-

×

Point and Figure Mentorship Course

1 × $54.00

Point and Figure Mentorship Course

1 × $54.00 -

×

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00 -

×

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00 -

×

Read the Greed. Take the Money & Teleseminar

1 × $6.00

Read the Greed. Take the Money & Teleseminar

1 × $6.00 -

×

The Tickmaster Indicator with Alphashark

1 × $54.00

The Tickmaster Indicator with Alphashark

1 × $54.00 -

×

Scanning for Gold with Doug Sutton

1 × $31.00

Scanning for Gold with Doug Sutton

1 × $31.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Tandem Trader with Investors Underground

1 × $6.00

Tandem Trader with Investors Underground

1 × $6.00 -

×

Main Online Course with Cue Banks

1 × $90.00

Main Online Course with Cue Banks

1 × $90.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00 -

×

XLT - Futures Trading Course

1 × $54.00

XLT - Futures Trading Course

1 × $54.00 -

×

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00 -

×

Andrews Pitchfork Basic

1 × $6.00

Andrews Pitchfork Basic

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Tape Reading & Market Tactics with Humphrey Neill

1 × $6.00

Tape Reading & Market Tactics with Humphrey Neill

1 × $6.00 -

×

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Beginner Course + access to Introductory Course

1 × $6.00

Beginner Course + access to Introductory Course

1 × $6.00 -

×

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00 -

×

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00 -

×

Bear Trap Indicator with Markay Latimer

1 × $5.00

Bear Trap Indicator with Markay Latimer

1 × $5.00 -

×

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00 -

×

Trend Trading Techniques with Rob Hoffman

1 × $6.00

Trend Trading Techniques with Rob Hoffman

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Currency Trading Seminar with Peter Bain

1 × $6.00

Currency Trading Seminar with Peter Bain

1 × $6.00 -

×

Overnight Trading with Nightly Patterns

1 × $5.00

Overnight Trading with Nightly Patterns

1 × $5.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Extracted MBA with Kelly Vinal

1 × $6.00

The Extracted MBA with Kelly Vinal

1 × $6.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00 -

×

Technical Analysis: Power Tools for Active Investors with Gerald Appel

1 × $6.00

Technical Analysis: Power Tools for Active Investors with Gerald Appel

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Art of Yen Course (Feb 2014)

1 × $23.00

Art of Yen Course (Feb 2014)

1 × $23.00 -

×

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00 -

×

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00 -

×

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00 -

×

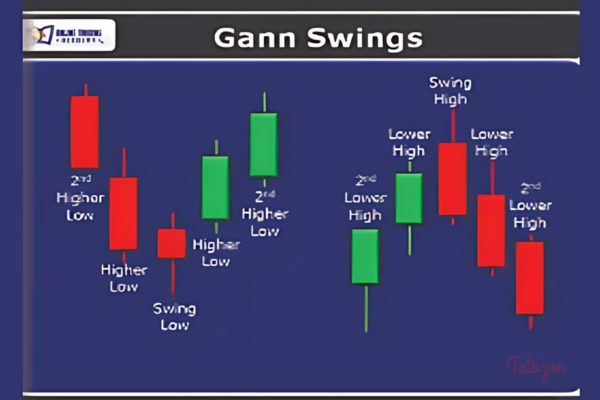

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Ocean’s CPA Force (Ebook)

1 × $6.00

Ocean’s CPA Force (Ebook)

1 × $6.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

Artificial Intelligence with Larry Pesavento

1 × $6.00

Artificial Intelligence with Larry Pesavento

1 × $6.00 -

×

Lazy Gap Trader Course with David Frost

1 × $6.00

Lazy Gap Trader Course with David Frost

1 × $6.00 -

×

The Market Matrix

1 × $6.00

The Market Matrix

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Flux Trigger Pack - Back To The Future Trading

1 × $15.00

Flux Trigger Pack - Back To The Future Trading

1 × $15.00 -

×

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00 -

×

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00 -

×

THE ORDERFLOWS DELTA TRADING COURSE

1 × $4.00

THE ORDERFLOWS DELTA TRADING COURSE

1 × $4.00 -

×

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00 -

×

The Option Pit VIX Primer

1 × $31.00

The Option Pit VIX Primer

1 × $31.00 -

×

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Advanced Trading Course with John Person

1 × $6.00

Advanced Trading Course with John Person

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

Order Flow Trader Education

1 × $15.00

Order Flow Trader Education

1 × $15.00 -

×

Tradingology Home Study Options Course

1 × $23.00

Tradingology Home Study Options Course

1 × $23.00 -

×

Fast Track Forex Course

1 × $62.00

Fast Track Forex Course

1 × $62.00 -

×

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

Wall Street Training

1 × $6.00

Wall Street Training

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

Investing Guide For New Investor with Alfred Scillitani

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Investing Guide For New Investor with Alfred Scillitani” below:

Investing Guide For New Investor with Alfred Scillitani

Introduction

Investing can be a daunting task, especially for those new to the world of finance. Fortunately, Alfred Scillitani offers a comprehensive guide to help new investors navigate the complexities of the market. In this guide, we’ll cover the essentials of investing, from understanding different types of investments to creating a diversified portfolio.

Understanding the Basics of Investing

What is Investing?

Investing involves committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. This can include stocks, bonds, mutual funds, real estate, and more.

Why Should You Invest?

Investing is crucial for building wealth over time. It helps you to outpace inflation, achieve financial goals, and secure a comfortable retirement.

Types of Investments

1. Stocks

Stocks represent ownership in a company. When you buy stocks, you become a shareholder and can benefit from the company’s growth and profits.

2. Bonds

Bonds are loans made to corporations or governments. In return, investors receive periodic interest payments and the return of the bond’s face value at maturity.

3. Mutual Funds

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities.

4. Real Estate

Investing in real estate involves purchasing property to generate income through renting, leasing, or price appreciation.

Steps to Start Investing

1. Set Financial Goals

Determine what you want to achieve with your investments. This could be buying a house, funding education, or saving for retirement.

2. Create a Budget

Before investing, ensure you have a clear budget. Allocate funds for investing without compromising your day-to-day needs.

3. Understand Your Risk Tolerance

Investments come with varying levels of risk. Assess your risk tolerance to choose investments that align with your comfort level.

4. Choose an Investment Account

Select an appropriate investment account based on your goals, such as a retirement account (IRA, 401(k)) or a taxable brokerage account.

5. Research and Choose Investments

Conduct thorough research to select the right mix of investments. Consider factors such as past performance, fees, and management.

Building a Diversified Portfolio

Importance of Diversification

Diversification reduces risk by spreading investments across various asset classes. This helps to minimize the impact of poor performance in any single investment.

How to Diversify

- Mix Asset Classes: Combine stocks, bonds, and real estate.

- Invest in Different Sectors: Spread investments across various industries.

- Geographical Diversification: Invest in both domestic and international markets.

Investing Strategies

1. Dollar-Cost Averaging

Invest a fixed amount regularly, regardless of market conditions. This reduces the impact of volatility and lowers the average cost per share.

2. Buy and Hold

Purchase investments and hold them for an extended period, benefiting from long-term growth rather than short-term fluctuations.

3. Value Investing

Focus on undervalued stocks with strong fundamentals. The idea is to buy low and sell high.

Common Mistakes to Avoid

1. Lack of Research

Investing without proper research can lead to poor decisions. Always understand what you’re investing in.

2. Emotional Investing

Avoid making decisions based on emotions. Stick to your plan and make informed choices.

3. Ignoring Fees

High fees can erode your returns. Be mindful of expense ratios and trading costs.

Monitoring and Adjusting Your Portfolio

Regular Reviews

Review your portfolio periodically to ensure it aligns with your goals. Adjust investments as needed based on performance and changes in your objectives.

Rebalancing

Rebalance your portfolio by buying or selling assets to maintain your desired asset allocation. This helps to manage risk.

Conclusion

Investing can be a rewarding journey with the right knowledge and strategies. Alfred Scillitani’s guide provides a solid foundation for new investors to build wealth and achieve their financial goals. By understanding the basics, diversifying your portfolio, and avoiding common mistakes, you can confidently embark on your investing journey.

Frequently Asked Questions:

1. What is the best investment for beginners?

The best investment for beginners depends on individual goals and risk tolerance. Mutual funds and ETFs are generally good starting points due to their diversification.

2. How much money do I need to start investing?

You can start investing with as little as $100. Many investment platforms offer low minimums and fractional shares.

3. How do I choose the right investment account?

Consider your financial goals and tax situation. Retirement accounts offer tax advantages, while taxable accounts provide more flexibility.

4. What is the safest investment?

Treasury bonds and high-yield savings accounts are considered safe investments due to their low risk and government backing.

5. How often should I review my investments?

It’s recommended to review your investments at least once a year, or more frequently if there are significant changes in your financial situation or market conditions.

Be the first to review “Investing Guide For New Investor with Alfred Scillitani” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.