-

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00 -

×

Scanning for Gold with Doug Sutton

1 × $31.00

Scanning for Gold with Doug Sutton

1 × $31.00 -

×

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00 -

×

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00 -

×

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00 -

×

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00 -

×

Introduction To The STRAT Course with Rob Smith

1 × $8.00

Introduction To The STRAT Course with Rob Smith

1 × $8.00 -

×

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00 -

×

Stock Speculation (Volume I & II) with Joseph A.Wyler

1 × $4.00

Stock Speculation (Volume I & II) with Joseph A.Wyler

1 × $4.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Cheatcode Trend System with Dominique Woodson

1 × $15.00

Cheatcode Trend System with Dominique Woodson

1 × $15.00 -

×

Quant Edge Online Home Study Course with T3 Live

1 × $39.00

Quant Edge Online Home Study Course with T3 Live

1 × $39.00 -

×

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00 -

×

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00 -

×

Chart Reading Course with TraderSumo

1 × $5.00

Chart Reading Course with TraderSumo

1 × $5.00 -

×

Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

1 × $109.00

Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

1 × $109.00 -

×

Lifespan Investing with Clifford Pistolese

1 × $6.00

Lifespan Investing with Clifford Pistolese

1 × $6.00 -

×

Lessons From A Trader’s Camp. Winning Psychology & Tactics with Alexander Elder

1 × $6.00

Lessons From A Trader’s Camp. Winning Psychology & Tactics with Alexander Elder

1 × $6.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Complete Series

1 × $31.00

Complete Series

1 × $31.00 -

×

Derivate Instruments by Brian A.Eales

1 × $6.00

Derivate Instruments by Brian A.Eales

1 × $6.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

Dow Theory Redux with Michael Sheimo

1 × $6.00

Dow Theory Redux with Michael Sheimo

1 × $6.00 -

×

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00 -

×

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00 -

×

Sample Item Sets 2003 - CFA Level 3

1 × $6.00

Sample Item Sets 2003 - CFA Level 3

1 × $6.00 -

×

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

The Introduction to the Magee System of Technical Analysis CD with John Magee

1 × $6.00

The Introduction to the Magee System of Technical Analysis CD with John Magee

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How to Trade Better with Larry Williams

1 × $6.00

How to Trade Better with Larry Williams

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00 -

×

New Market Timing Techniques

1 × $6.00

New Market Timing Techniques

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” below:

George Lindsay’s 3 Peaks and the Domed House Revised with Barclay T. Leib

Introduction to Lindsay’s Market Theory

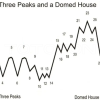

In the world of technical analysis, George Lindsay’s introduction of the “3 Peaks and the Domed House” model stands out as a landmark. Revised by Barclay T. Leib, this theory offers deep insights into market psychology and price movements. Let’s explore how this model works and its relevance in today’s trading environment.

Understanding the Basic Concept

The “3 Peaks and the Domed House” model is a method used to predict market cycles through specific patterns. It depicts the stages of a market cycle, from an optimistic peak to an inevitable decline, followed by a recovery phase.

The Structure of the Model

- Three Peaks: Representing the highs before a significant downturn.

- The Domed House: Illustrating the recovery and eventual peak before another decline.

Historical Application of the Model

Analyzing Past Market Cycles

George Lindsay originally used this model to analyze the stock market in the mid-20th century. Its accuracy in predicting the timing of market tops and bottoms has been noteworthy.

Case Studies

- The 1929 Stock Market Crash

- The 1960s Bull Market

Revisions by Barclay T. Leib

Enhancements to the Original Model

Barclay T. Leib’s revisions involve modernizing Lindsay’s approach to align with contemporary market mechanisms. This includes integrating digital trading data and advanced forecasting tools.

Key Updates

- Incorporation of Algorithmic Trading Data

- Use of Advanced Statistical Methods

Practical Application in Modern Markets

How Traders Use the Model Today

Today’s traders adapt Lindsay’s model to a range of markets, including stocks, commodities, and cryptocurrencies. Its flexibility and historical track record make it a valuable tool for predicting market phases.

Techniques for Application

- Technical Analysis Software: Traders use software to identify patterns that resemble the 3 Peaks and Domed House.

- Market Timing Strategies: The model helps in planning entry and exit points.

Theoretical Implications and Critiques

Economic Theories Supporting the Model

The model ties into broader economic theories about market cycles and investor psychology, suggesting that markets move in predictable phases based on human behavior.

Critiques and Limitations

- Predictability: Some critics argue that the model’s predictions are too rigid.

- Market Complexity: Others suggest that modern markets are too complex for such a straightforward model.

Integrating with Other Market Analysis Tools

Complementary Analysis Methods

To enhance the accuracy of Lindsay’s model, traders often combine it with other analytical tools like Elliott Wave Theory and Fibonacci retracements.

Combining Tools for Enhanced Prediction

- Elliott Wave Theory for Cycle Analysis

- Fibonacci for Resistance and Support Levels

Conclusion

George Lindsay’s “3 Peaks and the Domed House” model, revised by Barclay T. Leib, continues to be a profound tool for understanding and predicting market cycles. By incorporating modern techniques and theories, traders can utilize this model to enhance their market analysis and decision-making strategies.

Frequently Asked Questions:

- What is the main benefit of using Lindsay’s model?

It provides a structured way to forecast market tops and bottoms, helping traders with timing decisions. - Can this model be applied to all financial markets?

Yes, while originally used for stocks, it can be adapted to any market with price fluctuations. - How accurate is the model in today’s digital trading age?

When combined with modern analytical tools, it remains a valuable component of market analysis. - What are the main criticisms of the model?

Critics often point to its predictability and simplicity, arguing that modern markets require more nuanced approaches. - How do revisions by Barclay T. Leib enhance the model?

Leib’s revisions modernize the model by incorporating new data and analytical methods, improving its applicability.

Be the first to review “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.