-

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Banks Code with Smart Money Trader

1 × $34.00

The Banks Code with Smart Money Trader

1 × $34.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Illustrated Guide to Technical Analysis Signals and Phrases with Constance Brown

1 × $6.00

The Illustrated Guide to Technical Analysis Signals and Phrases with Constance Brown

1 × $6.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Complete Trading System with Segma Singh

1 × $6.00

Complete Trading System with Segma Singh

1 × $6.00 -

×

All About Stocks (3rd Ed.) withEsme E.Faerber

1 × $6.00

All About Stocks (3rd Ed.) withEsme E.Faerber

1 × $6.00 -

×

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00 -

×

Traders Positioning System with Lee Gettess

1 × $4.00

Traders Positioning System with Lee Gettess

1 × $4.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

Survive and Thrive in Extreme Volatility Class with Don Kaufman

1 × $6.00

Survive and Thrive in Extreme Volatility Class with Don Kaufman

1 × $6.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Confidence to Hypnotize

1 × $6.00

Confidence to Hypnotize

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Advanced Price Action Course with Chris Capre

1 × $7.00

Advanced Price Action Course with Chris Capre

1 × $7.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Trading With DiNapoli Levels

1 × $6.00

Trading With DiNapoli Levels

1 × $6.00 -

×

Penny Stock Mastery

1 × $31.00

Penny Stock Mastery

1 × $31.00 -

×

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

DOTS Method with Dean Malone

1 × $54.00

DOTS Method with Dean Malone

1 × $54.00 -

×

Foreign Exchange

1 × $6.00

Foreign Exchange

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00 -

×

Trading Hub 4.0 with Mr. Khan

1 × $27.00

Trading Hub 4.0 with Mr. Khan

1 × $27.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

Trading MasterMind Course

1 × $23.00

Trading MasterMind Course

1 × $23.00 -

×

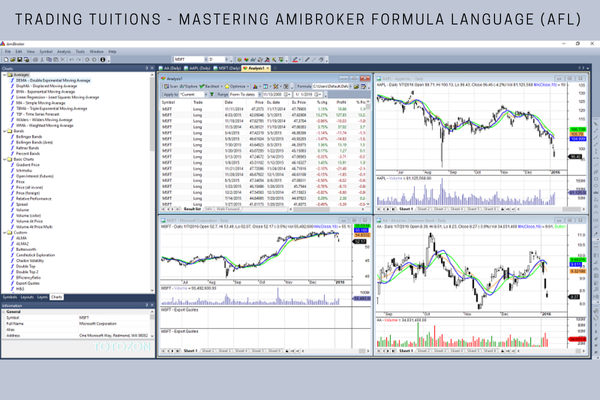

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success – Marty Kearney

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “LEAPS Trading Strategies- Powerful Techniques for Options Trading Success – Marty Kearney” below:

LEAPS Trading Strategies: Powerful Techniques for Options Trading Success with Marty Kearney

Introduction

Long-term Equity Anticipation Securities (LEAPS) are a dynamic component of the options trading world. Marty Kearney, a seasoned expert in options trading, offers deep insights into LEAPS trading strategies that can significantly enhance your trading portfolio. This guide explores these strategies to help you achieve long-term success in options trading.

Who is Marty Kearney?

Marty Kearney is a respected options trader and educator, known for his practical approach to options trading and deep expertise in LEAPS.

Contributions to Options Trading

Kearney has contributed extensively to educational programs about options trading, helping traders leverage the power of LEAPS for their investment strategies.

Understanding LEAPS

What are LEAPS?

LEAPS, or Long-term Equity Anticipation Securities, are options with an expiration date longer than one year, offering long-term investment opportunities.

Characteristics of LEAPS

- Longer time horizons

- Lower time decay rate

Benefits of Using LEAPS

Strategic Advantages

Discover the unique benefits LEAPS offer, including greater flexibility and reduced risk of capital loss.

Key Benefits

- Extended time for market movements

- Potential for substantial returns

Core LEAPS Trading Strategies

The Buy and Hold Strategy

Learn how to utilize LEAPS as a substitute for stock holdings to benefit from stock gains while risking less capital.

Implementation Guide

- Selecting the right LEAPS

- Timing the market entry

Protective Puts with LEAPS

Explore how to use LEAPS for protective puts to hedge long-term stock positions effectively.

Hedging Benefits

- Protection against downside risk

- Flexibility in holding positions

LEAPS for Income Generation

Selling Covered Calls

Master the technique of selling covered calls using LEAPS to generate consistent income.

Steps for Success

- Choosing the correct LEAPS

- Managing the calls for optimal income

Combining LEAPS with Other Options Strategies

Spreads and Straddles

Integrate LEAPS into spreads and straddles to maximize market opportunities and minimize risks.

Strategic Combinations

- Vertical spreads

- Calendar spreads

Managing Risks with LEAPS

Risk Assessment

Understand the risks associated with LEAPS and how to manage them effectively.

Mitigation Techniques

- Diversification

- Regular portfolio review

Tax Implications of Trading LEAPS

Navigating Taxes

Learn about the tax considerations important for LEAPS traders to optimize returns.

Tax Tips

- Long-term capital gains

- Tax-efficient trading strategies

The Psychological Aspect of Trading LEAPS

Emotional Discipline

Recognize the psychological challenges of long-term options trading and how to overcome them.

Emotional Management

- Patience

- Strategic decisiveness

Advanced LEAPS Trading Techniques

Dynamic Hedging

Delve into advanced strategies like dynamic hedging to protect investments and lock in profits.

Hedging Strategies

- Delta hedging

- Portfolio insurance

Conclusion

LEAPS offer a robust avenue for traders looking to expand their trading horizon and capitalize on long-term market trends. With strategies pioneered by Marty Kearney, traders can gain the necessary skills to navigate the complex landscape of options trading successfully.

Why LEAPS?

Choosing LEAPS trading strategies can provide significant advantages in terms of flexibility, cost efficiency, and potential for high returns, making them a valuable addition to any trader’s arsenal.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “LEAPS Trading Strategies- Powerful Techniques for Options Trading Success – Marty Kearney” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.