-

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Affinity Foundation Option Course with Affinitytrading

1 × $6.00

Affinity Foundation Option Course with Affinitytrading

1 × $6.00 -

×

All Access Online Trading Course with Steve Luke

1 × $6.00

All Access Online Trading Course with Steve Luke

1 × $6.00 -

×

Trading Analysis Crash Course

1 × $23.00

Trading Analysis Crash Course

1 × $23.00 -

×

The Nature of Risk with Justin Mamis

1 × $6.00

The Nature of Risk with Justin Mamis

1 × $6.00 -

×

Flow Indicator Software Perfect for Futures Ninjatrader

1 × $23.00

Flow Indicator Software Perfect for Futures Ninjatrader

1 × $23.00 -

×

Private Mentorship with ANICO Capital

1 × $10.00

Private Mentorship with ANICO Capital

1 × $10.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

RROP Course 2023

1 × $5.00

RROP Course 2023

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

Naked Trading Part 1 with Base Camp Trading

1 × $6.00

Naked Trading Part 1 with Base Camp Trading

1 × $6.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00 -

×

The Introduction to the Magee System of Technical Analysis CD with John Magee

1 × $6.00

The Introduction to the Magee System of Technical Analysis CD with John Magee

1 × $6.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Rise Precision Latest Course

1 × $10.00

Rise Precision Latest Course

1 × $10.00 -

×

Day Trading Freedom Course & Members Area Videos

1 × $6.00

Day Trading Freedom Course & Members Area Videos

1 × $6.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00 -

×

Learn To Trade with Tori Trades

1 × $8.00

Learn To Trade with Tori Trades

1 × $8.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

The Stock Rocket Trading System with Dave Wooding

1 × $6.00

The Stock Rocket Trading System with Dave Wooding

1 × $6.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Stock Selection Course with Dave Landry

1 × $6.00

Stock Selection Course with Dave Landry

1 × $6.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

Vaga Academy with VAGAFX

1 × $5.00

Vaga Academy with VAGAFX

1 × $5.00 -

×

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00 -

×

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00 -

×

Stock Patterns for Day Trading Home Study Course

1 × $23.00

Stock Patterns for Day Trading Home Study Course

1 × $23.00 -

×

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00 -

×

Forex Millionaire Course with Willis University

1 × $6.00

Forex Millionaire Course with Willis University

1 × $6.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Option Express Plugin

1 × $6.00

Option Express Plugin

1 × $6.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” below:

George Lindsay’s 3 Peaks and the Domed House Revised with Barclay T. Leib

Introduction to Lindsay’s Market Theory

In the world of technical analysis, George Lindsay’s introduction of the “3 Peaks and the Domed House” model stands out as a landmark. Revised by Barclay T. Leib, this theory offers deep insights into market psychology and price movements. Let’s explore how this model works and its relevance in today’s trading environment.

Understanding the Basic Concept

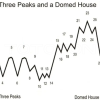

The “3 Peaks and the Domed House” model is a method used to predict market cycles through specific patterns. It depicts the stages of a market cycle, from an optimistic peak to an inevitable decline, followed by a recovery phase.

The Structure of the Model

- Three Peaks: Representing the highs before a significant downturn.

- The Domed House: Illustrating the recovery and eventual peak before another decline.

Historical Application of the Model

Analyzing Past Market Cycles

George Lindsay originally used this model to analyze the stock market in the mid-20th century. Its accuracy in predicting the timing of market tops and bottoms has been noteworthy.

Case Studies

- The 1929 Stock Market Crash

- The 1960s Bull Market

Revisions by Barclay T. Leib

Enhancements to the Original Model

Barclay T. Leib’s revisions involve modernizing Lindsay’s approach to align with contemporary market mechanisms. This includes integrating digital trading data and advanced forecasting tools.

Key Updates

- Incorporation of Algorithmic Trading Data

- Use of Advanced Statistical Methods

Practical Application in Modern Markets

How Traders Use the Model Today

Today’s traders adapt Lindsay’s model to a range of markets, including stocks, commodities, and cryptocurrencies. Its flexibility and historical track record make it a valuable tool for predicting market phases.

Techniques for Application

- Technical Analysis Software: Traders use software to identify patterns that resemble the 3 Peaks and Domed House.

- Market Timing Strategies: The model helps in planning entry and exit points.

Theoretical Implications and Critiques

Economic Theories Supporting the Model

The model ties into broader economic theories about market cycles and investor psychology, suggesting that markets move in predictable phases based on human behavior.

Critiques and Limitations

- Predictability: Some critics argue that the model’s predictions are too rigid.

- Market Complexity: Others suggest that modern markets are too complex for such a straightforward model.

Integrating with Other Market Analysis Tools

Complementary Analysis Methods

To enhance the accuracy of Lindsay’s model, traders often combine it with other analytical tools like Elliott Wave Theory and Fibonacci retracements.

Combining Tools for Enhanced Prediction

- Elliott Wave Theory for Cycle Analysis

- Fibonacci for Resistance and Support Levels

Conclusion

George Lindsay’s “3 Peaks and the Domed House” model, revised by Barclay T. Leib, continues to be a profound tool for understanding and predicting market cycles. By incorporating modern techniques and theories, traders can utilize this model to enhance their market analysis and decision-making strategies.

Frequently Asked Questions:

- What is the main benefit of using Lindsay’s model?

It provides a structured way to forecast market tops and bottoms, helping traders with timing decisions. - Can this model be applied to all financial markets?

Yes, while originally used for stocks, it can be adapted to any market with price fluctuations. - How accurate is the model in today’s digital trading age?

When combined with modern analytical tools, it remains a valuable component of market analysis. - What are the main criticisms of the model?

Critics often point to its predictability and simplicity, arguing that modern markets require more nuanced approaches. - How do revisions by Barclay T. Leib enhance the model?

Leib’s revisions modernize the model by incorporating new data and analytical methods, improving its applicability.

Be the first to review “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.