-

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Scalpathon by Trading Research Group

1 × $23.00

Scalpathon by Trading Research Group

1 × $23.00 -

×

Trading Like You’ve Never Heard Before – Digital Download

1 × $15.00

Trading Like You’ve Never Heard Before – Digital Download

1 × $15.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trend Commandments with Michael Covel

1 × $6.00

Trend Commandments with Michael Covel

1 × $6.00 -

×

Myths of the Free Market with Kenneth Friedman

1 × $6.00

Myths of the Free Market with Kenneth Friedman

1 × $6.00 -

×

Increasing Vertical Spread Probabilities With Technical Analysis Class with Doc Severso

1 × $6.00

Increasing Vertical Spread Probabilities With Technical Analysis Class with Doc Severso

1 × $6.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

Alexander Elder Full Courses Package

1 × $6.00

Alexander Elder Full Courses Package

1 × $6.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

FX Capital Online

1 × $5.00

FX Capital Online

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00 -

×

Market Profile Course

1 × $54.00

Market Profile Course

1 × $54.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

Master Bundle with Gemify Academy

1 × $5.00

Master Bundle with Gemify Academy

1 × $5.00 -

×

Low Stress Options Trading with Low Stress Training

1 × $23.00

Low Stress Options Trading with Low Stress Training

1 × $23.00 -

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

MotiveWave Course with Todd Gordon

1 × $23.00

MotiveWave Course with Todd Gordon

1 × $23.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00 -

×

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00 -

×

Programming in Python For Traders with Trading Markets

1 × $15.00

Programming in Python For Traders with Trading Markets

1 × $15.00 -

×

Module III - Peak Formation Trades with FX MindShift

1 × $6.00

Module III - Peak Formation Trades with FX MindShift

1 × $6.00 -

×

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00 -

×

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00

MACK – PATS Simple ES Scalping Strategy

$80.00 Original price was: $80.00.$15.00Current price is: $15.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

MACK – PATS Simple ES Scalping Strategy

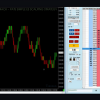

Scalping in the E-mini S&P 500 (ES) market can be highly rewarding when done correctly. One of the effective strategies in this realm is the MACK – PATS Simple ES Scalping Strategy. In this article, we will delve into the details of this strategy, its components, and how it can help traders achieve consistent success.

Understanding the MACK – PATS Simple ES Scalping Strategy

What is Scalping?

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades throughout the day. It requires quick decision-making and precise execution.

Overview of the MACK – PATS Strategy

The MACK – PATS Simple ES Scalping Strategy is a well-defined approach that focuses on specific setups and conditions in the ES market. This strategy emphasizes simplicity and consistency.

Key Components of the MACK – PATS Strategy

Price Action

Price action is at the core of the MACK – PATS strategy. It involves analyzing the movement of prices over time to make informed trading decisions.

Technical Indicators

The strategy employs a few essential technical indicators to identify potential trade setups. These include moving averages, support and resistance levels, and candlestick patterns.

Time Frames

The MACK – PATS strategy primarily uses short time frames, such as the 1-minute or 5-minute charts, to capture quick price movements.

Setting Up the MACK – PATS Strategy

Choosing the Right Time Frame

Selecting the appropriate time frame is crucial for this strategy. While the 1-minute chart provides more opportunities, the 5-minute chart offers more reliable signals.

Identifying Key Levels

Marking key support and resistance levels helps in identifying potential entry and exit points. These levels act as psychological barriers in the market.

Using Moving Averages

Moving averages, such as the 20-period and 50-period moving averages, help in identifying the trend direction and potential reversal points.

Candlestick Patterns

Recognizing candlestick patterns like doji, hammer, and engulfing patterns can provide valuable insights into market sentiment and potential price reversals.

Executing the MACK – PATS Strategy

Entry Criteria

- Trend Confirmation: Ensure the trend is confirmed by moving averages.

- Support and Resistance Levels: Look for entries near key levels.

- Candlestick Patterns: Enter trades based on reliable candlestick patterns.

Exit Criteria

- Profit Targets: Set clear profit targets based on previous price action.

- Stop-Loss Orders: Place stop-loss orders to limit potential losses.

- Trailing Stops: Use trailing stops to lock in profits as the trade moves in your favor.

Trade Management

Managing trades effectively involves monitoring the position, adjusting stop-loss levels, and taking partial profits when appropriate.

Advantages of the MACK – PATS Strategy

Simplicity

The strategy’s simplicity makes it accessible to traders of all experience levels. It focuses on clear, actionable signals.

Consistency

By adhering to predefined rules and setups, the MACK – PATS strategy offers consistent trading opportunities.

Risk Management

The strategy emphasizes risk management through the use of stop-loss orders and proper position sizing.

Challenges of Scalping with the MACK – PATS Strategy

Market Volatility

High market volatility can lead to quick price swings, making it challenging to execute trades accurately.

Emotional Discipline

Scalping requires emotional discipline to stick to the strategy and avoid impulsive decisions.

Execution Speed

Fast execution is essential in scalping. Traders need a reliable trading platform and a stable internet connection.

Tips for Success with the MACK – PATS Strategy

Practice on a Demo Account

Before trading with real money, practice the strategy on a demo account to gain confidence and refine your skills.

Stay Informed

Keep up with market news and economic events that can impact the ES market.

Maintain a Trading Journal

Document your trades, including entry and exit points, profit or loss, and any observations. This helps in evaluating and improving your performance.

Continuous Learning

The markets are constantly evolving. Continuously educate yourself and adapt your strategy as needed.

Tools and Resources for Scalping

Trading Platforms

Choose a reliable trading platform that offers fast execution speeds and advanced charting tools.

Indicators and Software

Utilize indicators and trading software that can assist in identifying setups and managing trades.

Educational Materials

Leverage educational resources, such as courses, webinars, and books, to enhance your understanding of scalping strategies.

Conclusion

The MACK – PATS Simple ES Scalping Strategy is a powerful tool for traders looking to capitalize on quick price movements in the ES market. By focusing on price action, key technical indicators, and strict risk management, this strategy offers a structured approach to scalping. With practice, discipline, and continuous learning, traders can achieve consistent success with the MACK – PATS strategy.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “MACK – PATS Simple ES Scalping Strategy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.