-

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

Penny Stock Mastery

1 × $31.00

Penny Stock Mastery

1 × $31.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

The Fortune Strategy. An Instruction Manual

1 × $6.00

The Fortune Strategy. An Instruction Manual

1 × $6.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Evolved Traders with Riley Coleman

1 × $5.00

Evolved Traders with Riley Coleman

1 × $5.00 -

×

![The Art of Trading Covered Writes [1 video (AVI)] image](https://www.totozon.com/wp-content/uploads/2024/07/A-trader-analyzing-earnings-reports-on-a-computer-screen.png) Learn To Trade Earnings with Dan Sheridan

1 × $23.00

Learn To Trade Earnings with Dan Sheridan

1 × $23.00 -

×

The Pitbull Investor (2009 Ed.)

1 × $6.00

The Pitbull Investor (2009 Ed.)

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Ultimate MT4 Course

1 × $15.00

Ultimate MT4 Course

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trading Harmonically with the Universe By John Jace

1 × $4.00

Trading Harmonically with the Universe By John Jace

1 × $4.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

Emini Volume Break Out System

1 × $6.00

Emini Volume Break Out System

1 × $6.00 -

×

Stock Market 101 with Sabrina Peterson

1 × $4.00

Stock Market 101 with Sabrina Peterson

1 × $4.00 -

×

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

The Full EMA Strategy with King Of Forex

1 × $5.00

The Full EMA Strategy with King Of Forex

1 × $5.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

Bill Williams Package ( Discount 30% )

1 × $6.00

Bill Williams Package ( Discount 30% )

1 × $6.00 -

×

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00 -

×

Opening Range Success Formula with Geoff Bysshe

1 × $4.00

Opening Range Success Formula with Geoff Bysshe

1 × $4.00 -

×

The Secret Code of The Superior Investor (Audio 293 MB)

1 × $6.00

The Secret Code of The Superior Investor (Audio 293 MB)

1 × $6.00 -

×

The Face of God Course

1 × $15.00

The Face of God Course

1 × $15.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

STREAM ALERTS

1 × $6.00

STREAM ALERTS

1 × $6.00 -

×

Introduction to Stocks & Forex

1 × $15.00

Introduction to Stocks & Forex

1 × $15.00 -

×

LT Gamma Confirmation

1 × $23.00

LT Gamma Confirmation

1 × $23.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00 -

×

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00 -

×

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00 -

×

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00 -

×

Back to the Futures

1 × $31.00

Back to the Futures

1 × $31.00 -

×

Brian James Sklenka Package

1 × $31.00

Brian James Sklenka Package

1 × $31.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

BalanceTrader II – For Advanced Traders

1 × $6.00

BalanceTrader II – For Advanced Traders

1 × $6.00 -

×

The Options Course Workbook: Step-by-Step Exercises and Tests to Help You Master the Options Course - George Fontanills

1 × $6.00

The Options Course Workbook: Step-by-Step Exercises and Tests to Help You Master the Options Course - George Fontanills

1 × $6.00 -

×

The Next Big Investment Boom with Mark Shipman

1 × $6.00

The Next Big Investment Boom with Mark Shipman

1 × $6.00 -

×

Offshore Keys (2023)

1 × $5.00

Offshore Keys (2023)

1 × $5.00 -

×

Money Miracle: Use Other Peoples Money to Make You Rich with George Angell

1 × $6.00

Money Miracle: Use Other Peoples Money to Make You Rich with George Angell

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Technical Indicators that Really Work with M.Larson

1 × $6.00

Technical Indicators that Really Work with M.Larson

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00 -

×

Calendar Spreads with Todd Mitchell

1 × $31.00

Calendar Spreads with Todd Mitchell

1 × $31.00 -

×

YouAreTheIndicator Online Course 1.0

1 × $6.00

YouAreTheIndicator Online Course 1.0

1 × $6.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

Trading Forex Exchange with Clifford Bennett

1 × $6.00

Trading Forex Exchange with Clifford Bennett

1 × $6.00 -

×

Trading Option Greeks with Dan Passarelli

1 × $6.00

Trading Option Greeks with Dan Passarelli

1 × $6.00 -

×

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00 -

×

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00 -

×

The Power of the Hexagon

1 × $6.00

The Power of the Hexagon

1 × $6.00 -

×

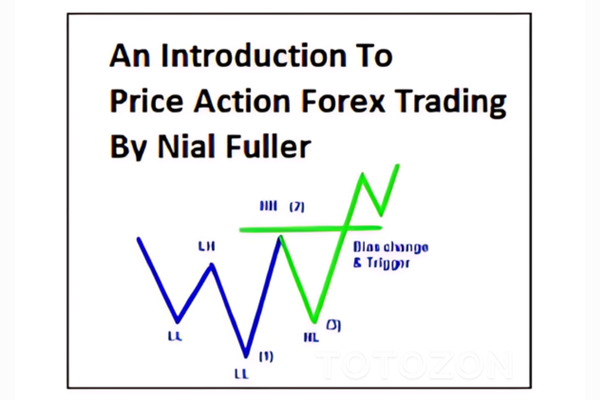

Daily Price Action Lifetime Membership

1 × $23.00

Daily Price Action Lifetime Membership

1 × $23.00 -

×

Introduction to Position Sizing Strategies with Van Tharp Institute

1 × $6.00

Introduction to Position Sizing Strategies with Van Tharp Institute

1 × $6.00 -

×

Scalping Dow Jones 30 (DJI30) course - Live Trading Sessions with ISSAC Asimov

1 × $5.00

Scalping Dow Jones 30 (DJI30) course - Live Trading Sessions with ISSAC Asimov

1 × $5.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00 -

×

Overnight Trading with Nightly Patterns

1 × $5.00

Overnight Trading with Nightly Patterns

1 × $5.00 -

×

Expectations Investing with Alfred Rappaport

1 × $6.00

Expectations Investing with Alfred Rappaport

1 × $6.00

Getting New Insights from Old Indicators with Martin Pring

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Getting New Insights from Old Indicators with Martin Pring” below:

Getting New Insights from Old Indicators with Martin Pring

Introduction to Martin Pring’s Approach

When it comes to technical analysis, Martin Pring is a name that resonates with both seasoned traders and newcomers. His ability to derive new insights from traditional indicators has set him apart in the trading community. This article delves into Pring’s innovative methods for extracting fresh perspectives from established indicators, helping traders enhance their strategies and achieve better results.

Who is Martin Pring?

A Pioneer in Technical Analysis

Martin Pring is a renowned author, educator, and trader who has significantly influenced the field of technical analysis. With decades of experience, he has developed numerous tools and methodologies that have become staples in the trading world.

Contributions to Trading

Pring’s work extends beyond his books and seminars. He has created innovative indicators and analysis techniques that traders around the world rely on to navigate the financial markets.

Understanding Technical Indicators

What are Technical Indicators?

Technical indicators are mathematical calculations based on historical price, volume, or open interest information. They are used by traders to predict future market movements.

Types of Technical Indicators

- Trend Indicators: Identify the direction of the market.

- Momentum Indicators: Measure the speed of price movements.

- Volume Indicators: Analyze trading volume to gauge the strength of a move.

- Volatility Indicators: Assess the rate of price fluctuations.

The Value of Old Indicators

Why Old Indicators Matter

Traditional indicators have stood the test of time because they provide valuable insights into market behavior. Understanding their strengths and limitations is crucial for effective trading.

Examples of Old Indicators

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

Martin Pring’s New Insights

Innovative Use of Moving Averages

Pring has developed new ways to interpret moving averages, such as combining different timeframes to better identify trend changes.

Combining Timeframes

Using short-term and long-term moving averages together can provide a clearer picture of market trends. For example, a crossover of a 50-day moving average with a 200-day moving average is a classic signal of a major trend shift.

Enhanced Relative Strength Index (RSI)

Pring’s approach to RSI involves adjusting the period settings and incorporating it with other indicators to confirm signals.

Adjusting Period Settings

Instead of the traditional 14-day period, Pring suggests experimenting with different periods to better match the market’s current volatility.

Reinterpreting Bollinger Bands

By modifying the standard deviation settings and analyzing the width of the bands, Pring offers deeper insights into market volatility and potential breakout points.

Modifying Standard Deviation

Using a 1.5 or 2.5 standard deviation instead of the typical 2 can highlight different market conditions and potential trade opportunities.

Advanced MACD Interpretations

Pring’s advanced interpretations of MACD focus on the histogram and its relation to price movements, offering a more nuanced view of market momentum.

Focus on Histogram

Analyzing the MACD histogram helps traders identify early signs of trend reversals and momentum shifts.

Applying Pring’s Methods

Step-by-Step Guide

- Identify the Indicator: Choose an indicator to analyze.

- Adjust Parameters: Modify the settings as suggested by Pring.

- Combine Indicators: Use multiple indicators for confirmation.

- Analyze Market Conditions: Consider current market trends and volatility.

- Make Informed Decisions: Use the insights gained to inform your trading strategy.

Practical Examples

Example 1: Moving Averages

Combine a 50-day and a 200-day moving average to identify long-term trends. Look for crossovers as signals for potential buy or sell opportunities.

Example 2: RSI

Adjust the RSI period to 20 days for a more sensitive reading. Combine it with volume indicators to confirm the strength of a trend.

The Importance of Continuous Learning

Staying Updated

The financial markets are constantly evolving. Staying informed about new techniques and continuously refining your approach is essential for success.

Educational Resources

Martin Pring offers a wealth of resources, including books, seminars, and online courses, to help traders stay ahead of the curve.

Conclusion

Martin Pring’s innovative approach to deriving new insights from old indicators provides traders with powerful tools to enhance their trading strategies. By reinterpreting traditional indicators like moving averages, RSI, Bollinger Bands, and MACD, Pring offers fresh perspectives that can lead to more informed trading decisions. Embracing these techniques and continuously learning can significantly improve trading performance.

FAQs

1. What are Martin Pring’s contributions to technical analysis?

Martin Pring has developed innovative indicators and analysis techniques that have become essential tools for traders. His work focuses on extracting new insights from traditional indicators.

2. How can I apply Pring’s methods to my trading strategy?

Start by choosing an indicator, adjusting its parameters as suggested by Pring, and combining it with other indicators for confirmation. Analyze market conditions and use the insights to make informed trading decisions.

3. Why are traditional indicators still relevant?

Traditional indicators have stood the test of time because they provide valuable insights into market behavior. Understanding their strengths and limitations is crucial for effective trading.

4. What is the importance of continuous learning in trading?

The financial markets are constantly evolving, making it essential for traders to stay informed about new techniques and continuously refine their approach to maintain a competitive edge.

5. Where can I find educational resources by Martin Pring?

Martin Pring offers a variety of resources, including books, seminars, and online courses, which can be found on his official website and other educational platforms.

Be the first to review “Getting New Insights from Old Indicators with Martin Pring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.