-

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

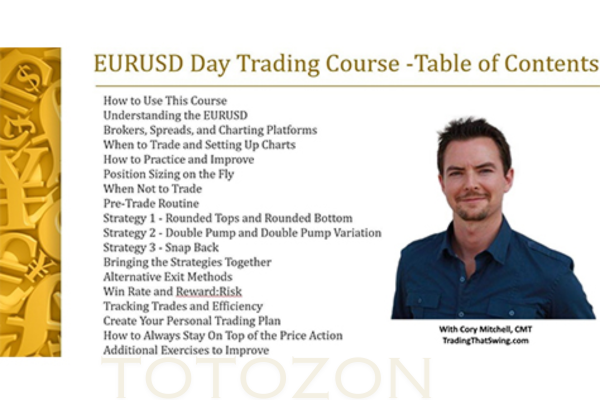

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00 -

×

May Madness with LIT Trading

1 × $5.00

May Madness with LIT Trading

1 × $5.00 -

×

Trading Psychology Mastery Course - Trading Composure

1 × $6.00

Trading Psychology Mastery Course - Trading Composure

1 × $6.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trend Trader PRO Suite Training Course

1 × $5.00

Trend Trader PRO Suite Training Course

1 × $5.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Beyond Fibonacci Retracements with Dynamic Traders

1 × $5.00

Beyond Fibonacci Retracements with Dynamic Traders

1 × $5.00 -

×

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00 -

×

Interpreting Money Stream with Peter Worden

1 × $6.00

Interpreting Money Stream with Peter Worden

1 × $6.00 -

×

Beat The Binaries

1 × $15.00

Beat The Binaries

1 × $15.00 -

×

Money Management

1 × $6.00

Money Management

1 × $6.00 -

×

Emini Strategy #6 with Steve Primo

1 × $39.00

Emini Strategy #6 with Steve Primo

1 × $39.00 -

×

Mark Sebastian – Gamma Trading Class

1 × $6.00

Mark Sebastian – Gamma Trading Class

1 × $6.00 -

×

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00 -

×

Day Trading Academy

1 × $54.00

Day Trading Academy

1 × $54.00 -

×

Indicators & BWT Bar Types for NT7

1 × $139.00

Indicators & BWT Bar Types for NT7

1 × $139.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

The Pitbull Investor (2009 Ed.)

1 × $6.00

The Pitbull Investor (2009 Ed.)

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Cobra (aka Viper Crude)

1 × $23.00

Cobra (aka Viper Crude)

1 × $23.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Reading & Understanding Charts with Andrew Baxter

1 × $6.00

Reading & Understanding Charts with Andrew Baxter

1 × $6.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

Ron Ianieri – Advanced Options Strategies

1 × $6.00

Ron Ianieri – Advanced Options Strategies

1 × $6.00 -

×

Order Flow Analytics

1 × $54.00

Order Flow Analytics

1 × $54.00 -

×

Learn to Trade Course with Mike Aston

1 × $6.00

Learn to Trade Course with Mike Aston

1 × $6.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00 -

×

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

Intro To Short Selling with Madaz Money

1 × $31.00

Intro To Short Selling with Madaz Money

1 × $31.00 -

×

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00

The C3PO Forex Trading Strategy with Jared Passey

1 × $4.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00 -

×

Galactic Trader Seminar

1 × $15.00

Galactic Trader Seminar

1 × $15.00 -

×

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00 -

×

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00 -

×

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

Stocks and Bonds with Elaine Scott

1 × $6.00

Stocks and Bonds with Elaine Scott

1 × $6.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Strategy Class + Indicators

1 × $31.00

Strategy Class + Indicators

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Into The Abbys with Black Rabbit

1 × $18.00

Into The Abbys with Black Rabbit

1 × $18.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

Elliott Wave DNA with Nicola Delic

1 × $31.00

Elliott Wave DNA with Nicola Delic

1 × $31.00 -

×

The Silver Edge Forex Training Program with T3 Live

1 × $5.00

The Silver Edge Forex Training Program with T3 Live

1 × $5.00 -

×

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00 -

×

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

Surefire Trading Plans with Mark McRae

1 × $6.00

Surefire Trading Plans with Mark McRae

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

Climate Behaviour with Feibel Trading

1 × $6.00

Climate Behaviour with Feibel Trading

1 × $6.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Decoded with Axia Futures

1 × $31.00

Trading Decoded with Axia Futures

1 × $31.00 -

×

Trading on the Edge with Guido J.Deboeck

1 × $6.00

Trading on the Edge with Guido J.Deboeck

1 × $6.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

Technical & Fundamental Courses with Diamant Capital

1 × $5.00

Technical & Fundamental Courses with Diamant Capital

1 × $5.00 -

×

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00 -

×

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

The Tickmaster Indicator

1 × $54.00

The Tickmaster Indicator

1 × $54.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00 -

×

Thetimefactor - TRADING WITH PRICE

1 × $15.00

Thetimefactor - TRADING WITH PRICE

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

Intermediate to Advance Trading Strategies

1 × $6.00

Intermediate to Advance Trading Strategies

1 × $6.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00 -

×

Ultimate Options Blue Print Course

1 × $23.00

Ultimate Options Blue Print Course

1 × $23.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

Wall Street Training

1 × $6.00

Wall Street Training

1 × $6.00 -

×

THE HARMONIC ELLIOTT WAVE VIDEO WEBINAR with Ian Copsey

1 × $23.00

THE HARMONIC ELLIOTT WAVE VIDEO WEBINAR with Ian Copsey

1 × $23.00 -

×

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00 -

×

Price Action Trading 101 By Steve Burns

1 × $15.00

Price Action Trading 101 By Steve Burns

1 × $15.00 -

×

Bollinger Bands Trading Strategies That Work

1 × $6.00

Bollinger Bands Trading Strategies That Work

1 × $6.00 -

×

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00 -

×

Expectations Investing with Alfred Rappaport

1 × $6.00

Expectations Investing with Alfred Rappaport

1 × $6.00 -

×

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00 -

×

Options Made Easy with Optionpit

1 × $62.00

Options Made Easy with Optionpit

1 × $62.00 -

×

Divergent swing trading

1 × $54.00

Divergent swing trading

1 × $54.00 -

×

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

Pips&Profit Trading Course

1 × $13.00

Pips&Profit Trading Course

1 × $13.00 -

×

Volcano Trading with Claytrader

1 × $15.00

Volcano Trading with Claytrader

1 × $15.00 -

×

LPC System

1 × $5.00

LPC System

1 × $5.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Overnight Trading with Nightly Patterns

1 × $5.00

Overnight Trading with Nightly Patterns

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Turtle Trading Concepts with Russell Sands

1 × $6.00

Turtle Trading Concepts with Russell Sands

1 × $6.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

WinXgo + Manual (moneytide.com)

1 × $6.00

WinXgo + Manual (moneytide.com)

1 × $6.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading The Hobbs Triple Crown Strategy with Derrik Hobbs” below:

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

Introduction

Welcome to the world of Trading The Hobbs Triple Crown Strategy with Derrik Hobbs, where strategic trading meets mathematical precision. This article will take you through the fundamentals of the Hobbs Triple Crown Strategy, a robust trading method designed to optimize your success in the financial markets. We will delve into its components, execution, and how you can leverage this strategy to enhance your trading performance.

What is the Hobbs Triple Crown Strategy?

Understanding the Basics

The Hobbs Triple Crown Strategy is a comprehensive trading approach developed by Derrik Hobbs. It integrates three critical technical indicators to identify high-probability trade setups. These indicators include moving averages, Fibonacci retracement levels, and candlestick patterns.

The Significance of Triple Indicators

Using three indicators provides a multi-faceted view of the market, enhancing the accuracy of trade entries and exits. This strategy aims to filter out false signals and increase the likelihood of successful trades.

Components of the Triple Crown Strategy

1. Moving Averages

Why Moving Averages Matter

Moving averages smooth out price data, creating a clearer picture of market trends. They help traders identify the direction of the trend and potential reversal points.

2. Fibonacci Retracement Levels

Precision with Fibonacci

Fibonacci retracement levels are used to predict potential support and resistance areas. These levels are derived from the Fibonacci sequence and are instrumental in pinpointing where the price might reverse.

3. Candlestick Patterns

Reading Candlestick Signals

Candlestick patterns provide visual cues about market sentiment and potential price movements. Patterns such as the Doji, Hammer, and Engulfing can indicate reversals or continuations.

Setting Up the Triple Crown Strategy

Step-by-Step Guide

Step 1: Apply Moving Averages

Start by applying two moving averages to your chart: a short-term (e.g., 20-period) and a long-term (e.g., 50-period) moving average. Look for crossovers, which signal potential buy or sell opportunities.

Step 2: Draw Fibonacci Retracement Levels

Identify a significant price move and draw Fibonacci retracement levels from the start to the end of the move. These levels will highlight potential areas of support and resistance.

Step 3: Identify Candlestick Patterns

Watch for key candlestick patterns at or near the Fibonacci levels. These patterns will provide additional confirmation for your trades.

Executing Trades with the Triple Crown Strategy

Entry Points

Combining Signals

Enter a trade when all three indicators align. For example, if the price is retracing to a Fibonacci level and a bullish candlestick pattern forms near the short-term moving average, this could signal a buy opportunity.

Exit Points

Setting Targets and Stops

Set your take profit and stop loss levels based on the Fibonacci extensions and moving average crossovers. This approach helps manage risk and lock in profits.

Advantages of the Triple Crown Strategy

Enhanced Accuracy

Combining three indicators increases the accuracy of trade signals, reducing the likelihood of false entries and exits.

Versatility Across Markets

The Hobbs Triple Crown Strategy is versatile and can be applied to various markets, including stocks, forex, and commodities.

Risk Management

By setting precise entry and exit points, this strategy helps traders manage risk more effectively, ensuring that losses are minimized and profits are maximized.

Common Mistakes to Avoid

Overtrading

Avoid the temptation to enter trades based on partial signals. Wait for all three indicators to align before executing a trade.

Ignoring Market Conditions

Market conditions can affect the reliability of technical indicators. Always consider the broader market context and any fundamental factors that might influence price movements.

Conclusion

Trading the Hobbs Triple Crown Strategy with Derrik Hobbs offers a structured and reliable approach to navigating the financial markets. By integrating moving averages, Fibonacci retracement levels, and candlestick patterns, this strategy provides traders with a comprehensive toolkit for making informed trading decisions. Embrace the discipline, patience, and precision of the Triple Crown Strategy to elevate your trading game.

FAQs

1. What is the primary goal of the Hobbs Triple Crown Strategy?

The primary goal is to increase trade accuracy by combining three technical indicators to identify high-probability trade setups.

2. Can this strategy be used in all market conditions?

While versatile, the strategy works best in trending markets. Always consider market conditions and adjust your approach accordingly.

3. How do I set up Fibonacci retracement levels?

Identify a significant price move and apply the Fibonacci retracement tool from the beginning to the end of the move. The levels will appear as horizontal lines on your chart.

4. Why are candlestick patterns important in this strategy?

Candlestick patterns provide visual cues about market sentiment and potential price movements, offering additional confirmation for trade entries and exits.

5. What is the significance of moving average crossovers?

Moving average crossovers signal potential buy or sell opportunities by indicating changes in the direction of the trend.

Be the first to review “Trading The Hobbs Triple Crown Strategy with Derrik Hobbs” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.