-

×

AdjustMax

1 × $31.00

AdjustMax

1 × $31.00 -

×

Unlock the Millionaire Within with Dan Lok

1 × $15.00

Unlock the Millionaire Within with Dan Lok

1 × $15.00 -

×

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

Z4X Long Term Trading System

1 × $6.00

Z4X Long Term Trading System

1 × $6.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

Slump Busting Techniques with Linda Raschke

1 × $4.00

Slump Busting Techniques with Linda Raschke

1 × $4.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Rapid Revenue Formula with Kate Beeders

1 × $54.00

Rapid Revenue Formula with Kate Beeders

1 × $54.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Money Management

1 × $6.00

Money Management

1 × $6.00 -

×

Trading Systems Explained with Martin Pring

1 × $6.00

Trading Systems Explained with Martin Pring

1 × $6.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

The Price Action Protocol - 2015 Edition

1 × $15.00

The Price Action Protocol - 2015 Edition

1 × $15.00 -

×

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00 -

×

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Core Strategy Program with Ota Courses

1 × $174.00

Core Strategy Program with Ota Courses

1 × $174.00 -

×

The Way to Trade with John Piper

1 × $6.00

The Way to Trade with John Piper

1 × $6.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Create Your Trade Plan with Yuri Shramenko

1 × $6.00

Create Your Trade Plan with Yuri Shramenko

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

How to Find a Trading Strategy with Mike Baehr

1 × $124.00

How to Find a Trading Strategy with Mike Baehr

1 × $124.00 -

×

Volume, Trend and Momentum with Philip Roth

1 × $6.00

Volume, Trend and Momentum with Philip Roth

1 × $6.00 -

×

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

Toast FX Course

1 × $5.00

Toast FX Course

1 × $5.00 -

×

MATS Market Auction Trading System with Ryan Watts

1 × $6.00

MATS Market Auction Trading System with Ryan Watts

1 × $6.00 -

×

Options Trading RD3 Webinar Series

1 × $31.00

Options Trading RD3 Webinar Series

1 × $31.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

iMarketsLive Academy Course

1 × $5.00

iMarketsLive Academy Course

1 × $5.00 -

×

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00 -

×

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00 -

×

Tradematic Trading Strategy

1 × $31.00

Tradematic Trading Strategy

1 × $31.00 -

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Trading Indicators NT7

1 × $85.00

Trading Indicators NT7

1 × $85.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00 -

×

Expert Forex Systems with Andrew Fields

1 × $6.00

Expert Forex Systems with Andrew Fields

1 × $6.00 -

×

Trading to Win with Ari Kiev

1 × $6.00

Trading to Win with Ari Kiev

1 × $6.00 -

×

In Jeremy's Stock Market Brain

1 × $62.00

In Jeremy's Stock Market Brain

1 × $62.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Mastering the Orderbook with Rowan Crawford

1 × $6.00

Mastering the Orderbook with Rowan Crawford

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00 -

×

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

$95.00 Original price was: $95.00.$6.00Current price is: $6.00.

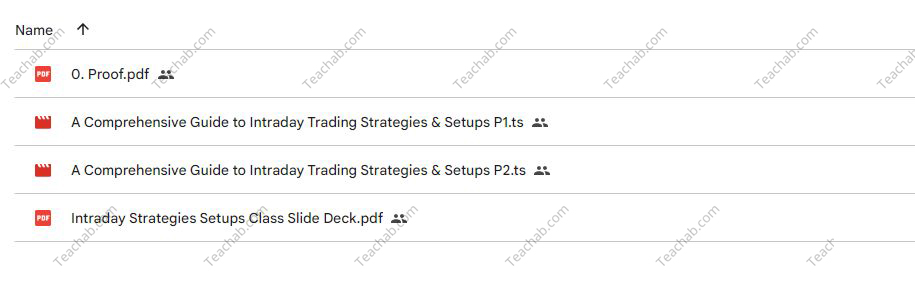

File Size: 956 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman ” below:

A Comprehensive Guide to Intraday Trading Strategies & Setups with Jeff Bierman

Introduction

Intraday trading offers dynamic opportunities for traders seeking to capitalize on market movements within a single trading day. Jeff Bierman’s class, “A Comprehensive Guide to Intraday Trading Strategies & Setups,” is designed to equip traders with the knowledge and tools needed to succeed in this fast-paced trading environment.

What is Intraday Trading?

Definition of Intraday Trading

Intraday trading involves buying and selling securities within the same trading day, often to capitalize on small price movements.

Benefits of Intraday Trading

- Potential for Quick Profits

- Avoidance of Overnight Market Risk

Key Concepts in Intraday Trading

Understanding Market Liquidity

Liquidity is crucial in intraday trading as it affects the ease of entering and exiting trades.

Volatility and Its Impact

Volatility can provide opportunities for profit, but it also increases risk.

Developing a Trading Plan

Setting Clear Objectives

Establishing what you want to achieve through intraday trading, such as regular income or capital growth.

Risk Management Framework

Implementing effective risk management strategies to protect your capital.

Core Trading Strategies

Scalping

A strategy that involves making numerous trades to capture small price changes.

Momentum Trading

Identifying and following market momentum during significant price movements.

Technical Analysis Tools

Chart Patterns and Indicators

How to use chart patterns and technical indicators to find trading opportunities.

Volume Analysis

Using volume as a key indicator to confirm the strength of price movements.

Trade Setup and Execution

Entry and Exit Points

Determining where to enter and exit the market for maximum profitability.

Order Types and Their Uses

Understanding different order types and how they can help manage trades.

Common Intraday Trading Setups

Breakout Trades

Identifying and trading breakouts of established ranges.

Reversal Trades

Recognizing potential reversals and how to trade them effectively.

Psychological Factors in Trading

Emotional Control

Managing emotions to make objective trading decisions.

Overcoming Psychological Barriers

Tips for overcoming fear, greed, and other psychological barriers to success.

Advanced Intraday Trading Techniques

Algorithmic Trading

Incorporating algorithms to automate trading strategies and improve execution speed.

Intermarket Analysis

Using information from related markets to enhance trading decisions in the primary market.

Monitoring and Reviewing Your Trades

Keeping a Trading Journal

The benefits of maintaining a detailed journal to review performance and refine strategies.

Performance Analysis

Regularly analyzing your trading outcomes to identify areas for improvement.

Continued Education and Resources

Ongoing Learning Opportunities

Exploring additional resources and advanced courses to continue your trading education.

Engaging with the Trading Community

The importance of participating in trading forums and networks for shared knowledge and support.

Conclusion

Jeff Bierman’s guide to intraday trading strategies provides a robust foundation for anyone looking to enhance their trading skills and profitability. By mastering the art of intraday trading, you can take advantage of market movements to achieve financial success.

FAQs

1. Is intraday trading suitable for beginners?

Intraday trading can be suitable for beginners, provided they invest time in education and start with small trades to manage risk.

2. How much capital is required to start intraday trading?

While it varies, starting with a small amount of capital is advisable as you refine your trading strategies and gain more experience.

3. What are the most important technical indicators for intraday trading?

Key indicators include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

4. How do I choose the best stocks for intraday trading?

Focus on stocks with high liquidity and volatility, as these provide more opportunities for profit.

5. Can intraday trading be a full-time profession?

Yes, many traders trade full-time, especially those who have developed effective strategies and can manage the associated risks.

Be the first to review “A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.