-

×

Trading Systems Explained with Martin Pring

1 × $6.00

Trading Systems Explained with Martin Pring

1 × $6.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Advanced Stock Trading Course + Strategies

1 × $15.00

Advanced Stock Trading Course + Strategies

1 × $15.00 -

×

Winning with Value Charts with Dave Stendahl

1 × $6.00

Winning with Value Charts with Dave Stendahl

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Janus Factor with Gary Anderson

1 × $6.00

The Janus Factor with Gary Anderson

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

2016 Chicago Annual Options Seminar with Dan Sheridan

1 × $23.00

2016 Chicago Annual Options Seminar with Dan Sheridan

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

$588.00 Original price was: $588.00.$15.00Current price is: $15.00.

File Size: 3.31 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

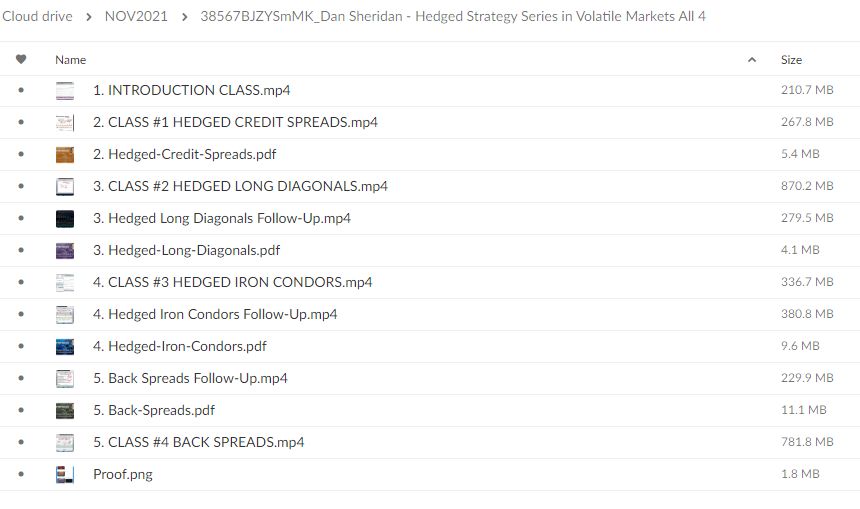

You may check content proof of “Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan” below:

Hedged Strategy Series in Volatile Markets: All 4 with Dan Sheridan

Introduction: Navigating Turbulence with Strategy

In the whirlwind of volatile markets, traders and investors seek stability and profit through well-crafted strategies. Dan Sheridan’s Hedged Strategy Series offers a beacon of wisdom for those aiming to navigate these choppy waters effectively. Let’s explore these strategies and see how they can fortify your trading arsenal.

Understanding the Basics of Hedged Strategies

What is a Hedged Strategy?

At its core, a hedged strategy involves using financial instruments to offset potential losses in investments. It’s akin to having an insurance policy for your trades.

Why Use Hedged Strategies in Volatile Markets?

- Risk Reduction: Minimizes potential losses during unexpected market movements.

- Profit Potential: Allows traders to capitalize on market volatility without excessive risk.

The Four Pillars of Sheridan’s Strategy

Strategy 1: Protective Puts

This strategy involves buying put options to safeguard against a decline in the stock price. It’s like an airbag for your stock investments—deploying protection when things go south.

Strategy 2: Covered Calls

Selling call options against a stock position can generate income and provide a slight buffer against price decreases. Think of it as setting a safety net where you can catch some gains even if the stock slips a bit.

Strategy 3: Iron Condors

This strategy uses four different options to capitalize on stocks trading in a narrow range during high volatility. It’s like playing both sides of the field, ensuring you score whether the market swings up or down.

Strategy 4: Butterfly Spreads

Utilizing both calls and puts, this strategy thrives on minimal movement in the underlying stock. It’s designed to capture gains from small market moves, much like a butterfly delicately landing on targets.

Tools and Resources for Hedging

Essential Tools for Implementing Hedged Strategies

To effectively use these strategies, traders need tools that provide real-time data and analytics. Platforms like Thinkorswim and Interactive Brokers are invaluable for these tasks.

Real-World Application: Learning from Dan Sheridan

Sheridan’s Approach to Teaching

Dan Sheridan emphasizes the importance of education in trading. His approach is not just about strategies but also understanding the market’s nature, helping traders make informed decisions.

Conclusion: Mastering Market Volatility

With Dan Sheridan’s Hedged Strategy Series, traders can approach volatile markets with confidence. These strategies, when applied correctly, offer a way to manage risk while maintaining the potential for profit.

FAQs

What are hedged strategies in trading?

Hedged strategies involve using financial instruments to offset potential losses in investments, similar to insurance for trades.

Why are these strategies beneficial in volatile markets?

They reduce risk and allow traders to profit from market volatility safely.

Can beginners implement these strategies?

Yes, with proper education and the right tools, even beginners can apply hedged strategies effectively.

What tools does Dan Sheridan recommend for trading?

Sheridan often suggests using platforms like Thinkorswim for their robust analytics and real-time data capabilities.

How do these strategies help in risk management?

By providing protective measures against market downturns and allowing for gains in various market conditions, these strategies enhance risk management.

Be the first to review “Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.