-

×

Iconic Trader Program with Urban Forex

1 × $5.00

Iconic Trader Program with Urban Forex

1 × $5.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

The Complete 12 Week Transformation Course

1 × $31.00

The Complete 12 Week Transformation Course

1 × $31.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00 -

×

ICT Mastery with Casper SMC

1 × $14.00

ICT Mastery with Casper SMC

1 × $14.00 -

×

Crypto Momentum Trading System with Pollinate Trading

1 × $34.00

Crypto Momentum Trading System with Pollinate Trading

1 × $34.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

The Candlestick Training Series with Timon Weller

1 × $6.00

The Candlestick Training Series with Timon Weller

1 × $6.00 -

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

How to Profit in Gold with Jonathan Spall

1 × $6.00

How to Profit in Gold with Jonathan Spall

1 × $6.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

The Day Traders Fast Track Program

1 × $23.00

The Day Traders Fast Track Program

1 × $23.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

The Janus Factor with Gary Anderson

1 × $6.00

The Janus Factor with Gary Anderson

1 × $6.00 -

×

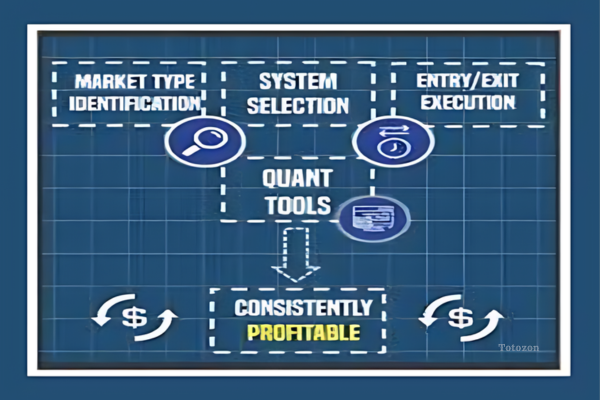

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Complete Trading System with Segma Singh

1 × $6.00

Complete Trading System with Segma Singh

1 × $6.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

Derivates Demystified

1 × $6.00

Derivates Demystified

1 × $6.00 -

×

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

THE BUNDLE (MAIN COURSE) with Daniel Savage - Forex Savages

1 × $6.00

THE BUNDLE (MAIN COURSE) with Daniel Savage - Forex Savages

1 × $6.00 -

×

Super CD Companion for Metastock with Martin Pring

1 × $6.00

Super CD Companion for Metastock with Martin Pring

1 × $6.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00 -

×

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00 -

×

Supply and Demand Video Course with JamesFXS

1 × $13.00

Supply and Demand Video Course with JamesFXS

1 × $13.00 -

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00 -

×

Trading Spreads and Seasonals (tradingeducators.com)

1 × $6.00

Trading Spreads and Seasonals (tradingeducators.com)

1 × $6.00 -

×

Robotic trading interactive

1 × $31.00

Robotic trading interactive

1 × $31.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

The Complete Guide to Spread Trading

1 × $6.00

The Complete Guide to Spread Trading

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00 -

×

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Forex Trading Using Fibonacci & Elliott Wave with Todd Gordon

1 × $6.00

Forex Trading Using Fibonacci & Elliott Wave with Todd Gordon

1 × $6.00 -

×

OPTIONS FOR BEGINNERS

1 × $6.00

OPTIONS FOR BEGINNERS

1 × $6.00 -

×

Full Credit Spreads with Ryan Litchfield

1 × $6.00

Full Credit Spreads with Ryan Litchfield

1 × $6.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

Edge Trading Group with Edge Elite

1 × $6.00

Edge Trading Group with Edge Elite

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00 -

×

Trading System Development 101,102,103

1 × $6.00

Trading System Development 101,102,103

1 × $6.00 -

×

Forex Trading Made Ez with G.C.Smith

1 × $6.00

Forex Trading Made Ez with G.C.Smith

1 × $6.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Fantastic 4 Trading Strategies

1 × $15.00

Fantastic 4 Trading Strategies

1 × $15.00 -

×

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00 -

×

Complete Day Trading Course with The Trading Floor

1 × $13.00

Complete Day Trading Course with The Trading Floor

1 × $13.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Euro Error with Jean-Jacques Rosa

1 × $6.00

Euro Error with Jean-Jacques Rosa

1 × $6.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

The Quarters Theory with Ilian Yotov

1 × $6.00

The Quarters Theory with Ilian Yotov

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00 -

×

Rockwell Day Trading - Starter Package

1 × $6.00

Rockwell Day Trading - Starter Package

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00 -

×

SOT Intermediate Course (May 2014)

1 × $23.00

SOT Intermediate Course (May 2014)

1 × $23.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

![Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)] img](https://www.totozon.com/wp-content/uploads/2024/05/Robert-Miner-Complete-Price-Tutorial-Series-5-Videos-AVI-img.png) Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00

Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00 -

×

Alfred White’s Rules of Planetary Pictures with Witte, Rudolph, Lefeldt

1 × $6.00

Alfred White’s Rules of Planetary Pictures with Witte, Rudolph, Lefeldt

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00 -

×

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00 -

×

Sell & Sell Short with Alexander Elder

1 × $6.00

Sell & Sell Short with Alexander Elder

1 × $6.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

All About High-Frequency Trading with Michael Durbin

1 × $6.00

All About High-Frequency Trading with Michael Durbin

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

The Complete Guide to Option Selling with James Cordier

1 × $6.00

The Complete Guide to Option Selling with James Cordier

1 × $6.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Exchange-Traded Derivatives with Erik Banks

1 × $6.00

Exchange-Traded Derivatives with Erik Banks

1 × $6.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors” below:

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

Exchange-Traded Funds (ETFs) have become a popular investment vehicle for traders seeking diversification and liquidity. To succeed in this dynamic market, you need reliable strategies. In this article, we’ll explore High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors. Larry Connors, a veteran in the trading community, offers insights that can significantly enhance your ETF trading approach.

Introduction to ETF Trading

What Are ETFs?

ETFs are investment funds that are traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value.

Why Trade ETFs?

ETFs offer several benefits, including diversification, lower costs, and flexibility. They are ideal for both beginner and experienced traders looking to broaden their investment portfolio.

Strategy 1: RSI Overbought/Oversold

Understanding RSI

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with readings above 70 indicating overbought conditions and below 30 indicating oversold conditions.

Implementing RSI in ETF Trading

Connors suggests using RSI to identify overbought and oversold conditions in ETFs. When the RSI drops below 30, consider it a buying opportunity, and when it rises above 70, it may be time to sell.

Strategy 2: The 2-Period RSI Pullback

Why 2-Period RSI?

The 2-period RSI is a shorter-term indicator that provides more frequent signals. It’s particularly effective for capturing short-term price movements.

How to Use It

Buy when the 2-period RSI drops below 10 and sell when it rises above 90. This strategy helps capture quick, profitable trades within a short time frame.

Strategy 3: Mean Reversion

Concept of Mean Reversion

Mean reversion is based on the idea that prices and returns eventually move back towards the mean or average.

Applying Mean Reversion in ETFs

Identify ETFs that have deviated significantly from their historical average prices. Connors recommends buying when an ETF is significantly below its mean and selling when it’s above.

Strategy 4: Trend Following

What is Trend Following?

Trend following involves buying assets that have been rising and selling those that have been falling. It’s a momentum-based strategy.

Implementing Trend Following

Use moving averages to identify trends. For example, buy when the ETF’s price is above its 200-day moving average and sell when it falls below.

Strategy 5: The ConnorsRSI Strategy

What is ConnorsRSI?

ConnorsRSI is a composite indicator combining three different components: the RSI, the duration of the up/down streak, and the magnitude of the price change.

Using ConnorsRSI

This strategy helps identify short-term mean reversion opportunities. Buy when ConnorsRSI is low (e.g., below 20) and sell when it’s high (e.g., above 80).

Strategy 6: Pair Trading

Understanding Pair Trading

Pair trading involves trading two correlated securities simultaneously, one long and one short. The idea is to profit from the relative performance between the two.

Executing Pair Trades with ETFs

Identify pairs of ETFs that typically move together. For instance, if one ETF is underperforming its pair, consider going long on the underperforming ETF and short on the outperforming one.

Strategy 7: Volatility-Based Trading

What is Volatility?

Volatility refers to the degree of variation of a trading price series over time. High volatility indicates large price movements, while low volatility indicates smaller movements.

Trading Based on Volatility

Use indicators like the VIX to gauge market volatility. Connors suggests trading ETFs that respond well to volatility signals. For example, buy volatility-sensitive ETFs when the VIX spikes and sell when it drops.

Advantages of Connors’ ETF Trading Strategies

High Probability Setups

Each strategy is designed based on historical data and statistical analysis, providing high-probability trading setups.

Diverse Approaches

From mean reversion to trend following, these strategies offer diverse approaches to suit different market conditions and trading styles.

Automation Friendly

Many of these strategies can be automated using trading platforms like TradeStation, ensuring consistent execution and minimizing human error.

Challenges and Considerations

Market Conditions

No strategy is foolproof. Market conditions can change rapidly, affecting the performance of these strategies. Stay informed and be prepared to adapt.

Emotional Discipline

Successful trading requires emotional discipline. Stick to the strategy rules and avoid making impulsive decisions based on emotions.

Continuous Learning

The market is constantly evolving. Continuously educate yourself and refine your strategies to stay ahead.

Conclusion

High Probability ETF Trading with Larry Connors offers a structured and effective approach to trading ETFs. By implementing these seven professional strategies, you can improve your trading performance and achieve greater success in the markets.

FAQs

1. What is the main advantage of using RSI in ETF trading?

RSI helps identify overbought and oversold conditions, providing timely entry and exit signals for trades.

2. How does mean reversion benefit ETF traders?

Mean reversion allows traders to capitalize on ETFs that have deviated significantly from their historical averages, profiting from their eventual return to the mean.

3. Can beginners use these strategies effectively?

Yes, but it requires a willingness to learn and practice. Starting with a simulated account can help beginners gain confidence.

4. What are the risks associated with pair trading?

Pair trading risks include correlation breakdowns and execution challenges. Proper analysis and risk management are crucial.

5. How can I stay disciplined in my trading approach?

Stick to your trading plan, avoid impulsive decisions, and continuously educate yourself to stay disciplined.

Be the first to review “High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.