-

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

US indices system with LaMartinatradingFx

1 × $10.00

US indices system with LaMartinatradingFx

1 × $10.00 -

×

Instant Profits System with Bill Poulos

1 × $6.00

Instant Profits System with Bill Poulos

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

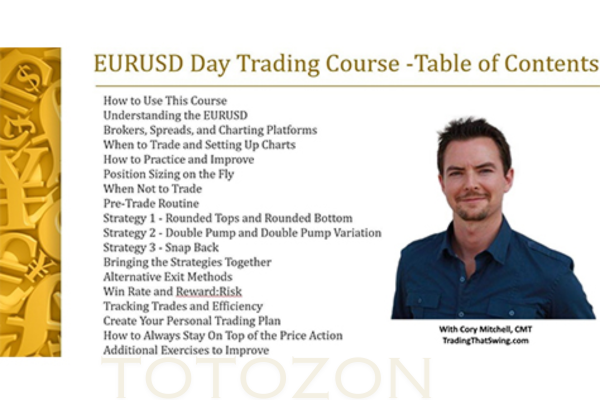

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00 -

×

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00 -

×

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00 -

×

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00 -

×

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00 -

×

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00 -

×

The Value Connection with Marc Gerstein

1 × $5.00

The Value Connection with Marc Gerstein

1 × $5.00 -

×

Calendar Spreads with Todd Mitchell

1 × $31.00

Calendar Spreads with Todd Mitchell

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Day Trade to Win E-Course with John Paul

1 × $6.00

Day Trade to Win E-Course with John Paul

1 × $6.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00 -

×

Trading the Pristine Method 2020 with T3 Live

1 × $39.00

Trading the Pristine Method 2020 with T3 Live

1 × $39.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

Workshop Metals Mastery

1 × $23.00

Workshop Metals Mastery

1 × $23.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

Divergence Trading – Mastering Market Reversals

1 × $31.00

Divergence Trading – Mastering Market Reversals

1 × $31.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00 -

×

Forex Trading Make Your First Trader Today with Corey Halliday

1 × $6.00

Forex Trading Make Your First Trader Today with Corey Halliday

1 × $6.00 -

×

The Next Great Bull Market with Matthew McCall

1 × $6.00

The Next Great Bull Market with Matthew McCall

1 × $6.00 -

×

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00 -

×

Trading Spreads and Seasonals (tradingeducators.com)

1 × $6.00

Trading Spreads and Seasonals (tradingeducators.com)

1 × $6.00 -

×

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers

Investing in commodities can be a lucrative endeavor if approached with the right knowledge and strategies. Jim Rogers, a renowned investor and author, provides invaluable insights into this market in his book, Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market. This article explores the key concepts and strategies from Rogers’ book, offering readers a comprehensive guide to successful commodity investing.

Understanding the Commodities Market

What Are Commodities?

Commodities are basic goods used in commerce that are interchangeable with other goods of the same type. They include items such as oil, gold, and agricultural products.

Why Invest in Commodities?

Investing in commodities can offer diversification, a hedge against inflation, and the potential for substantial returns. Commodities often move inversely to stocks and bonds, providing balance to an investment portfolio.

Historical Context

Historically, commodities have been a fundamental part of global trade and economics. They are influenced by supply and demand dynamics, geopolitical events, and economic cycles.

Key Takeaways from Jim Rogers’ Book

The Case for Commodities

Rogers makes a compelling case for commodities as an investment class, emphasizing their tangible nature and essential role in the global economy.

Identifying Trends

Rogers highlights the importance of recognizing long-term trends in commodities markets. He suggests that successful investors focus on fundamental factors that drive supply and demand.

The Role of Emerging Markets

Emerging markets play a crucial role in the commodities boom. As these economies grow, their demand for commodities increases, driving prices higher.

Strategies for Investing in Commodities

Diversification

Why Diversify?

Diversification helps manage risk by spreading investments across different commodities. This strategy can protect against volatility in any single market.

How to Diversify?

Invest in a mix of energy, metals, and agricultural commodities. Consider exchange-traded funds (ETFs) that offer broad exposure to various commodities.

Understanding Supply and Demand

Key Factors

- Supply: Production levels, weather conditions, and geopolitical events.

- Demand: Economic growth, technological advancements, and consumer trends.

Analyzing Trends

Use tools such as futures contracts and commodity indexes to analyze market trends and make informed investment decisions.

Long-Term Investment Approach

Patience is Key

Commodity markets can be volatile. A long-term investment approach allows investors to ride out short-term fluctuations and capitalize on long-term trends.

Buy and Hold Strategy

Invest in commodities with strong fundamentals and hold them for an extended period. This strategy can yield substantial returns as market cycles play out.

Leveraging Futures Contracts

What Are Futures Contracts?

Futures contracts are agreements to buy or sell a commodity at a predetermined price at a specific time in the future. They are used to hedge against price fluctuations and speculate on market movements.

How to Use Futures Contracts

Use futures contracts to lock in prices and manage risk. This strategy requires careful planning and a thorough understanding of market dynamics.

Tools and Resources for Commodity Investors

Commodity ETFs

Commodity ETFs offer a convenient way to invest in a diversified basket of commodities without directly trading futures contracts.

Analytical Software

Invest in analytical software that provides real-time data and market analysis. These tools can help you track trends and make informed decisions.

Educational Materials

Books, courses, and seminars on commodity investing can enhance your knowledge and skills. Continuous learning is crucial for staying ahead in the market.

Challenges and Risks

Market Volatility

Commodity prices can be highly volatile, influenced by factors such as weather, geopolitical events, and economic cycles.

Regulatory Risks

Changes in regulations can impact commodity markets. Stay informed about regulatory developments that may affect your investments.

Economic Factors

Global economic conditions play a significant role in commodity prices. Monitor economic indicators and adjust your strategies accordingly.

Conclusion

Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers provides a comprehensive guide to successful commodity investing. By understanding market dynamics, diversifying investments, and adopting a long-term approach, investors can profit from the commodities market. Continuous learning and staying informed about market trends are essential for success. As Jim Rogers emphasizes, commodities offer unique opportunities for those willing to explore this dynamic and rewarding market.

FAQs

What are the best commodities to invest in?

The best commodities to invest in depend on market conditions and individual risk tolerance. Common choices include gold, oil, and agricultural products.

How can I start investing in commodities?

Start by educating yourself about the commodities market, then consider investing in commodity ETFs or futures contracts. Consult with a financial advisor if needed.

What are the risks of commodity investing?

Risks include market volatility, regulatory changes, and economic factors. Diversification and informed decision-making can help manage these risks.

Can I invest in commodities with a small budget?

Yes, commodity ETFs and mutual funds allow for smaller investments and provide diversified exposure to the commodities market.

How do I stay informed about the commodities market?

Follow financial news, use analytical tools, and continuously educate yourself through books and courses on commodity investing.

Be the first to review “Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market with Jim Rogers” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.