-

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Dynamic Gann Levels with Don Fisher

1 × $6.00

Dynamic Gann Levels with Don Fisher

1 × $6.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00 -

×

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00 -

×

The Compleat Day Trader with Jake Bernstein

1 × $6.00

The Compleat Day Trader with Jake Bernstein

1 × $6.00 -

×

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

George Bayer Squarring the Circle for Excel

1 × $6.00

George Bayer Squarring the Circle for Excel

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” below:

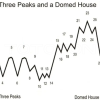

George Lindsay’s 3 Peaks and the Domed House Revised with Barclay T. Leib

Introduction to Lindsay’s Market Theory

In the world of technical analysis, George Lindsay’s introduction of the “3 Peaks and the Domed House” model stands out as a landmark. Revised by Barclay T. Leib, this theory offers deep insights into market psychology and price movements. Let’s explore how this model works and its relevance in today’s trading environment.

Understanding the Basic Concept

The “3 Peaks and the Domed House” model is a method used to predict market cycles through specific patterns. It depicts the stages of a market cycle, from an optimistic peak to an inevitable decline, followed by a recovery phase.

The Structure of the Model

- Three Peaks: Representing the highs before a significant downturn.

- The Domed House: Illustrating the recovery and eventual peak before another decline.

Historical Application of the Model

Analyzing Past Market Cycles

George Lindsay originally used this model to analyze the stock market in the mid-20th century. Its accuracy in predicting the timing of market tops and bottoms has been noteworthy.

Case Studies

- The 1929 Stock Market Crash

- The 1960s Bull Market

Revisions by Barclay T. Leib

Enhancements to the Original Model

Barclay T. Leib’s revisions involve modernizing Lindsay’s approach to align with contemporary market mechanisms. This includes integrating digital trading data and advanced forecasting tools.

Key Updates

- Incorporation of Algorithmic Trading Data

- Use of Advanced Statistical Methods

Practical Application in Modern Markets

How Traders Use the Model Today

Today’s traders adapt Lindsay’s model to a range of markets, including stocks, commodities, and cryptocurrencies. Its flexibility and historical track record make it a valuable tool for predicting market phases.

Techniques for Application

- Technical Analysis Software: Traders use software to identify patterns that resemble the 3 Peaks and Domed House.

- Market Timing Strategies: The model helps in planning entry and exit points.

Theoretical Implications and Critiques

Economic Theories Supporting the Model

The model ties into broader economic theories about market cycles and investor psychology, suggesting that markets move in predictable phases based on human behavior.

Critiques and Limitations

- Predictability: Some critics argue that the model’s predictions are too rigid.

- Market Complexity: Others suggest that modern markets are too complex for such a straightforward model.

Integrating with Other Market Analysis Tools

Complementary Analysis Methods

To enhance the accuracy of Lindsay’s model, traders often combine it with other analytical tools like Elliott Wave Theory and Fibonacci retracements.

Combining Tools for Enhanced Prediction

- Elliott Wave Theory for Cycle Analysis

- Fibonacci for Resistance and Support Levels

Conclusion

George Lindsay’s “3 Peaks and the Domed House” model, revised by Barclay T. Leib, continues to be a profound tool for understanding and predicting market cycles. By incorporating modern techniques and theories, traders can utilize this model to enhance their market analysis and decision-making strategies.

Frequently Asked Questions:

- What is the main benefit of using Lindsay’s model?

It provides a structured way to forecast market tops and bottoms, helping traders with timing decisions. - Can this model be applied to all financial markets?

Yes, while originally used for stocks, it can be adapted to any market with price fluctuations. - How accurate is the model in today’s digital trading age?

When combined with modern analytical tools, it remains a valuable component of market analysis. - What are the main criticisms of the model?

Critics often point to its predictability and simplicity, arguing that modern markets require more nuanced approaches. - How do revisions by Barclay T. Leib enhance the model?

Leib’s revisions modernize the model by incorporating new data and analytical methods, improving its applicability.

Be the first to review “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.