-

×

RadioActive Trading Home Study Kit with Power Options

1 × $31.00

RadioActive Trading Home Study Kit with Power Options

1 × $31.00 -

×

The Master Indicator 2023 with Lance Ippolito

1 × $101.00

The Master Indicator 2023 with Lance Ippolito

1 × $101.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Out of the Pits with Caitlin Zaloom

1 × $6.00

Out of the Pits with Caitlin Zaloom

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00 -

×

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

Most Woke Trading Methods with Hunter FX

1 × $5.00

Most Woke Trading Methods with Hunter FX

1 × $5.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Building Winning Trading Systems

1 × $6.00

Building Winning Trading Systems

1 × $6.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

$900.00 Original price was: $900.00.$179.00Current price is: $179.00.

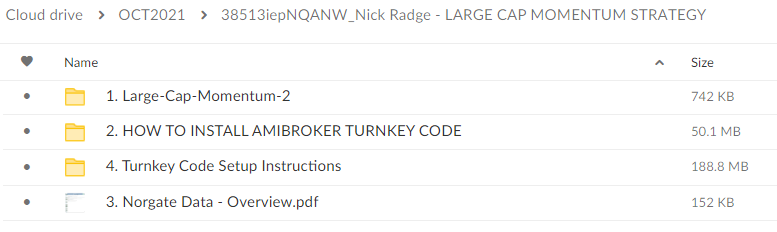

File Size: 239.7 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “LARGE CAP MOMENTUM STRATEGY with Nick Radge ” below:

Large Cap Momentum Strategy with Nick Radge

Introduction

When it comes to investing in the stock market, the momentum strategy has proven to be one of the most effective approaches, particularly with large cap stocks. Nick Radge, a renowned figure in the trading community, has tailored this strategy to maximize returns by focusing on the strongest performers among large cap stocks. This article delves into the essence of the Large Cap Momentum Strategy and how it can be a lucrative choice for your investment portfolio.

Understanding Momentum Investing

Momentum investing involves buying stocks that have shown high returns over the past few months and selling those that have shown poor performance. The belief is that stocks which are performing well will continue to perform well in the near term.

Why Focus on Large Cap Stocks?

- Stability: Large cap stocks are typically more stable and less volatile.

- Liquidity: They offer greater liquidity, making it easier to enter and exit positions.

- Growth Potential: Despite their size, many large cap stocks still offer significant growth potential.

Nick Radge’s Approach to Momentum Investing

Nick Radge tweaks traditional momentum strategies to better suit large cap stocks, enhancing their ability to generate sustainable returns.

Key Elements of Radge’s Strategy

- Selection Criteria: Focuses on stocks that are not only performing well but also have solid fundamentals.

- Holding Period: Advocates for a disciplined approach to holding periods to optimize the trade’s lifecycle.

Implementing the Strategy

Tools and Resources Needed

To effectively implement this strategy, investors need access to reliable financial data and analytical tools that can track stock performance and trends.

Building a Momentum Portfolio

- Stock Selection: How to choose the right stocks.

- Portfolio Allocation: Deciding how much to invest in each stock.

Risk Management

Managing risk is crucial in momentum investing, and Radge emphasizes the importance of stop-loss orders and portfolio rebalancing to protect gains.

Benefits of Large Cap Momentum Strategy

Higher Return Potential

By focusing on large cap stocks, the strategy tends to yield higher returns compared to investing in smaller companies, given the same level of market exposure.

Reduced Volatility

Large cap stocks are generally less volatile, which can help in maintaining portfolio stability during market downturns.

Challenges and Considerations

Market Dependency

The success of momentum strategies often hinges on market conditions. In bear markets, momentum can lead to significant losses.

Requires Active Management

This strategy requires constant monitoring and adjustment, which might not be suitable for passive investors.

Expert Insights from Nick Radge

Strategic Advice

Nick Radge often shares insights on the timing and market conditions favorable for momentum strategies, advocating for a proactive rather than reactive approach.

Adaptability and Learning

He also emphasizes the need to adapt the strategy as market dynamics change.

Real-Life Success Stories

Highlighting successful case studies where the Large Cap Momentum Strategy has significantly outperformed the market.

Conclusion

The Large Cap Momentum Strategy, as refined by Nick Radge, offers a robust framework for investors looking to leverage the ongoing success of high-performing large cap stocks. By understanding and applying the principles of momentum investing, and incorporating Radge’s expert enhancements, investors can potentially achieve superior returns while managing risk effectively.

FAQs

- What is the large cap momentum strategy?

- It’s an investment strategy that buys high-performing large cap stocks expecting that they will continue to perform well.

- Why does Nick Radge focus on large cap stocks for this strategy?

- Because they provide stability, liquidity, and still offer growth potential, making them ideal for momentum strategies.

- What are the main benefits of this strategy?

- Higher potential returns and reduced volatility compared to strategies involving smaller companies.

- What are the key risks with the large cap momentum strategy?

- The strategy depends heavily on market conditions and requires active management, which can be a challenge during bear markets.

- How can an investor mitigate risks when using this strategy?

- Through disciplined use of stop-loss orders and regular portfolio rebalancing.

Be the first to review “LARGE CAP MOMENTUM STRATEGY with Nick Radge” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.