-

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Advanced Fibonacci Course with Major League Trading

1 × $23.00

Advanced Fibonacci Course with Major League Trading

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Balance Trader – Market Profile Trading Course

1 × $23.00

Balance Trader – Market Profile Trading Course

1 × $23.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

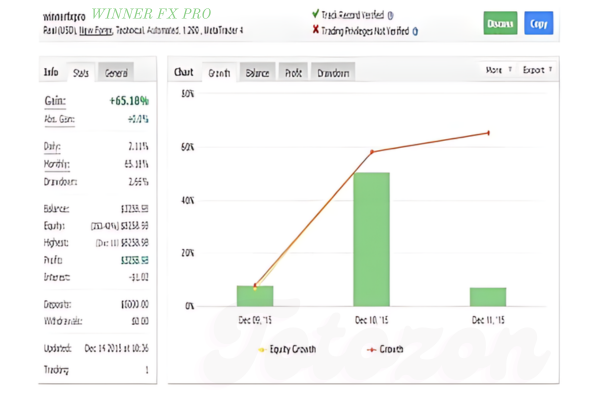

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Introduction to Stocks & Forex

1 × $15.00

Introduction to Stocks & Forex

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00 -

×

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

MQ MZT with Base Camp Trading

1 × $31.00

MQ MZT with Base Camp Trading

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

MLT Divergence Indicator with Major League Trading

1 × $23.00

MLT Divergence Indicator with Major League Trading

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Simple Profit Trading System 2020

1 × $54.00

Simple Profit Trading System 2020

1 × $54.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Forexmentor – LiveConnect

1 × $23.00

Forexmentor – LiveConnect

1 × $23.00 -

×

Mastering the Stock Market with Andrew Baxter

1 × $6.00

Mastering the Stock Market with Andrew Baxter

1 × $6.00 -

×

IncomeMAX Spreads and Straddles with Hari Swaminathan

1 × $15.00

IncomeMAX Spreads and Straddles with Hari Swaminathan

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

Joshua ICT ChartLab 2023

1 × $5.00

Joshua ICT ChartLab 2023

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

Self-Study Day Trading Course

1 × $39.00

Self-Study Day Trading Course

1 × $39.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Binary Defender

1 × $15.00

Binary Defender

1 × $15.00 -

×

Market Profile Course

1 × $54.00

Market Profile Course

1 × $54.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00 -

×

The BULLFx Forex Trading Course

1 × $5.00

The BULLFx Forex Trading Course

1 × $5.00 -

×

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00 -

×

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00 -

×

Price Action Room - The Scalper’s Boot Camp

1 × $15.00

Price Action Room - The Scalper’s Boot Camp

1 × $15.00 -

×

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00

The Ultimate Options Course - Building a Money-Making Trading Business

1 × $31.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

Live Video Revolution

1 × $15.00

Live Video Revolution

1 × $15.00 -

×

The Big Picture Trading Strategy with Avery T.Horton Jr.

1 × $7.00

The Big Picture Trading Strategy with Avery T.Horton Jr.

1 × $7.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00 -

×

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00 -

×

Investment Valuation

1 × $6.00

Investment Valuation

1 × $6.00 -

×

The New Contrarian Investing Strategies. The Next Generation. Psychology and the Stock with David Dreman

1 × $6.00

The New Contrarian Investing Strategies. The Next Generation. Psychology and the Stock with David Dreman

1 × $6.00 -

×

Read the Greed. Take the Money & Teleseminar

1 × $6.00

Read the Greed. Take the Money & Teleseminar

1 × $6.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

Learn to Make Money Trading Options

1 × $6.00

Learn to Make Money Trading Options

1 × $6.00 -

×

How to Stack Your Trades

1 × $6.00

How to Stack Your Trades

1 × $6.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

Andrew Keene's Most Confident Trade Yet

1 × $54.00

Andrew Keene's Most Confident Trade Yet

1 × $54.00 -

×

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge” below:

How To Invest By Instinct: Instinctively Self-Guided Investments with Lin Eldridge

Investing can be a daunting task, but what if you could rely on your instincts to guide your investment decisions? Lin Eldridge’s approach to self-guided investments emphasizes the power of intuition. In this article, we’ll explore how to harness your instincts for successful investing.

What is Instinctive Investing?

Instinctive investing involves using your intuition and gut feelings to make investment decisions. It’s about trusting your natural inclinations rather than relying solely on data and analysis.

Why Trust Your Instincts?

- Experience and Knowledge: Your instincts are often based on your experiences and knowledge, even if you’re not consciously aware of it.

- Quick Decision-Making: Instincts allow for faster decision-making, which can be crucial in volatile markets.

- Emotional Intelligence: Instinctive investing taps into your emotional intelligence, helping you navigate market psychology.

Lin Eldridge’s Philosophy on Instinctive Investing

Lin Eldridge advocates for a balanced approach that combines instinct with informed decision-making. According to Eldridge, instincts should complement, not replace, traditional investment strategies.

Understanding Market Trends

- Pattern Recognition: Use your instincts to recognize patterns in market behavior.

- Historical Context: Trust your gut when comparing current trends with historical data.

Diversifying Your Portfolio

Instinctive investors should still diversify their portfolios to mitigate risk. Use your instincts to identify promising sectors and asset classes.

Steps to Develop Your Instincts for Investing

1. Educate Yourself

- Read Widely: Gain a broad understanding of financial markets.

- Follow Experts: Learn from successful investors and financial advisors.

2. Practice Mindfulness

- Stay Present: Mindfulness practices can help you stay in the moment and tune into your instincts.

- Reduce Stress: Lower stress levels to enhance your decision-making abilities.

3. Reflect on Past Decisions

- Analyze Outcomes: Reflect on your past investment decisions to understand your instincts better.

- Identify Patterns: Look for patterns in your successful and unsuccessful investments.

Balancing Instincts with Analysis

While instincts are valuable, they should be balanced with thorough analysis. Use data to support your intuitive decisions.

Quantitative Analysis

- Financial Metrics: Evaluate financial statements and key metrics.

- Market Indicators: Pay attention to market indicators and trends.

Qualitative Analysis

- Company Management: Trust your instincts about a company’s leadership.

- Industry Outlook: Use your intuition to gauge the future potential of industries.

Common Mistakes in Instinctive Investing

Overconfidence

- Risk Awareness: Don’t let overconfidence lead to excessive risk-taking.

- Seek Feedback: Regularly seek feedback from trusted advisors.

Ignoring Data

- Data Integration: Always integrate data with your instincts.

- Stay Informed: Keep up-to-date with market news and reports.

Real-Life Examples of Instinctive Investors

Successful Instinctive Investors

- Warren Buffett: Known for his intuitive investment style, Buffett combines instinct with rigorous analysis.

- George Soros: Soros often trusts his gut feelings about market movements.

Developing Your Instinctive Investment Strategy

Set Clear Goals

- Define Objectives: Know what you want to achieve with your investments.

- Time Horizon: Consider your investment time horizon.

Regularly Review Your Portfolio

- Monitor Performance: Keep an eye on your portfolio’s performance.

- Adjust as Needed: Be willing to make adjustments based on your instincts and analysis.

Conclusion

Investing by instinct is about harnessing your natural inclinations while balancing them with informed decision-making. Lin Eldridge’s approach to self-guided investments can help you develop a more intuitive and effective investment strategy. Trust your instincts, but never ignore the importance of data and analysis.

FAQs

1. Can anyone develop instinctive investing skills?

Yes, with practice and education, anyone can hone their instinctive investing skills.

2. How can I improve my investment instincts?

Educate yourself, practice mindfulness, and reflect on past investment decisions.

3. Are there risks to relying on instincts for investing?

Yes, overconfidence and ignoring data can lead to poor decisions. Balance instincts with analysis.

4. What role does emotional intelligence play in instinctive investing?

Emotional intelligence helps you understand market psychology and make better intuitive decisions.

5. Can instinctive investing replace traditional strategies?

No, it should complement traditional strategies, not replace them.

Be the first to review “How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.