade

1 × $31.00

Blank Check Trade

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

How to Manage a $25,000 Portfolio with Dan Sheridan – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$6.00Current price is: $6.00.

File Size: 489.3 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How to Manage a $25,000 Portfolio with Dan Sheridan – Sheridan Options Mentoring ” below:

How to Manage a $25,000 Portfolio with Dan Sheridan – Sheridan Options Mentoring

Managing a $25,000 portfolio can seem daunting, but with the right guidance and strategies, you can navigate the financial markets with confidence. Dan Sheridan, a seasoned options trader, offers invaluable insights through his Sheridan Options Mentoring program. This article will explore how to effectively manage a $25,000 portfolio using the principles and techniques taught by Dan Sheridan.

Introduction

Who is Dan Sheridan?

Dan Sheridan is a veteran options trader with over three decades of experience. He has mentored numerous traders through his comprehensive training programs, helping them develop successful trading strategies.

What is Sheridan Options Mentoring?

Sheridan Options Mentoring is a program designed to provide traders with the knowledge and tools needed to excel in options trading. The program offers personalized mentoring and practical strategies to help traders achieve their financial goals.

Setting Up Your Portfolio

Establishing Your Investment Goals

Before diving into trading, it’s crucial to define your investment goals. Are you looking for short-term gains, long-term growth, or income generation? Clear goals will guide your trading decisions.

Allocating Your Capital

Diversification

Diversifying your portfolio helps spread risk across different assets. Allocate your $25,000 across various sectors and instruments to minimize exposure to any single investment.

Risk Tolerance

Determine your risk tolerance to guide your investment choices. Higher risk can lead to higher returns, but it’s essential to balance this with your comfort level.

Options Strategies for a $25,000 Portfolio

Basic Options Strategies

Covered Calls

Covered calls involve holding a long position in a stock and selling call options on the same stock. This strategy can generate income and provide some downside protection.

Cash-Secured Puts

Selling cash-secured puts involves writing put options while holding enough cash to buy the stock if it’s exercised. This strategy can generate income and potentially purchase stocks at a lower price.

Advanced Options Strategies

Iron Condors

Iron condors involve selling a lower-strike put and a higher-strike call while buying a further out-of-the-money put and call. This strategy profits from low volatility and time decay.

Vertical Spreads

Vertical spreads involve buying and selling options of the same type (calls or puts) with different strike prices but the same expiration date. They can limit risk and offer defined profit potential.

Risk Management Techniques

Position Sizing

Determining Position Size

Limit each trade to a small percentage of your portfolio to manage risk. For example, risk no more than 2-5% of your $25,000 portfolio on a single trade.

Setting Stop-Loss Orders

Stop-loss orders automatically sell a position when it reaches a certain price, limiting potential losses. Setting these orders is crucial for protecting your capital.

Hedging Strategies

Using Options to Hedge

Options can be used to hedge against potential losses in your portfolio. For example, buying protective puts can limit downside risk.

Technical and Fundamental Analysis

Technical Analysis

Chart Patterns

Learn to identify chart patterns such as head and shoulders, double tops, and triangles to predict potential price movements.

Indicators and Oscillators

Use technical indicators like moving averages, RSI, and MACD to enhance your trading decisions.

Fundamental Analysis

Evaluating Company Financials

Assess company financials such as earnings, revenue, and debt levels to determine their intrinsic value and growth potential.

Industry and Economic Trends

Consider industry trends and economic conditions to inform your investment choices and strategies.

Psychological Aspects of Trading

Maintaining Discipline

Trading discipline is crucial for long-term success. Stick to your trading plan and avoid impulsive decisions based on emotions.

Overcoming Psychological Barriers

Fear and Greed

Fear and greed can cloud judgment. Develop strategies to manage these emotions and make rational trading decisions.

Consistency

Consistency in your trading approach can lead to better results. Regularly review and adjust your strategies based on performance.

Utilizing Sheridan Options Mentoring

Personalized Mentoring

Dan Sheridan offers personalized mentoring to help you develop and refine your trading strategies. This one-on-one guidance can accelerate your learning and improve your trading performance.

Interactive Learning Resources

Webinars and Workshops

Participate in live webinars and workshops to stay updated on market trends and refine your trading skills.

Educational Materials

Access a wealth of educational materials, including videos, articles, and case studies, to deepen your understanding of options trading.

Conclusion

Why Choose Sheridan Options Mentoring?

Choosing Sheridan Options Mentoring provides you with expert guidance, practical strategies, and personalized support. With Dan Sheridan’s mentorship, you can confidently manage your $25,000 portfolio and navigate the complexities of the financial markets.

FAQs

1. What is the main focus of Sheridan Options Mentoring?

The program focuses on providing practical, actionable strategies for options trading, tailored to individual traders’ needs and goals.

2. Can beginners benefit from this program?

Absolutely. The program is designed for traders of all levels, offering foundational knowledge and advanced strategies.

3. How does personalized mentoring work?

Personalized mentoring involves one-on-one sessions with Dan Sheridan, where you receive tailored advice and strategies based on your trading goals and experience.

4. What kind of support materials are included?

The program includes a variety of support materials such as videos, webinars, articles, and case studies to enhance your learning experience.

5. How will this program improve my trading?

By providing comprehensive education, practical strategies, and personalized guidance, the program helps you make informed decisions and manage your portfolio more effectively.

Be the first to review “How to Manage a $25,000 Portfolio with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.