-

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

US indices system with LaMartinatradingFx

1 × $10.00

US indices system with LaMartinatradingFx

1 × $10.00 -

×

Instant Profits System with Bill Poulos

1 × $6.00

Instant Profits System with Bill Poulos

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

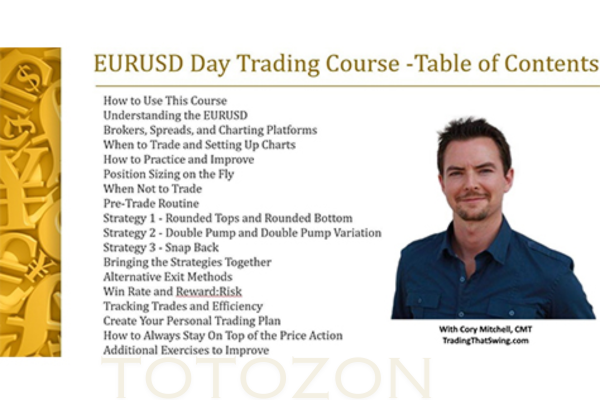

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00 -

×

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00 -

×

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00 -

×

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00 -

×

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00 -

×

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00 -

×

The Value Connection with Marc Gerstein

1 × $5.00

The Value Connection with Marc Gerstein

1 × $5.00 -

×

Calendar Spreads with Todd Mitchell

1 × $31.00

Calendar Spreads with Todd Mitchell

1 × $31.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00

Inefficient Markets with Andrei Shleifer

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Inefficient Markets with Andrei Shleifer” below:

Inefficient Markets with Andrei Shleifer

Introduction to Inefficient Markets

The concept of market efficiency suggests that asset prices reflect all available information. However, Andrei Shleifer, a prominent economist, challenges this notion, arguing that markets can often be inefficient. This article delves into Shleifer’s insights on inefficient markets, exploring the causes, implications, and strategies for navigating them.

Understanding Market Efficiency

What is Market Efficiency?

Market efficiency, as defined by the Efficient Market Hypothesis (EMH), posits that asset prices fully reflect all available information. According to this theory, it is impossible to consistently achieve higher returns than the overall market through stock selection or market timing.

Degrees of Market Efficiency

- Weak Form Efficiency: All past trading information is reflected in stock prices.

- Semi-Strong Form Efficiency: All publicly available information is reflected in stock prices.

- Strong Form Efficiency: All information, including insider information, is reflected in stock prices.

Critique of Market Efficiency

Shleifer’s Perspective

Andrei Shleifer argues that markets are not always efficient. Behavioral biases, market frictions, and other anomalies can lead to price deviations from their true value.

Behavioral Finance

Shleifer’s work in behavioral finance highlights how psychological factors and cognitive biases influence investor behavior, leading to market inefficiencies.

Common Cognitive Biases

- Overconfidence: Investors overestimate their knowledge and abilities.

- Herd Behavior: Investors follow the crowd rather than making independent decisions.

- Loss Aversion: Investors fear losses more than they value gains, affecting their risk-taking behavior.

Causes of Market Inefficiency

1. Information Asymmetry

When some investors have access to information that others do not, it can lead to mispriced assets.

2. Limited Arbitrage

Arbitrage opportunities can correct mispricings, but when arbitrage is limited by risk, costs, or other factors, inefficiencies persist.

3. Transaction Costs

High transaction costs can prevent investors from exploiting arbitrage opportunities, allowing inefficiencies to remain.

4. Behavioral Factors

Investor psychology and behavior can cause prices to deviate from their fundamental values.

Implications of Inefficient Markets

Investment Opportunities

Inefficient markets can create opportunities for investors to achieve above-average returns by identifying mispriced assets.

Risk Management

Understanding market inefficiencies can help investors develop better risk management strategies by anticipating potential price corrections.

Market Stability

Inefficiencies can lead to market instability, as price corrections may occur suddenly, causing volatility.

Strategies for Navigating Inefficient Markets

1. Fundamental Analysis

Conducting thorough fundamental analysis can help identify mispriced assets and provide investment opportunities.

2. Behavioral Analysis

Incorporating behavioral analysis into investment strategies can help anticipate market movements driven by investor psychology.

3. Diversification

Diversifying investments across different asset classes and markets can help mitigate the risks associated with market inefficiencies.

4. Risk Management

Implementing robust risk management practices, such as stop-loss orders and position sizing, can protect against potential market corrections.

Case Studies in Market Inefficiency

Dot-Com Bubble

The late 1990s dot-com bubble exemplifies market inefficiency, where investor exuberance drove technology stock prices to unsustainable levels, followed by a sharp correction.

2008 Financial Crisis

The 2008 financial crisis highlighted inefficiencies in the housing market and financial sector, driven by poor risk management and information asymmetry.

Future of Market Efficiency

Technological Advances

Advancements in technology and data analytics may help reduce market inefficiencies by improving information dissemination and analysis.

Regulatory Changes

Regulatory changes aimed at increasing transparency and reducing information asymmetry can enhance market efficiency.

Behavioral Insights

Incorporating behavioral insights into economic models and investment strategies can provide a more comprehensive understanding of market dynamics.

Conclusion

Understanding the principles of inefficient markets as explained by Andrei Shleifer can significantly enhance investment strategies. By recognizing the causes and implications of market inefficiencies, investors can better navigate the financial markets and capitalize on opportunities. Embrace these insights, apply them diligently, and refine your approach to achieve better investment outcomes.

Frequently Asked Questions:

What are inefficient markets?

Inefficient markets are markets where asset prices do not fully reflect all available information, leading to mispricings.

Who is Andrei Shleifer?

Andrei Shleifer is a prominent economist known for his work in behavioral finance and market inefficiencies.

What causes market inefficiencies?

Market inefficiencies can be caused by information asymmetry, limited arbitrage, transaction costs, and behavioral factors.

How can investors benefit from market inefficiencies?

Investors can benefit by identifying mispriced assets through fundamental and behavioral analysis and implementing robust risk management strategies.

What are the implications of market inefficiencies?

Market inefficiencies can create investment opportunities, but they can also lead to increased risk and market instability.

Be the first to review “Inefficient Markets with Andrei Shleifer” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.