-

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

21 Candlesticks Every Trader Should Know with Melvin Pasternak

1 × $5.00

21 Candlesticks Every Trader Should Know with Melvin Pasternak

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

24-Hour Un-Education Trading Course

1 × $54.00

24-Hour Un-Education Trading Course

1 × $54.00 -

×

$1,500 to $1 Million In 3 Years

1 × $39.00

$1,500 to $1 Million In 3 Years

1 × $39.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

2 Trades A Day with Jason Hale

1 × $15.00

2 Trades A Day with Jason Hale

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Russell Futures Scalping Course with Bill McDowell

1 × $6.00

Russell Futures Scalping Course with Bill McDowell

1 × $6.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Pivotboss Masters - Become Elite

1 × $5.00

Pivotboss Masters - Become Elite

1 × $5.00 -

×

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00 -

×

2-Phase Inducement Theorem with Vector Trading FX

1 × $6.00

2-Phase Inducement Theorem with Vector Trading FX

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

10x Trade Formula Master Collection

1 × $54.00

10x Trade Formula Master Collection

1 × $54.00 -

×

Finserv Corp Complete Course

1 × $4.00

Finserv Corp Complete Course

1 × $4.00 -

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00 -

×

2010 The Market Mastery Protégé Program

1 × $31.00

2010 The Market Mastery Protégé Program

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

2016 Chicago Annual Options Seminar with Dan Sheridan

1 × $23.00

2016 Chicago Annual Options Seminar with Dan Sheridan

1 × $23.00 -

×

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00 -

×

2014 Advanced Swing Trading Summit

1 × $31.00

2014 Advanced Swing Trading Summit

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

$199.00 Original price was: $199.00.$6.00Current price is: $6.00.

File Size: 3.31 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

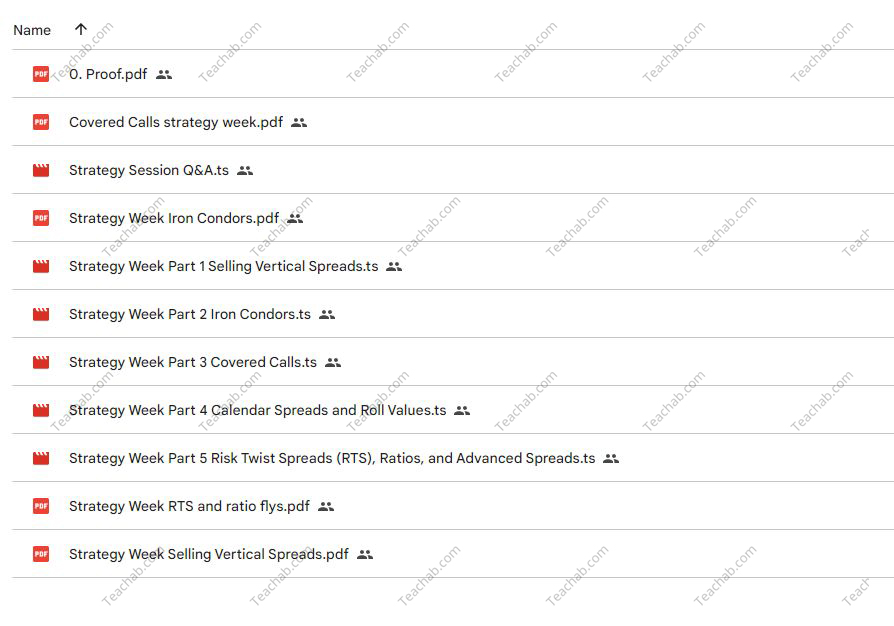

You may check content proof of “Strategy Week: Using High Probability Options Strategies with Don Kaufman” below:

Strategy Week: Using High Probability Options Strategies with Don Kaufman

Navigating the complex world of options trading requires a clear understanding and strategic execution. “Strategy Week: Using High Probability Options Strategies with Don Kaufman” is a dedicated series designed to equip traders with the skills to leverage options for maximum gain. Let’s delve into these high probability strategies that can transform your trading outlook.

Introduction to High Probability Options Trading

What are High Probability Options Strategies?

High probability options strategies are techniques that statistically increase the likelihood of profitable trades by focusing on specific market conditions and volatility factors.

Why Focus on Probability?

Emphasizing probability in trading ensures that over time, the strategies yield consistent returns, minimizing risk and enhancing portfolio stability.

The Role of Don Kaufman in Options Trading

Expertise and Experience

Don Kaufman, a renowned trader and educator, brings years of experience to the table, offering insights that demystify the complexities of options trading.

Educational Approach

Kaufman’s educational sessions are famed for their clarity, depth, and practicality, making them invaluable for both beginners and seasoned traders.

Core Strategies Discussed During Strategy Week

The Iron Condor

Learn how to set up this market-neutral strategy that profits from low volatility in the market.

Credit Spreads

Discover how selling options spreads can generate consistent income with defined risk.

Butterflies and Condors

Understand the intricacies of these advanced strategies that can capitalize on specific market conditions.

Daily Breakdown of Strategy Week

Day 1: Introduction to Options

Grasp the basics of options trading, including terms, concepts, and the foundational strategies.

Day 2: Mastering Vertical Spreads

Dive deep into vertical spreads to understand how they can be used to play directional market moves with limited risk.

Day 3: Exploring Non-Directional Trades

Focus on strategies that aren’t dependent on market direction, such as iron condors and butterflies.

Day 4: Risk Management Techniques

Learn to manage risks associated with options trading, ensuring that you know how to limit losses and lock in profits.

Day 5: Live Trading Session

Put theory into practice with a live trading session led by Don Kaufman, applying strategies in real-time market scenarios.

Implementing What You Learn

Simulation Trading

Before going live, practice the strategies learned during Strategy Week in a simulation environment to build confidence.

Continuous Learning

The world of options is dynamic; continuous learning and adaptation are key to maintaining an edge.

Tools and Resources for Options Traders

Analytical Software

Discover the best software that can help analyze options strategies and market conditions.

Educational Platforms

Identify platforms where you can continue learning and stay updated with new strategies.

Who Should Attend Strategy Week?

Novice Traders

If you’re new to options, this week provides a structured learning path.

Experienced Traders

Even if you’re experienced, updating your strategies with Kaufman’s insights can prove beneficial.

Conclusion

“Strategy Week: Using High Probability Options Strategies with Don Kaufman” offers a rare opportunity to learn directly from a seasoned expert. Through a structured approach and emphasis on high probability strategies, traders can significantly enhance their trading skills and market understanding.

Frequently Asked Questions

- What is the key benefit of attending Strategy Week?

- The key benefit is gaining comprehensive knowledge and practical skills in high probability options strategies.

- How can I access materials from Strategy Week?

- Participants will receive access to digital materials, recordings, and exclusive webinars.

- Is there a community or network I can join post-Strategy Week?

- Yes, attendees gain access to an exclusive community of traders where ongoing support and learning are encouraged.

- What level of trading experience is required?

- The program is designed to benefit everyone from beginners to advanced traders.

- How often is Strategy Week held?

- Strategy Week is an annual event, providing ample opportunity for traders to join.

Be the first to review “Strategy Week: Using High Probability Options Strategies with Don Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.