-

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Investing in the stock market

1 × $6.00

Investing in the stock market

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00 -

×

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00 -

×

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00 -

×

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Python for Traders Masterclass with Mr James

1 × $10.00

The Python for Traders Masterclass with Mr James

1 × $10.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Precise Planetary Timing for Stock Trading

1 × $6.00

Precise Planetary Timing for Stock Trading

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

Exchange-Traded Derivatives with Erik Banks

1 × $6.00

Exchange-Traded Derivatives with Erik Banks

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

CrewFX Group Course Package with Language Of The Markets

1 × $6.00

CrewFX Group Course Package with Language Of The Markets

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

You AreThe Indicator Online Course

1 × $31.00

You AreThe Indicator Online Course

1 × $31.00 -

×

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00 -

×

Diary of an Internet Trader with Alpesh Patel

1 × $6.00

Diary of an Internet Trader with Alpesh Patel

1 × $6.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

Part I Basic and Part II Beyond the Basic with Strategic Trading

1 × $6.00

Part I Basic and Part II Beyond the Basic with Strategic Trading

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Profit Before Work System with John Piper

1 × $6.00

Profit Before Work System with John Piper

1 × $6.00 -

×

HINT (High Income No Taxes) with Jeff Watson

1 × $54.00

HINT (High Income No Taxes) with Jeff Watson

1 × $54.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Candlesticks Trading Course

1 × $31.00

Candlesticks Trading Course

1 × $31.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

Forex Power Strategy Course with Jason Steele

1 × $6.00

Forex Power Strategy Course with Jason Steele

1 × $6.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Investing in 401k Plans with Cliffsnotes

1 × $6.00

Investing in 401k Plans with Cliffsnotes

1 × $6.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

Trading Academy 2024 with Tradeciety

1 × $5.00

Trading Academy 2024 with Tradeciety

1 × $5.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00 -

×

Quant Edge with T3 Live

1 × $6.00

Quant Edge with T3 Live

1 × $6.00 -

×

Forecast, Filings, & News with Jtrader

1 × $6.00

Forecast, Filings, & News with Jtrader

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

How to Collect Income Being Short with Don Kaufman

1 × $6.00

How to Collect Income Being Short with Don Kaufman

1 × $6.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

Beyond Fibonacci Retracements with Dynamic Traders

1 × $5.00

Beyond Fibonacci Retracements with Dynamic Traders

1 × $5.00 -

×

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Prasna Tantra. Horary Astrology with Bangalore Venkata Raman

1 × $6.00

Prasna Tantra. Horary Astrology with Bangalore Venkata Raman

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00 -

×

Portfolio Investing with Ron Bertino

1 × $54.00

Portfolio Investing with Ron Bertino

1 × $54.00 -

×

Rise Precision Latest Course

1 × $10.00

Rise Precision Latest Course

1 × $10.00 -

×

One Shot One Kill Trading with John Netto

1 × $6.00

One Shot One Kill Trading with John Netto

1 × $6.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

NJAT Trading Course with Not Just A Trade

1 × $6.00

NJAT Trading Course with Not Just A Trade

1 × $6.00 -

×

OPTIONS FOR BEGINNERS

1 × $6.00

OPTIONS FOR BEGINNERS

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00

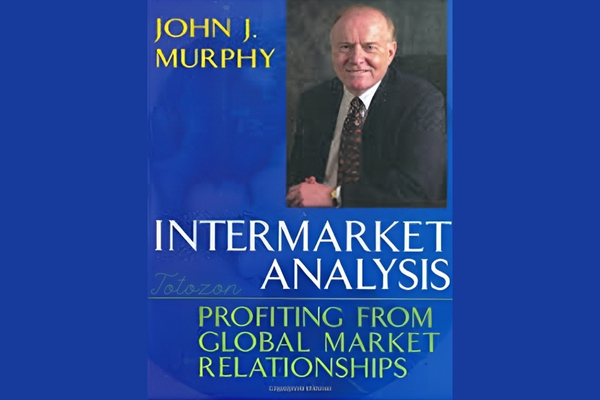

InterMarket Analysis (Ed.2004) with John J.Murphy

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “InterMarket Analysis (Ed.2004) with John J.Murphy” below:

InterMarket Analysis (Ed. 2004) with John J. Murphy

In the complex world of financial trading, understanding the relationships between different markets is crucial. John J. Murphy’s “InterMarket Analysis” (Ed. 2004) provides a comprehensive guide to this approach, offering traders invaluable insights into market dynamics. This article explores the key concepts, tools, and techniques from Murphy’s work, helping you leverage InterMarket Analysis for better trading decisions.

What is InterMarket Analysis?

Definition

InterMarket Analysis involves studying the correlations between different financial markets, such as stocks, bonds, commodities, and currencies. By analyzing these relationships, traders can predict market trends and make informed decisions.

Historical Context

The concept of InterMarket Analysis gained popularity in the late 20th century, with John J. Murphy being one of its foremost proponents. His 2004 edition expands on these principles, incorporating modern market dynamics.

Key Concepts in InterMarket Analysis

Market Correlations

Stocks and Bonds

Typically, stocks and bonds have an inverse relationship. When stock prices rise, bond prices often fall, indicating shifts in investor sentiment and economic conditions.

Commodities and Currencies

Commodity prices can significantly impact currency values, particularly for countries that are major exporters or importers. For instance, rising oil prices can strengthen the currencies of oil-exporting nations.

Leading and Lagging Indicators

Leading Indicators

Leading indicators, such as commodity prices and bond yields, often change direction before the broader market. They provide early signals of potential market trends.

Lagging Indicators

Lagging indicators, like stock prices, confirm trends after they have started. These indicators help validate the signals from leading indicators.

Practical Application of InterMarket Analysis

Identifying Trends

Analyzing the relationships between different markets helps identify trends that might not be apparent when looking at a single market. For example, a rise in bond yields might signal future stock market weakness.

Confirming Signals

InterMarket Analysis can confirm signals from other technical indicators. If multiple markets point in the same direction, it increases the likelihood of a valid trend.

Risk Management

Understanding market correlations helps manage risk more effectively. For example, knowing that rising interest rates typically lead to lower stock prices allows traders to adjust their portfolios accordingly.

Techniques for InterMarket Analysis

Chart Patterns

Head and Shoulders

The head and shoulders pattern, a common reversal pattern, can appear across different markets. Analyzing this pattern in related markets can provide additional confirmation of a trend reversal.

Double Tops and Bottoms

Double tops and bottoms are also reversal patterns that signal the end of a trend. Observing these patterns in multiple markets can provide stronger signals.

Correlation Analysis

Positive Correlation

A positive correlation between two markets means they move in the same direction. For example, a positive correlation between stock prices and commodity prices might indicate a strong economy.

Negative Correlation

A negative correlation means two markets move in opposite directions. The inverse relationship between stocks and bonds is a classic example of negative correlation.

Using Technical Indicators

Moving Averages

Moving averages smooth out price data to identify trends. Applying moving averages to multiple markets can highlight broader market trends.

Relative Strength Index (RSI)

The RSI measures the speed and change of price movements. Comparing RSI values across different markets can provide insights into market strength and potential reversals.

Benefits of InterMarket Analysis

Enhanced Market Understanding

InterMarket Analysis offers a deeper understanding of market dynamics, enabling traders to make more informed decisions.

Improved Trading Strategies

Considering multiple markets allows traders to develop more robust trading strategies that account for broader economic trends.

Better Risk Management

Understanding intermarket relationships helps traders anticipate market movements and manage risk more effectively.

Challenges of InterMarket Analysis

Complexity

InterMarket Analysis requires broad knowledge of multiple markets and their interactions, which can be complex and time-consuming.

Data Interpretation

Accurate data interpretation is crucial. Misinterpreting correlations or signals can lead to incorrect trading decisions.

Advanced Techniques in InterMarket Analysis

Algorithmic Trading

Algorithmic trading uses computer programs to execute trades based on predefined criteria. This approach can enhance trading efficiency and accuracy.

Leveraging Data Analytics

Big data and analytics provide deeper insights into market trends and trader behavior. Use advanced analytics tools to refine your trading strategies.

Utilizing Modern Trading Tools

Modern trading platforms offer real-time data, advanced charting capabilities, and automated trading features, making it easier to apply InterMarket Analysis.

Conclusion

John J. Murphy’s “InterMarket Analysis” (Ed. 2004) remains a crucial resource for traders seeking to understand and anticipate market movements. By analyzing the relationships between different financial markets, traders can gain valuable insights, confirm signals, and manage risk more effectively. As with any trading strategy, continuous education and adaptation to changing market conditions are essential.

FAQs

1. What is InterMarket Analysis?

InterMarket Analysis studies the relationships between different financial markets to predict market movements.

2. Why is InterMarket Analysis important?

It provides a comprehensive view of market behavior, helping traders identify trends and potential turning points.

3. How can InterMarket Analysis improve trading strategies?

It enhances market understanding, allowing for more informed trading decisions and better risk management.

4. What are the key tools used in InterMarket Analysis?

Key tools include chart patterns, correlation analysis, and technical indicators like moving averages and RSI.

5. What are the challenges of InterMarket Analysis?

The main challenges are its complexity and the need for accurate data interpretation.

Be the first to review “InterMarket Analysis (Ed.2004) with John J.Murphy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.