-

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

ICT Charter 2020 with Inner Circle Trader

1 × $13.00

ICT Charter 2020 with Inner Circle Trader

1 × $13.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Trap Trade Workshop with Doc Severson

1 × $6.00

The Trap Trade Workshop with Doc Severson

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Swinging For The Fences

1 × $15.00

Swinging For The Fences

1 × $15.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00 -

×

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00 -

×

Divergence Trading – Mastering Market Reversals

1 × $31.00

Divergence Trading – Mastering Market Reversals

1 × $31.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

Ichimokutrade - Elliot Wave 101

1 × $15.00

Ichimokutrade - Elliot Wave 101

1 × $15.00 -

×

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

Forex Trading for Beginners 100 Must Know “What”&”How” Q&A

1 × $5.00

Forex Trading for Beginners 100 Must Know “What”&”How” Q&A

1 × $5.00 -

×

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

MotiveWave Course with Todd Gordon

1 × $23.00

MotiveWave Course with Todd Gordon

1 × $23.00 -

×

Money & European Union with Stephen Frank Overturf

1 × $6.00

Money & European Union with Stephen Frank Overturf

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

DayTrading Made Simple with William Greenspan

1 × $4.00

DayTrading Made Simple with William Greenspan

1 × $4.00 -

×

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00 -

×

Options Trading Accelerator with Base Camp Trading

1 × $23.00

Options Trading Accelerator with Base Camp Trading

1 × $23.00 -

×

Introduction to Candlestick (Article) with Arthur A.Hill

1 × $6.00

Introduction to Candlestick (Article) with Arthur A.Hill

1 × $6.00 -

×

Eye Opening FX

1 × $5.00

Eye Opening FX

1 × $5.00 -

×

Introduction to Amibroker with Howard B.Bandy

1 × $6.00

Introduction to Amibroker with Howard B.Bandy

1 × $6.00 -

×

Forex Trading: Comprehensive & Concise Forex Trading Course with Luciano Kelly & Learn Forex Mentor

1 × $6.00

Forex Trading: Comprehensive & Concise Forex Trading Course with Luciano Kelly & Learn Forex Mentor

1 × $6.00 -

×

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00 -

×

Forex Masterclass with 20 Minute Trader

1 × $23.00

Forex Masterclass with 20 Minute Trader

1 × $23.00 -

×

Elliott Flat Waves CD with David Elliott

1 × $6.00

Elliott Flat Waves CD with David Elliott

1 × $6.00 -

×

Inside Strategies for Profiting with Options with Max Ansbacher

1 × $6.00

Inside Strategies for Profiting with Options with Max Ansbacher

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00 -

×

Master NFTs in 7 Days with Ben Yu

1 × $23.00

Master NFTs in 7 Days with Ben Yu

1 × $23.00 -

×

The Tickmaster Indicator

1 × $54.00

The Tickmaster Indicator

1 × $54.00 -

×

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00 -

×

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Jimdandym Ql4 Courses

1 × $15.00

Jimdandym Ql4 Courses

1 × $15.00 -

×

Jigsaw Orderflow Training Course with Jigsaw Trading

1 × $6.00

Jigsaw Orderflow Training Course with Jigsaw Trading

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00 -

×

Edges For Ledges with Trader Dante

1 × $4.00

Edges For Ledges with Trader Dante

1 × $4.00 -

×

Special Webinars Module 1 with Trader Dante

1 × $6.00

Special Webinars Module 1 with Trader Dante

1 × $6.00 -

×

PIPSOCIETY - FOREX AMAZING STRATEGY

1 × $15.00

PIPSOCIETY - FOREX AMAZING STRATEGY

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

2 Trades A Day with Jason Hale

$495.00 Original price was: $495.00.$15.00Current price is: $15.00.

File Size: 239 MB

Delivery Time: 1–12 hours

Media Type: Online Course

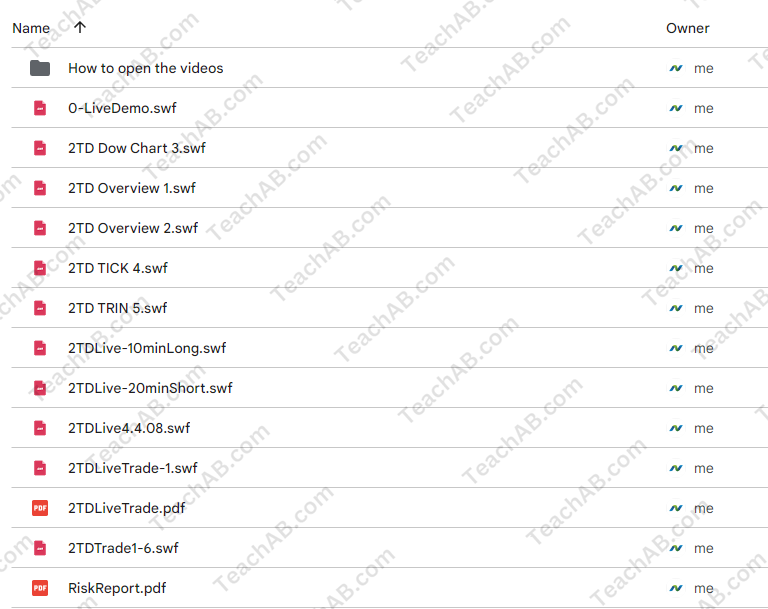

Content Proof: Watch Here!

You may check content proof of “2 Trades A Day with Jason Hale” below:

In the dynamic world of stock trading, having a clear, concise strategy is key to success. Jason Hale’s “2 Trades A Day” method provides just that—a focused, systematic approach to making the most out of your trading day, every day. In this article, we delve into how this strategy works, its benefits, and how you can implement it to potentially increase your trading success.

Introduction to Jason Hale and His Trading Philosophy

Who is Jason Hale?

Jason Hale is a seasoned trader known for his pragmatic approach to the stock market. With years of experience, Jason has refined his strategy to what he believes is an optimal approach for consistent gains.

The Core of His Strategy: Simplicity and Focus

At its heart, the “2 Trades A Day” strategy is about reducing complexity and focusing on two well-planned trades each trading day. This method encourages discipline and helps traders avoid common pitfalls like overtrading.

Understanding the ‘2 Trades A Day’ Strategy

Selection of Trades

The first step in Jason’s strategy is selecting two trades with the highest potential each day. This involves detailed market analysis and identifying signals that suggest a strong move in stock prices.

Criteria for Trade Selection

- Market Trends: Understanding broader market trends is crucial.

- Volume Analysis: High trading volumes can indicate strong interest in a stock.

- Technical Indicators: Tools like moving averages and RSI play a key role.

Timing the Trades

Timing is everything in trading. Jason emphasizes the importance of executing trades at optimal times during the trading day, often around market open or close, to capitalize on market volatility.

Benefits of the ‘2 Trades A Day’ Method

Enhanced Focus

By limiting the number of trades, you can dedicate more time and resources to researching and executing each trade effectively.

Risk Management

This approach inherently limits exposure to market volatility, as it avoids the temptation to make impulsive trades throughout the day.

Consistency and Discipline

Following a strict rule of two trades per day fosters discipline, a crucial trait for successful traders.

How to Implement This Strategy

Pre-Market Preparation

- Review market news and events: Be aware of factors that could impact the markets.

- Prepare your watchlist: Select potential stocks based on your pre-market analysis.

Execution

- Enter trades with precision: Timing your entry is as important as the selection.

- Monitor and adjust: Stay vigilant and be ready to exit if conditions change.

Tools and Resources for Support

Technical Analysis Software

Utilizing robust technical analysis tools can enhance the effectiveness of your trades by providing real-time data and insights.

Continual Education

Engage with resources like webinars, books, and courses to keep your trading skills sharp and up-to-date.

Challenges and How to Overcome Them

Emotional Trading

Sticking strictly to the strategy helps mitigate emotional decisions, which can often lead to losses.

Market Anomalies

Sometimes, the market behaves unpredictably. In such cases, it’s important to stick to your risk management principles and not deviate from your strategy.

Conclusion

Jason Hale’s “2 Trades A Day” approach simplifies trading into manageable, focused actions that, if executed well, can lead to consistent trading success. By adopting this strategy, you embrace a disciplined, informed trading practice that can significantly enhance your ability to make profitable decisions in the stock market.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “2 Trades A Day with Jason Hale” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.