-

×

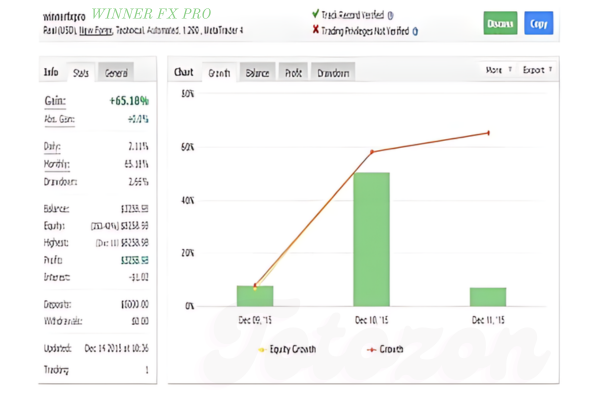

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading Pro System

1 × $31.00

Trading Pro System

1 × $31.00 -

×

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

The Viper Advanced Program

1 × $13.00

The Viper Advanced Program

1 × $13.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

TTM Indicators Package for eSignal

1 × $6.00

TTM Indicators Package for eSignal

1 × $6.00 -

×

The FOREX Blueprint with The Swag Academy

1 × $5.00

The FOREX Blueprint with The Swag Academy

1 × $5.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

Scalping Betfair For Daily Profits

1 × $6.00

Scalping Betfair For Daily Profits

1 × $6.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00 -

×

Strategy Class + Indicators

1 × $31.00

Strategy Class + Indicators

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00 -

×

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Understanding Electronic DayTrading with Carol Troy

1 × $6.00

Understanding Electronic DayTrading with Carol Troy

1 × $6.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00 -

×

Options Trading RD3 Webinar Series

1 × $31.00

Options Trading RD3 Webinar Series

1 × $31.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Astro FX 2.0

1 × $6.00

Astro FX 2.0

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Random Character of Interest Rates with Joseph Murphy

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The Random Character of Interest Rates with Joseph Murphy” below:

The Random Character of Interest Rates with Joseph Murphy

Introduction to Interest Rates

Interest rates play a pivotal role in the financial world, influencing everything from mortgages to investments. Understanding the random character of interest rates is crucial for investors, borrowers, and policymakers. Joseph Murphy, a seasoned financial expert, offers profound insights into this complex topic.

What Are Interest Rates?

Interest rates are the cost of borrowing money, typically expressed as a percentage of the principal amount. They are determined by various factors, including central bank policies, economic conditions, and market forces.

Why Do Interest Rates Matter?

Interest rates affect the economy by influencing consumer spending, business investments, and inflation. Higher rates can cool down an overheating economy, while lower rates can stimulate growth.

The Nature of Interest Rate Movements

Randomness in Interest Rates

Interest rates are often perceived as being subject to random fluctuations. This randomness stems from unpredictable economic events, policy changes, and market sentiments.

Factors Influencing Interest Rates

- Economic Indicators: GDP growth, employment rates, and inflation impact interest rates.

- Central Bank Policies: Decisions by entities like the Federal Reserve influence short-term interest rates.

- Market Demand and Supply: The availability of credit and the demand for loans affect interest rate levels.

The Role of Central Banks

Central banks use interest rates as a tool to control monetary policy. By adjusting rates, they aim to maintain economic stability and control inflation.

Models of Interest Rate Behavior

The Random Walk Theory

The random walk theory suggests that interest rates move unpredictably, with future movements being independent of past trends. This theory implies that predicting interest rate changes is inherently challenging.

Mean Reversion

Mean reversion theory posits that interest rates tend to move back towards a long-term average over time. This behavior can provide a framework for forecasting future rate movements.

The Impact of External Shocks

Unexpected events, such as political upheavals or natural disasters, can cause sudden and significant changes in interest rates. These shocks introduce additional randomness into interest rate movements.

Practical Implications for Investors

Managing Interest Rate Risk

Investors can use various strategies to manage interest rate risk, such as diversifying their portfolios and using interest rate derivatives.

Fixed vs. Variable Rate Investments

Choosing between fixed and variable rate investments involves considering the potential for future interest rate changes. Fixed rates provide stability, while variable rates can offer higher returns in rising rate environments.

The Importance of Yield Curves

The yield curve, which plots interest rates across different maturities, is a valuable tool for understanding market expectations and making investment decisions.

Interest Rates and Economic Growth

The Relationship Between Rates and Growth

Interest rates and economic growth are closely linked. Low rates can spur economic activity by making borrowing cheaper, while high rates can slow down growth by increasing borrowing costs.

Policy Implications

Policymakers must balance the need to control inflation with the desire to promote economic growth. Interest rate adjustments are a primary tool for achieving this balance.

Case Studies in Interest Rate Movements

Historical Interest Rate Trends

Examining historical interest rate trends can provide insights into how rates have responded to different economic conditions and policy decisions.

Impact of Major Economic Events

Major economic events, such as the 2008 financial crisis, illustrate how interest rates can fluctuate dramatically in response to changing economic landscapes.

Conclusion

Understanding the random character of interest rates is essential for navigating the financial markets. With insights from Joseph Murphy, we gain a deeper appreciation of the factors influencing rate movements and the implications for investors and policymakers alike. By embracing the inherent uncertainty of interest rates, we can make more informed decisions and better manage the associated risks.

FAQs

What causes interest rates to fluctuate?

Interest rates fluctuate due to a combination of economic indicators, central bank policies, and market forces. Unexpected events can also introduce additional variability.

How can investors manage interest rate risk?

Investors can manage interest rate risk by diversifying their portfolios, using interest rate derivatives, and carefully choosing between fixed and variable rate investments.

What is the random walk theory of interest rates?

The random walk theory suggests that interest rates move unpredictably, with future changes being independent of past trends, making predictions challenging.

Why are yield curves important?

Yield curves are important because they provide insights into market expectations for future interest rates and economic conditions, aiding in investment decisions.

How do interest rates affect economic growth?

Interest rates affect economic growth by influencing borrowing costs. Low rates encourage borrowing and spending, while high rates can slow down economic activity.

Be the first to review “The Random Character of Interest Rates with Joseph Murphy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.