-

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Wall Street Training

1 × $6.00

Wall Street Training

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Breakout And Breakdown Strategies For Daytraders with Chris Tyler

1 × $6.00

Breakout And Breakdown Strategies For Daytraders with Chris Tyler

1 × $6.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Wealth, War & Wisdom with Barton Biggs

1 × $6.00

Wealth, War & Wisdom with Barton Biggs

1 × $6.00 -

×

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00 -

×

Wall Street Stories with Edwin Lefevre

1 × $6.00

Wall Street Stories with Edwin Lefevre

1 × $6.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Ultimate Guide to Stock Investing

1 × $6.00

Ultimate Guide to Stock Investing

1 × $6.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

Weekly Playbook Workshop #1

1 × $31.00

Weekly Playbook Workshop #1

1 × $31.00 -

×

Weekly Options Windfall and Bonus with James Preston

1 × $54.00

Weekly Options Windfall and Bonus with James Preston

1 × $54.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

BearProof Investing with Kenneth Little

1 × $6.00

BearProof Investing with Kenneth Little

1 × $6.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Iron Condors in a Volatile Market 2022 with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$46.00Current price is: $46.00.

File Size: 4.12 GB

Delivery Time: 1–12 hours

Media Type: Online Course

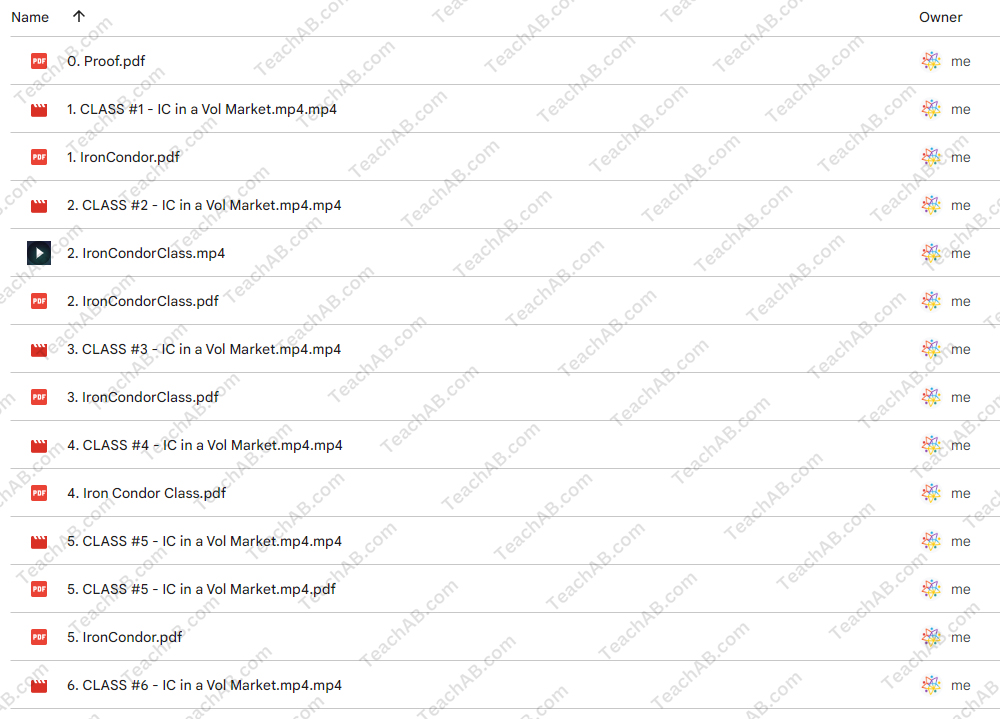

Content Proof: Watch Here!

You may check content proof of “Iron Condors in a Volatile Market 2022 with Dan Sheridan – Sheridan Options Mentoring” below:

Navigating the tumultuous waves of the stock market in 2022 requires not just courage but a robust strategy. The Iron Condor, a popular options trading strategy, has shown considerable promise in such volatile environments. This article explores the intricacies of executing Iron Condors effectively under the guidance of Dan Sheridan of Sheridan Options Mentoring.

Introduction to Iron Condors

What is an Iron Condor?

An Iron Condor is a non-directional options strategy that involves selling and buying of calls and puts to generate profit from a stock that remains within a specific price range. It is best utilized in markets where significant price swings are not expected.

Understanding Market Volatility

The Impact of Volatility on Options

2022 has been a year marked by significant volatility, influenced by economic uncertainties and geopolitical tensions. This environment impacts options trading, particularly strategies like the Iron Condor, which thrive in stable conditions.

Mastering Iron Condors with Dan Sheridan

Dan Sheridan’s Expertise

Dan Sheridan is a veteran options trader and respected mentor in the trading community. His approach to Iron Condors in volatile markets is both strategic and informed, aimed at minimizing risk while maximizing profitability.

Sheridan’s Strategy for 2022

- Adjusting Strike Prices: Slightly wider spreads to accommodate unexpected movements.

- Risk Management: Tighter stop-loss levels to protect gains.

- Profit Targets: Realistic profit targets to ensure timely exit.

Course Structure and Content

What the Course Offers

Sheridan Options Mentoring offers a comprehensive course that covers:

- Theory of Iron Condors

- Application in Current Markets

- Hands-on Trading Simulations

Key Learning Modules

- Basics of Options Trading

- Introduction to Iron Condors

- Adapting to Market Volatility

- Risk and Money Management

Who Should Attend?

Target Audience

- Novice Traders: Those new to options trading.

- Experienced Traders: Seasoned traders looking to refine their strategies.

- Investment Professionals: Analysts and portfolio managers.

Benefits of Learning from Dan Sheridan

Why Choose This Mentor?

- Expert Guidance: Direct insights from a seasoned trader.

- Proven Strategies: Tested methods in real-world scenarios.

- Community and Support: Access to a like-minded community of traders.

Preparing for the Course

What You Need to Know Beforehand

- Basic Understanding of Options

- Familiarity with Trading Platforms

- Willingness to Learn and Adapt

Course Highlights and Features

Unique Aspects of the Course

- Live Trading Sessions: Real-time application of strategies.

- Interactive Q&A: Direct interaction with Dan Sheridan.

- Post-Course Support: Continued learning and mentorship.

Success Stories

Testimonials from Past Participants

Many participants have successfully applied the strategies learned, noting improved confidence and profitability in their trading endeavors.

Conclusion

The Iron Condors strategy, especially in a volatile market like that of 2022, offers a sophisticated means of risk-controlled trading. Under the expert tutelage of Dan Sheridan and Sheridan Options Mentoring, traders can learn to navigate these waters with greater assurance and achieve consistent returns.

Frequently Asked Questions

- What is an Iron Condor? An Iron Condor is an options strategy involving four different contracts to profit from stocks trading within a specific price range.

- Why is the Iron Condor suitable for volatile markets? With proper adjustments, it can capitalize on market stability and mitigate risk during fluctuations.

- How experienced should I be to enroll in the course? While beginners are welcome, some basic knowledge of options trading is beneficial.

- What can I realistically expect to gain from this course? Expect to learn effective risk management and strategic planning for trading Iron Condors.

- Is there any follow-up support after the course? Yes, participants gain access to an exclusive community for ongoing support and learning.

Be the first to review “Iron Condors in a Volatile Market 2022 with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.