-

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

Boiler Room Trading

1 × $15.00

Boiler Room Trading

1 × $15.00 -

×

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Make Money While You Sleep with Forex Night Train

1 × $6.00

Make Money While You Sleep with Forex Night Train

1 × $6.00 -

×

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00 -

×

Ultimate Titan Trader Bootcamp with Silas Peters

1 × $23.00

Ultimate Titan Trader Bootcamp with Silas Peters

1 × $23.00 -

×

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00 -

×

Four Steps to Trading Economic Indicators

1 × $6.00

Four Steps to Trading Economic Indicators

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00 -

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

Forex Commander Package by Amin Sadak

1 × $6.00

Forex Commander Package by Amin Sadak

1 × $6.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

Phantom Trading Course 2.0

1 × $7.00

Phantom Trading Course 2.0

1 × $7.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

How to Stack Your Trades

1 × $6.00

How to Stack Your Trades

1 × $6.00 -

×

Forex Scalping Strategy Course with Vic Noble & Sarid Harper

1 × $6.00

Forex Scalping Strategy Course with Vic Noble & Sarid Harper

1 × $6.00 -

×

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00 -

×

Mastering Intraday Trend Days with Corey Rosenbloom

1 × $6.00

Mastering Intraday Trend Days with Corey Rosenbloom

1 × $6.00 -

×

Gann Simplified with Clif Droke

1 × $6.00

Gann Simplified with Clif Droke

1 × $6.00 -

×

Trading NQ At The US Open with TradeSmart

1 × $10.00

Trading NQ At The US Open with TradeSmart

1 × $10.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00 -

×

Going Global 2015

1 × $6.00

Going Global 2015

1 × $6.00 -

×

Stonhill Forex 201 Advanced Course

1 × $5.00

Stonhill Forex 201 Advanced Course

1 × $5.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

How To Successfully Trade The Haggerty 1,2,3 Strategy Home Study Trading Course with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty 1,2,3 Strategy Home Study Trading Course with Kevin Haggerty

1 × $6.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00 -

×

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00 -

×

Essentials For Amibroker with Matt Radtke - Marwood Research

1 × $15.00

Essentials For Amibroker with Matt Radtke - Marwood Research

1 × $15.00 -

×

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00 -

×

Secrets of Great Investors (Audio Book 471 MB) with Louis Rukeyser

1 × $6.00

Secrets of Great Investors (Audio Book 471 MB) with Louis Rukeyser

1 × $6.00 -

×

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Building High-Performance Trading Systems. What Works & What Doesn’t with Nelson Freeburg

1 × $6.00

Building High-Performance Trading Systems. What Works & What Doesn’t with Nelson Freeburg

1 × $6.00 -

×

Forex Master Levels with Nicola Delic

1 × $15.00

Forex Master Levels with Nicola Delic

1 × $15.00 -

×

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00 -

×

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00 -

×

The 1st Leveraged ETF Trading Strategies Workshop

1 × $54.00

The 1st Leveraged ETF Trading Strategies Workshop

1 × $54.00 -

×

All About Technical Analysis with Constance Brown

1 × $6.00

All About Technical Analysis with Constance Brown

1 × $6.00 -

×

How to Find a Trading Strategy with Mike Baehr

1 × $124.00

How to Find a Trading Strategy with Mike Baehr

1 × $124.00 -

×

Trading Decoded with Axia Futures

1 × $31.00

Trading Decoded with Axia Futures

1 × $31.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

Japanese Trading Systems with Tradesmart University

1 × $9.00

Japanese Trading Systems with Tradesmart University

1 × $9.00 -

×

Intermediate Stock Course

1 × $54.00

Intermediate Stock Course

1 × $54.00 -

×

Lazy Gap Trader Course with David Frost

1 × $6.00

Lazy Gap Trader Course with David Frost

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

Learn to Make Money Trading Options

1 × $6.00

Learn to Make Money Trading Options

1 × $6.00 -

×

Complete Cryptocurrency Trading 2021

1 × $5.00

Complete Cryptocurrency Trading 2021

1 × $5.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” below:

George Lindsay’s 3 Peaks and the Domed House Revised with Barclay T. Leib

Introduction to Lindsay’s Market Theory

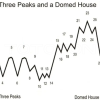

In the world of technical analysis, George Lindsay’s introduction of the “3 Peaks and the Domed House” model stands out as a landmark. Revised by Barclay T. Leib, this theory offers deep insights into market psychology and price movements. Let’s explore how this model works and its relevance in today’s trading environment.

Understanding the Basic Concept

The “3 Peaks and the Domed House” model is a method used to predict market cycles through specific patterns. It depicts the stages of a market cycle, from an optimistic peak to an inevitable decline, followed by a recovery phase.

The Structure of the Model

- Three Peaks: Representing the highs before a significant downturn.

- The Domed House: Illustrating the recovery and eventual peak before another decline.

Historical Application of the Model

Analyzing Past Market Cycles

George Lindsay originally used this model to analyze the stock market in the mid-20th century. Its accuracy in predicting the timing of market tops and bottoms has been noteworthy.

Case Studies

- The 1929 Stock Market Crash

- The 1960s Bull Market

Revisions by Barclay T. Leib

Enhancements to the Original Model

Barclay T. Leib’s revisions involve modernizing Lindsay’s approach to align with contemporary market mechanisms. This includes integrating digital trading data and advanced forecasting tools.

Key Updates

- Incorporation of Algorithmic Trading Data

- Use of Advanced Statistical Methods

Practical Application in Modern Markets

How Traders Use the Model Today

Today’s traders adapt Lindsay’s model to a range of markets, including stocks, commodities, and cryptocurrencies. Its flexibility and historical track record make it a valuable tool for predicting market phases.

Techniques for Application

- Technical Analysis Software: Traders use software to identify patterns that resemble the 3 Peaks and Domed House.

- Market Timing Strategies: The model helps in planning entry and exit points.

Theoretical Implications and Critiques

Economic Theories Supporting the Model

The model ties into broader economic theories about market cycles and investor psychology, suggesting that markets move in predictable phases based on human behavior.

Critiques and Limitations

- Predictability: Some critics argue that the model’s predictions are too rigid.

- Market Complexity: Others suggest that modern markets are too complex for such a straightforward model.

Integrating with Other Market Analysis Tools

Complementary Analysis Methods

To enhance the accuracy of Lindsay’s model, traders often combine it with other analytical tools like Elliott Wave Theory and Fibonacci retracements.

Combining Tools for Enhanced Prediction

- Elliott Wave Theory for Cycle Analysis

- Fibonacci for Resistance and Support Levels

Conclusion

George Lindsay’s “3 Peaks and the Domed House” model, revised by Barclay T. Leib, continues to be a profound tool for understanding and predicting market cycles. By incorporating modern techniques and theories, traders can utilize this model to enhance their market analysis and decision-making strategies.

Frequently Asked Questions:

- What is the main benefit of using Lindsay’s model?

It provides a structured way to forecast market tops and bottoms, helping traders with timing decisions. - Can this model be applied to all financial markets?

Yes, while originally used for stocks, it can be adapted to any market with price fluctuations. - How accurate is the model in today’s digital trading age?

When combined with modern analytical tools, it remains a valuable component of market analysis. - What are the main criticisms of the model?

Critics often point to its predictability and simplicity, arguing that modern markets require more nuanced approaches. - How do revisions by Barclay T. Leib enhance the model?

Leib’s revisions modernize the model by incorporating new data and analytical methods, improving its applicability.

Be the first to review “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.