-

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Get Rich with Dividends

1 × $6.00

Get Rich with Dividends

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

How I Trade the QQQs with Don Miller

1 × $6.00

How I Trade the QQQs with Don Miller

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The 4 Horsemen CD with David Elliott

1 × $6.00

The 4 Horsemen CD with David Elliott

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

$95.00 Original price was: $95.00.$6.00Current price is: $6.00.

File Size: 1.25 GB

Delivery Time: 1–12 hours

Media Type: Online Course

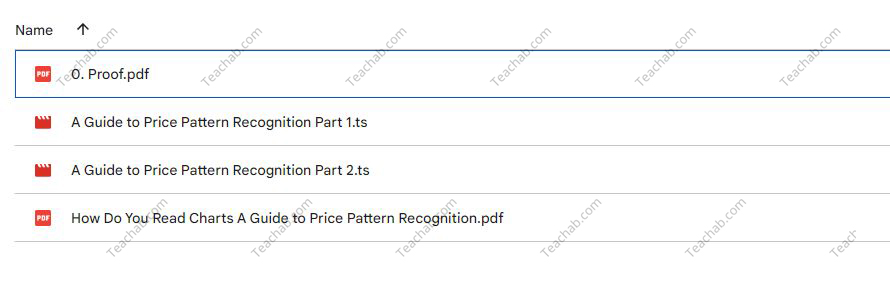

Content Proof: Watch Here!

You may check content proof of “How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman” below:

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

Introduction

In the world of trading and investment, chart reading is not just a skill—it’s an essential language. Professor Jeff Bierman, a renowned expert in technical analysis, has developed a comprehensive approach to understanding this language through classic price pattern recognition. Let’s dive into the fundamentals of chart reading as taught by Professor Bierman, and discover how you can turn these intricate patterns into actionable trading strategies.

Understanding Chart Types

What Are the Main Types of Charts?

- Line Charts: Simple and straightforward, showing the closing prices over time.

- Bar Charts: Provide more data such as opening, high, low, and closing prices.

- Candlestick Charts: Offer a detailed view of market psychology and can indicate potential reversals.

Why Chart Types Matter

Choosing the right chart type can enhance your ability to read and interpret market movements effectively. Each chart type provides different insights, which are crucial for making informed trading decisions.

The Basics of Price Patterns

Identifying Common Price Patterns

- Head and Shoulders: Indicative of a reversal in trend.

- Double Tops and Bottoms: Signal strength or weakness in a market.

- Triangles and Flags: Suggest continuation or breakout.

What These Patterns Tell Us

Price patterns are the language of the markets. By learning to recognize these patterns, traders can anticipate potential market movements and adjust their strategies accordingly.

Decoding Market Trends with Professor Bierman

The Role of Volume in Chart Analysis

Volume plays a pivotal role in confirming the strength of a price pattern. Professor Bierman emphasizes the importance of volume analysis as a fundamental aspect of chart interpretation.

How Volume Influences Price Movements

- High volume during a market breakout suggests a strong move.

- Low volume may indicate a lack of conviction or potential reversal.

Using Technical Indicators

Technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are tools that, when used alongside price patterns, can provide deeper insights into market trends.

Applying Price Pattern Recognition in Trading

Steps to Effective Chart Reading

- Identify the chart type and set an appropriate time frame.

- Recognize the prevailing price patterns.

- Analyze volume and apply technical indicators to confirm the pattern.

- Make informed trading decisions based on the analysis.

Real-World Application

Through practical examples and case studies in his classes, Professor Bierman demonstrates how these strategies can be applied in real trading scenarios.

Advanced Techniques in Price Pattern Recognition

Beyond the Basics

Professor Bierman also covers more complex patterns and scenarios, including false breakouts and the psychology behind price movements, providing a more nuanced understanding of market dynamics.

Integrating Multiple Analysis Tools

Combining price patterns with other forms of technical analysis creates a robust trading strategy that can adapt to various market conditions.

Conclusion

Chart reading is an invaluable skill in the trading world, and Professor Jeff Bierman’s class on classic price pattern recognition offers a foundational gateway into mastering this skill. By understanding and applying the techniques discussed, traders can enhance their ability to make strategic decisions based on comprehensive market analysis.

FAQs

1. How important is chart type selection in trading?

Chart type selection is crucial as it determines the clarity and type of information available for making trading decisions.

2. Can price patterns predict market movements accurately?

While not infallible, price patterns provide significant insights and are widely used as predictive tools in trading.

3. How does Professor Bierman suggest using volume in trading?

Professor Bierman recommends using volume as a confirmation tool to ensure the strength of price movements and patterns.

4. Are technical indicators necessary for recognizing price patterns?

While not necessary, technical indicators greatly enhance the reliability of pattern recognition and trading decisions.

5. What’s the first step for a novice trader in learning chart reading?

The first step is understanding different chart types and beginning to recognize basic price patterns.

Be the first to review “How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.