-

×

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

Weekly Credit Spreads for Income

1 × $6.00

Weekly Credit Spreads for Income

1 × $6.00 -

×

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

SRC (Smart Raja Concepts) with Forex 101

1 × $5.00

SRC (Smart Raja Concepts) with Forex 101

1 × $5.00 -

×

The Blueprint to Success with Humair FX

1 × $5.00

The Blueprint to Success with Humair FX

1 × $5.00 -

×

TechnicalGodsFX Advanced Forex Education

1 × $7.00

TechnicalGodsFX Advanced Forex Education

1 × $7.00 -

×

Extreme Events: Robust Portfolio Construction in the Presence of Fat Tails with Malcolm Kemp

1 × $6.00

Extreme Events: Robust Portfolio Construction in the Presence of Fat Tails with Malcolm Kemp

1 × $6.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Tradematic Trading Strategy

1 × $31.00

Tradematic Trading Strategy

1 × $31.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

USDX Trading Course with Jared Martinez - MTI

1 × $6.00

USDX Trading Course with Jared Martinez - MTI

1 × $6.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00 -

×

Simple Cyclical Analysis with Stan Erlich

1 × $6.00

Simple Cyclical Analysis with Stan Erlich

1 × $6.00 -

×

Point And Figure Part III By Bruce Fraser & Roman Bogomazov - Wyckoff Analytics

1 × $23.00

Point And Figure Part III By Bruce Fraser & Roman Bogomazov - Wyckoff Analytics

1 × $23.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

Forecasting Financial Markets (2nd Ed.)

1 × $6.00

Forecasting Financial Markets (2nd Ed.)

1 × $6.00 -

×

Forex Mastery with Willis University

1 × $6.00

Forex Mastery with Willis University

1 × $6.00 -

×

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

FX Utopia

1 × $6.00

FX Utopia

1 × $6.00 -

×

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00 -

×

Jimdandym Ql4 Courses

1 × $15.00

Jimdandym Ql4 Courses

1 × $15.00 -

×

Mastering Candlestick Charts I with Greg Capra

1 × $6.00

Mastering Candlestick Charts I with Greg Capra

1 × $6.00 -

×

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” below:

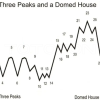

George Lindsay’s 3 Peaks and the Domed House Revised with Barclay T. Leib

Introduction to Lindsay’s Market Theory

In the world of technical analysis, George Lindsay’s introduction of the “3 Peaks and the Domed House” model stands out as a landmark. Revised by Barclay T. Leib, this theory offers deep insights into market psychology and price movements. Let’s explore how this model works and its relevance in today’s trading environment.

Understanding the Basic Concept

The “3 Peaks and the Domed House” model is a method used to predict market cycles through specific patterns. It depicts the stages of a market cycle, from an optimistic peak to an inevitable decline, followed by a recovery phase.

The Structure of the Model

- Three Peaks: Representing the highs before a significant downturn.

- The Domed House: Illustrating the recovery and eventual peak before another decline.

Historical Application of the Model

Analyzing Past Market Cycles

George Lindsay originally used this model to analyze the stock market in the mid-20th century. Its accuracy in predicting the timing of market tops and bottoms has been noteworthy.

Case Studies

- The 1929 Stock Market Crash

- The 1960s Bull Market

Revisions by Barclay T. Leib

Enhancements to the Original Model

Barclay T. Leib’s revisions involve modernizing Lindsay’s approach to align with contemporary market mechanisms. This includes integrating digital trading data and advanced forecasting tools.

Key Updates

- Incorporation of Algorithmic Trading Data

- Use of Advanced Statistical Methods

Practical Application in Modern Markets

How Traders Use the Model Today

Today’s traders adapt Lindsay’s model to a range of markets, including stocks, commodities, and cryptocurrencies. Its flexibility and historical track record make it a valuable tool for predicting market phases.

Techniques for Application

- Technical Analysis Software: Traders use software to identify patterns that resemble the 3 Peaks and Domed House.

- Market Timing Strategies: The model helps in planning entry and exit points.

Theoretical Implications and Critiques

Economic Theories Supporting the Model

The model ties into broader economic theories about market cycles and investor psychology, suggesting that markets move in predictable phases based on human behavior.

Critiques and Limitations

- Predictability: Some critics argue that the model’s predictions are too rigid.

- Market Complexity: Others suggest that modern markets are too complex for such a straightforward model.

Integrating with Other Market Analysis Tools

Complementary Analysis Methods

To enhance the accuracy of Lindsay’s model, traders often combine it with other analytical tools like Elliott Wave Theory and Fibonacci retracements.

Combining Tools for Enhanced Prediction

- Elliott Wave Theory for Cycle Analysis

- Fibonacci for Resistance and Support Levels

Conclusion

George Lindsay’s “3 Peaks and the Domed House” model, revised by Barclay T. Leib, continues to be a profound tool for understanding and predicting market cycles. By incorporating modern techniques and theories, traders can utilize this model to enhance their market analysis and decision-making strategies.

Frequently Asked Questions:

- What is the main benefit of using Lindsay’s model?

It provides a structured way to forecast market tops and bottoms, helping traders with timing decisions. - Can this model be applied to all financial markets?

Yes, while originally used for stocks, it can be adapted to any market with price fluctuations. - How accurate is the model in today’s digital trading age?

When combined with modern analytical tools, it remains a valuable component of market analysis. - What are the main criticisms of the model?

Critics often point to its predictability and simplicity, arguing that modern markets require more nuanced approaches. - How do revisions by Barclay T. Leib enhance the model?

Leib’s revisions modernize the model by incorporating new data and analytical methods, improving its applicability.

Be the first to review “George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.