-

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

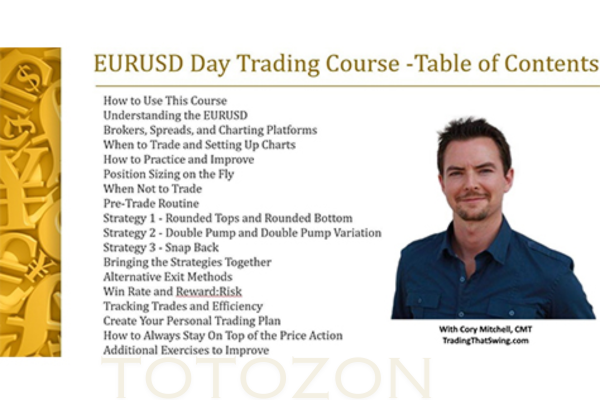

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00 -

×

May Madness with LIT Trading

1 × $5.00

May Madness with LIT Trading

1 × $5.00 -

×

Trading Psychology Mastery Course - Trading Composure

1 × $6.00

Trading Psychology Mastery Course - Trading Composure

1 × $6.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trend Trader PRO Suite Training Course

1 × $5.00

Trend Trader PRO Suite Training Course

1 × $5.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Beyond Fibonacci Retracements with Dynamic Traders

1 × $5.00

Beyond Fibonacci Retracements with Dynamic Traders

1 × $5.00 -

×

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00 -

×

Interpreting Money Stream with Peter Worden

1 × $6.00

Interpreting Money Stream with Peter Worden

1 × $6.00 -

×

Beat The Binaries

1 × $15.00

Beat The Binaries

1 × $15.00 -

×

Money Management

1 × $6.00

Money Management

1 × $6.00 -

×

Emini Strategy #6 with Steve Primo

1 × $39.00

Emini Strategy #6 with Steve Primo

1 × $39.00 -

×

Mark Sebastian – Gamma Trading Class

1 × $6.00

Mark Sebastian – Gamma Trading Class

1 × $6.00 -

×

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00 -

×

Day Trading Academy

1 × $54.00

Day Trading Academy

1 × $54.00 -

×

Indicators & BWT Bar Types for NT7

1 × $139.00

Indicators & BWT Bar Types for NT7

1 × $139.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

The Pitbull Investor (2009 Ed.)

1 × $6.00

The Pitbull Investor (2009 Ed.)

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Cobra (aka Viper Crude)

1 × $23.00

Cobra (aka Viper Crude)

1 × $23.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Reading & Understanding Charts with Andrew Baxter

1 × $6.00

Reading & Understanding Charts with Andrew Baxter

1 × $6.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

Ron Ianieri – Advanced Options Strategies

1 × $6.00

Ron Ianieri – Advanced Options Strategies

1 × $6.00 -

×

Order Flow Analytics

1 × $54.00

Order Flow Analytics

1 × $54.00 -

×

Learn to Trade Course with Mike Aston

1 × $6.00

Learn to Trade Course with Mike Aston

1 × $6.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00 -

×

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

Intro To Short Selling with Madaz Money

1 × $31.00

Intro To Short Selling with Madaz Money

1 × $31.00 -

×

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00 -

×

Galactic Trader Seminar

1 × $15.00

Galactic Trader Seminar

1 × $15.00 -

×

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00 -

×

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00 -

×

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

Stocks and Bonds with Elaine Scott

1 × $6.00

Stocks and Bonds with Elaine Scott

1 × $6.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Strategy Class + Indicators

1 × $31.00

Strategy Class + Indicators

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Into The Abbys with Black Rabbit

1 × $18.00

Into The Abbys with Black Rabbit

1 × $18.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

Elliott Wave DNA with Nicola Delic

1 × $31.00

Elliott Wave DNA with Nicola Delic

1 × $31.00 -

×

The Silver Edge Forex Training Program with T3 Live

1 × $5.00

The Silver Edge Forex Training Program with T3 Live

1 × $5.00 -

×

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00 -

×

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

Surefire Trading Plans with Mark McRae

1 × $6.00

Surefire Trading Plans with Mark McRae

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

Climate Behaviour with Feibel Trading

1 × $6.00

Climate Behaviour with Feibel Trading

1 × $6.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Decoded with Axia Futures

1 × $31.00

Trading Decoded with Axia Futures

1 × $31.00 -

×

Trading on the Edge with Guido J.Deboeck

1 × $6.00

Trading on the Edge with Guido J.Deboeck

1 × $6.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

Technical & Fundamental Courses with Diamant Capital

1 × $5.00

Technical & Fundamental Courses with Diamant Capital

1 × $5.00 -

×

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00 -

×

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

The Tickmaster Indicator

1 × $54.00

The Tickmaster Indicator

1 × $54.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00 -

×

Thetimefactor - TRADING WITH PRICE

1 × $15.00

Thetimefactor - TRADING WITH PRICE

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman” below:

Investing with LEAPS: What You Should Know About Long Term Investing with James Bittman

Long-Term Equity Anticipation Securities (LEAPS) are an essential tool for investors looking to gain long-term exposure to stocks without the need for immediate large capital outlays. As a leading expert in options trading, James Bittman provides invaluable insights into how to leverage LEAPS for long-term investing. This comprehensive guide will navigate you through the fundamentals, strategies, and tips to effectively use LEAPS as part of your investment portfolio.

Understanding LEAPS

What are LEAPS?

LEAPS are long-term options that provide the right, but not the obligation, to buy or sell a stock at a predetermined price before the option expires, typically up to three years.

Benefits of Investing in LEAPS

- Extended Time Frame: Gives more time for your investment thesis to unfold.

- Reduced Capital Requirement: Less capital is needed upfront compared to buying stocks outright.

Strategic Advantages of LEAPS

Hedging Long-Term Investments

LEAPS can be used to hedge against downside risks in long-term holdings, providing an insurance-like protection.

Leveraging Market Movements

With LEAPS, you can leverage significant market moves without committing a substantial amount of capital.

James Bittman’s Techniques for LEAPS

Selecting the Right LEAPS

Bittman emphasizes the importance of choosing LEAPS with a careful analysis of strike price and expiration date to match your investment goals.

Combining LEAPS with Stock Positions

Integrating LEAPS into your existing stock portfolio can enhance overall returns and provide additional flexibility.

Practical Tips for Using LEAPS

Manage Risks Effectively

Understand the risks associated with options and implement strategies to manage them effectively.

Monitor Market Conditions

Regular monitoring of market conditions is crucial to adjust your LEAPS strategies as needed.

Common Misconceptions About LEAPS

Overestimating Market Movements

Investors often overestimate how much the market will move, potentially leading to losses.

Underestimating Time Decay

LEAPS, like all options, suffer from time decay, which accelerates as the expiration date approaches.

Financial Planning with LEAPS

Long-Term Financial Goals

LEAPS can be aligned with your long-term financial goals, offering a strategic way to achieve them.

Diversification

Adding LEAPS to your investment mix can help diversify your portfolio risks.

LEAPS vs. Traditional Options

Comparing Durations

LEAPS have much longer durations than standard options, providing a different risk and reward balance.

Strategic Differences

The strategies employed with LEAPS are often more focused on longer-term market trends and fundamentals.

Learning from James Bittman

Key Takeaways

Bittman’s teachings encourage a disciplined approach to selecting and managing LEAPS.

Advanced Strategies

He also covers advanced strategies that can optimize the use of LEAPS in various market conditions.

Conclusion

Investing with LEAPS offers a unique opportunity for long-term growth and risk management. By understanding and utilizing the strategies taught by James Bittman, investors can enhance their ability to navigate the complexities of long-term options trading. Whether looking to hedge, leverage, or diversify, LEAPS provide a versatile tool in the savvy investor’s arsenal.

FAQs

What are LEAPS in options trading?

LEAPS are Long-Term Equity Anticipation Securities, which are options with a longer time frame than typical options, up to three years.

How do LEAPS differ from regular options?

The primary difference is the duration; LEAPS allow for longer-term strategies due to their extended expiration periods.

What are the benefits of using LEAPS?

Benefits include lower capital outlay, potential for higher leverage, and the ability to hedge long-term investments.

What should be considered when choosing LEAPS?

Consider the underlying asset, strike price, expiration date, and how these factors align with your investment goals.

Can LEAPS be used for portfolio diversification?

Yes, LEAPS can be an effective tool for diversifying investment risks, especially in a long-term investment strategy.

Be the first to review “Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.