-

×

Oil Trading Academy Code 3 Video Course

1 × $6.00

Oil Trading Academy Code 3 Video Course

1 × $6.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

Secrets of Investors on WallStreet (Audio) with Ken Fisher

1 × $6.00

Secrets of Investors on WallStreet (Audio) with Ken Fisher

1 × $6.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00 -

×

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00 -

×

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00 -

×

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Scalping the Forex

1 × $6.00

Scalping the Forex

1 × $6.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

The Python for Traders Masterclass with Mr James

1 × $10.00

The Python for Traders Masterclass with Mr James

1 × $10.00 -

×

Stock Selection Course with Dave Landry

1 × $6.00

Stock Selection Course with Dave Landry

1 × $6.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00 -

×

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

Raghee’s Winners Circle Course

1 × $6.00

Raghee’s Winners Circle Course

1 × $6.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

SE ELITE COURSE with SE TRADINGX

1 × $5.00

SE ELITE COURSE with SE TRADINGX

1 × $5.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

AM Trader - Strategy Training Course

1 × $23.00

AM Trader - Strategy Training Course

1 × $23.00 -

×

Inside the House of Money (2006) with Steven Drobny

1 × $6.00

Inside the House of Money (2006) with Steven Drobny

1 × $6.00 -

×

Fig Combo Course

1 × $5.00

Fig Combo Course

1 × $5.00 -

×

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00 -

×

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00 -

×

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00 -

×

The 5 Day Momentum Method

1 × $6.00

The 5 Day Momentum Method

1 × $6.00 -

×

How I Made One Million Dollars with Larry Williams

1 × $6.00

How I Made One Million Dollars with Larry Williams

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

$900.00 Original price was: $900.00.$179.00Current price is: $179.00.

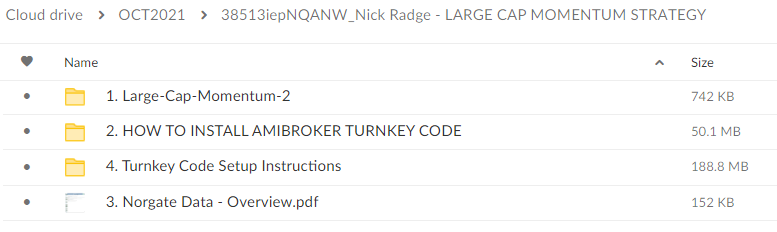

File Size: 239.7 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “LARGE CAP MOMENTUM STRATEGY with Nick Radge ” below:

Large Cap Momentum Strategy with Nick Radge

Introduction

When it comes to investing in the stock market, the momentum strategy has proven to be one of the most effective approaches, particularly with large cap stocks. Nick Radge, a renowned figure in the trading community, has tailored this strategy to maximize returns by focusing on the strongest performers among large cap stocks. This article delves into the essence of the Large Cap Momentum Strategy and how it can be a lucrative choice for your investment portfolio.

Understanding Momentum Investing

Momentum investing involves buying stocks that have shown high returns over the past few months and selling those that have shown poor performance. The belief is that stocks which are performing well will continue to perform well in the near term.

Why Focus on Large Cap Stocks?

- Stability: Large cap stocks are typically more stable and less volatile.

- Liquidity: They offer greater liquidity, making it easier to enter and exit positions.

- Growth Potential: Despite their size, many large cap stocks still offer significant growth potential.

Nick Radge’s Approach to Momentum Investing

Nick Radge tweaks traditional momentum strategies to better suit large cap stocks, enhancing their ability to generate sustainable returns.

Key Elements of Radge’s Strategy

- Selection Criteria: Focuses on stocks that are not only performing well but also have solid fundamentals.

- Holding Period: Advocates for a disciplined approach to holding periods to optimize the trade’s lifecycle.

Implementing the Strategy

Tools and Resources Needed

To effectively implement this strategy, investors need access to reliable financial data and analytical tools that can track stock performance and trends.

Building a Momentum Portfolio

- Stock Selection: How to choose the right stocks.

- Portfolio Allocation: Deciding how much to invest in each stock.

Risk Management

Managing risk is crucial in momentum investing, and Radge emphasizes the importance of stop-loss orders and portfolio rebalancing to protect gains.

Benefits of Large Cap Momentum Strategy

Higher Return Potential

By focusing on large cap stocks, the strategy tends to yield higher returns compared to investing in smaller companies, given the same level of market exposure.

Reduced Volatility

Large cap stocks are generally less volatile, which can help in maintaining portfolio stability during market downturns.

Challenges and Considerations

Market Dependency

The success of momentum strategies often hinges on market conditions. In bear markets, momentum can lead to significant losses.

Requires Active Management

This strategy requires constant monitoring and adjustment, which might not be suitable for passive investors.

Expert Insights from Nick Radge

Strategic Advice

Nick Radge often shares insights on the timing and market conditions favorable for momentum strategies, advocating for a proactive rather than reactive approach.

Adaptability and Learning

He also emphasizes the need to adapt the strategy as market dynamics change.

Real-Life Success Stories

Highlighting successful case studies where the Large Cap Momentum Strategy has significantly outperformed the market.

Conclusion

The Large Cap Momentum Strategy, as refined by Nick Radge, offers a robust framework for investors looking to leverage the ongoing success of high-performing large cap stocks. By understanding and applying the principles of momentum investing, and incorporating Radge’s expert enhancements, investors can potentially achieve superior returns while managing risk effectively.

FAQs

- What is the large cap momentum strategy?

- It’s an investment strategy that buys high-performing large cap stocks expecting that they will continue to perform well.

- Why does Nick Radge focus on large cap stocks for this strategy?

- Because they provide stability, liquidity, and still offer growth potential, making them ideal for momentum strategies.

- What are the main benefits of this strategy?

- Higher potential returns and reduced volatility compared to strategies involving smaller companies.

- What are the key risks with the large cap momentum strategy?

- The strategy depends heavily on market conditions and requires active management, which can be a challenge during bear markets.

- How can an investor mitigate risks when using this strategy?

- Through disciplined use of stop-loss orders and regular portfolio rebalancing.

Be the first to review “LARGE CAP MOMENTUM STRATEGY with Nick Radge” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.