-

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

Complete Trading Bundle with AAA Quants

1 × $27.00

Complete Trading Bundle with AAA Quants

1 × $27.00 -

×

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

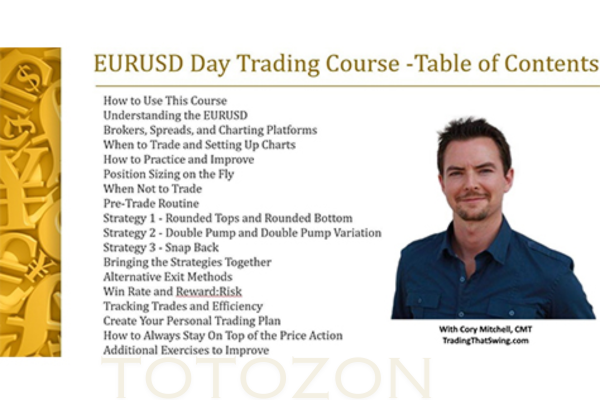

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

The Finessee_fx Enigma Course + PD Array Matrix with Pipsey Hussle

1 × $13.00

The Finessee_fx Enigma Course + PD Array Matrix with Pipsey Hussle

1 × $13.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Toast FX Course

1 × $5.00

Toast FX Course

1 × $5.00 -

×

Investments (6th Ed.)

1 × $6.00

Investments (6th Ed.)

1 × $6.00 -

×

Tradeciety Online Forex Trading MasterClass

1 × $5.00

Tradeciety Online Forex Trading MasterClass

1 × $5.00 -

×

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

Trading Indicators for the 21th Century

1 × $15.00

Trading Indicators for the 21th Century

1 × $15.00 -

×

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

The Investor Accelerator Premium Membership

1 × $34.00

The Investor Accelerator Premium Membership

1 × $34.00 -

×

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00 -

×

MOJO TOOLBOX with ProTrader Mike

1 × $23.00

MOJO TOOLBOX with ProTrader Mike

1 × $23.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Trading BIG Moves With Options

1 × $31.00

Trading BIG Moves With Options

1 × $31.00 -

×

Thetimefactor - TRADING WITH PRICE

1 × $15.00

Thetimefactor - TRADING WITH PRICE

1 × $15.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Advanced Seminar

1 × $31.00

Advanced Seminar

1 × $31.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00 -

×

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

TTM Slingshot

1 × $6.00

TTM Slingshot

1 × $6.00 -

×

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00 -

×

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00 -

×

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Trading Hub 4.0 Ebook

1 × $5.00

Trading Hub 4.0 Ebook

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00 -

×

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00 -

×

Trading on the Edge with Guido J.Deboeck

1 × $6.00

Trading on the Edge with Guido J.Deboeck

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

Turtle Soup Course with ICT Trader Romeo

1 × $5.00

Turtle Soup Course with ICT Trader Romeo

1 × $5.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

The Unified Theory of Markets with Earik Beann

1 × $78.00

The Unified Theory of Markets with Earik Beann

1 × $78.00 -

×

Professional Trader Series DVD Set (Full)

1 × $23.00

Professional Trader Series DVD Set (Full)

1 × $23.00 -

×

Forex Masterclass with 20 Minute Trader

1 × $23.00

Forex Masterclass with 20 Minute Trader

1 × $23.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Tradeonix Trading System

1 × $31.00

Tradeonix Trading System

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

TotalTheo 12 Month Mentorship

1 × $54.00

TotalTheo 12 Month Mentorship

1 × $54.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00 -

×

The Squeeze Pro System: How to Catch Bigger and Faster Squeezes More Often

1 × $54.00

The Squeeze Pro System: How to Catch Bigger and Faster Squeezes More Often

1 × $54.00 -

×

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00 -

×

Trading Power Tools with Ryan Litchfield

1 × $6.00

Trading Power Tools with Ryan Litchfield

1 × $6.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

The Foundation with Dan Maxwell

1 × $6.00

The Foundation with Dan Maxwell

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers

Investing in commodities can be a lucrative endeavor if approached with the right knowledge and strategies. Jim Rogers, a renowned investor and author, provides invaluable insights into this market in his book, Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market. This article explores the key concepts and strategies from Rogers’ book, offering readers a comprehensive guide to successful commodity investing.

Understanding the Commodities Market

What Are Commodities?

Commodities are basic goods used in commerce that are interchangeable with other goods of the same type. They include items such as oil, gold, and agricultural products.

Why Invest in Commodities?

Investing in commodities can offer diversification, a hedge against inflation, and the potential for substantial returns. Commodities often move inversely to stocks and bonds, providing balance to an investment portfolio.

Historical Context

Historically, commodities have been a fundamental part of global trade and economics. They are influenced by supply and demand dynamics, geopolitical events, and economic cycles.

Key Takeaways from Jim Rogers’ Book

The Case for Commodities

Rogers makes a compelling case for commodities as an investment class, emphasizing their tangible nature and essential role in the global economy.

Identifying Trends

Rogers highlights the importance of recognizing long-term trends in commodities markets. He suggests that successful investors focus on fundamental factors that drive supply and demand.

The Role of Emerging Markets

Emerging markets play a crucial role in the commodities boom. As these economies grow, their demand for commodities increases, driving prices higher.

Strategies for Investing in Commodities

Diversification

Why Diversify?

Diversification helps manage risk by spreading investments across different commodities. This strategy can protect against volatility in any single market.

How to Diversify?

Invest in a mix of energy, metals, and agricultural commodities. Consider exchange-traded funds (ETFs) that offer broad exposure to various commodities.

Understanding Supply and Demand

Key Factors

- Supply: Production levels, weather conditions, and geopolitical events.

- Demand: Economic growth, technological advancements, and consumer trends.

Analyzing Trends

Use tools such as futures contracts and commodity indexes to analyze market trends and make informed investment decisions.

Long-Term Investment Approach

Patience is Key

Commodity markets can be volatile. A long-term investment approach allows investors to ride out short-term fluctuations and capitalize on long-term trends.

Buy and Hold Strategy

Invest in commodities with strong fundamentals and hold them for an extended period. This strategy can yield substantial returns as market cycles play out.

Leveraging Futures Contracts

What Are Futures Contracts?

Futures contracts are agreements to buy or sell a commodity at a predetermined price at a specific time in the future. They are used to hedge against price fluctuations and speculate on market movements.

How to Use Futures Contracts

Use futures contracts to lock in prices and manage risk. This strategy requires careful planning and a thorough understanding of market dynamics.

Tools and Resources for Commodity Investors

Commodity ETFs

Commodity ETFs offer a convenient way to invest in a diversified basket of commodities without directly trading futures contracts.

Analytical Software

Invest in analytical software that provides real-time data and market analysis. These tools can help you track trends and make informed decisions.

Educational Materials

Books, courses, and seminars on commodity investing can enhance your knowledge and skills. Continuous learning is crucial for staying ahead in the market.

Challenges and Risks

Market Volatility

Commodity prices can be highly volatile, influenced by factors such as weather, geopolitical events, and economic cycles.

Regulatory Risks

Changes in regulations can impact commodity markets. Stay informed about regulatory developments that may affect your investments.

Economic Factors

Global economic conditions play a significant role in commodity prices. Monitor economic indicators and adjust your strategies accordingly.

Conclusion

Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers provides a comprehensive guide to successful commodity investing. By understanding market dynamics, diversifying investments, and adopting a long-term approach, investors can profit from the commodities market. Continuous learning and staying informed about market trends are essential for success. As Jim Rogers emphasizes, commodities offer unique opportunities for those willing to explore this dynamic and rewarding market.

FAQs

What are the best commodities to invest in?

The best commodities to invest in depend on market conditions and individual risk tolerance. Common choices include gold, oil, and agricultural products.

How can I start investing in commodities?

Start by educating yourself about the commodities market, then consider investing in commodity ETFs or futures contracts. Consult with a financial advisor if needed.

What are the risks of commodity investing?

Risks include market volatility, regulatory changes, and economic factors. Diversification and informed decision-making can help manage these risks.

Can I invest in commodities with a small budget?

Yes, commodity ETFs and mutual funds allow for smaller investments and provide diversified exposure to the commodities market.

How do I stay informed about the commodities market?

Follow financial news, use analytical tools, and continuously educate yourself through books and courses on commodity investing.

Be the first to review “Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.