-

×

S&P Reloaded System with Ryan Jones

1 × $4.00

S&P Reloaded System with Ryan Jones

1 × $4.00 -

×

Introduction to Macro Investing with Mike Singleton

1 × $31.00

Introduction to Macro Investing with Mike Singleton

1 × $31.00 -

×

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00 -

×

Advanced Trading Strategies

1 × $31.00

Advanced Trading Strategies

1 × $31.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Introduction to Amibroker with Howard B.Bandy

1 × $6.00

Introduction to Amibroker with Howard B.Bandy

1 × $6.00 -

×

Live Online Masterclass with XSPY Trader

1 × $5.00

Live Online Masterclass with XSPY Trader

1 × $5.00 -

×

Trading Without Gambling with Marcel Link

1 × $6.00

Trading Without Gambling with Marcel Link

1 × $6.00 -

×

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00 -

×

The Fx220 1 on 1 Mentoring Program

1 × $5.00

The Fx220 1 on 1 Mentoring Program

1 × $5.00 -

×

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00 -

×

The Compleat Day Trader with Jake Bernstein

1 × $6.00

The Compleat Day Trader with Jake Bernstein

1 × $6.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Carter FX 2.0 with CFX University

1 × $5.00

Carter FX 2.0 with CFX University

1 × $5.00 -

×

Developting a Forex Trading Plan Webminar

1 × $6.00

Developting a Forex Trading Plan Webminar

1 × $6.00 -

×

Open Trader Pro Training

1 × $23.00

Open Trader Pro Training

1 × $23.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

Futures Masterclass with Market Flow Trader

1 × $17.00

Futures Masterclass with Market Flow Trader

1 × $17.00 -

×

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00

Trading Dave Landry’s Ultimate Bow Ties Strategy with Dave Landry

1 × $6.00 -

×

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Century Capital Group Course with Dylan Forexia

1 × $6.00

Century Capital Group Course with Dylan Forexia

1 × $6.00 -

×

Order Flow Analysis

1 × $15.00

Order Flow Analysis

1 × $15.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Technical Analysis with Alexander Elder Video Series

1 × $6.00

Technical Analysis with Alexander Elder Video Series

1 × $6.00 -

×

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00 -

×

Gamma Options Boot Camp with Bigtrends

1 × $74.00

Gamma Options Boot Camp with Bigtrends

1 × $74.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00 -

×

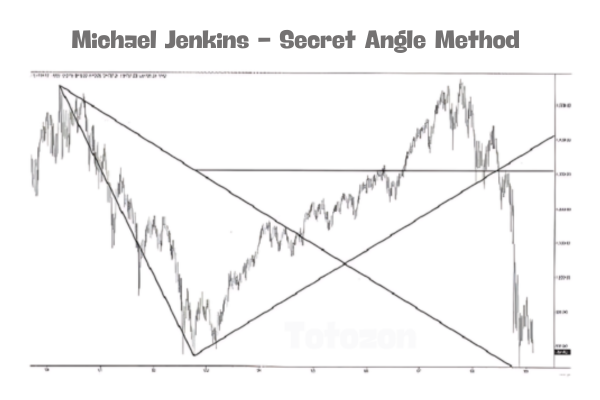

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00 -

×

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00 -

×

Forecast for 2010 with Larry Williams

1 × $6.00

Forecast for 2010 with Larry Williams

1 × $6.00 -

×

Self-Destructing Trader with Ryan Jonesc

1 × $6.00

Self-Destructing Trader with Ryan Jonesc

1 × $6.00 -

×

Directional Option Strategies for Swing and Day Trading with Dan Gibby - Master Trader

1 × $54.00

Directional Option Strategies for Swing and Day Trading with Dan Gibby - Master Trader

1 × $54.00 -

×

Elite Day Trading Bundle (Series 4) with The Swag Academy

1 × $101.00

Elite Day Trading Bundle (Series 4) with The Swag Academy

1 × $101.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

Debt Capital Markets in China with Jian Gao

1 × $6.00

Debt Capital Markets in China with Jian Gao

1 × $6.00 -

×

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Futures & Options 101 with Talkin Options

1 × $8.00

Futures & Options 101 with Talkin Options

1 × $8.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

1 × $6.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

1 × $6.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott’s Impulsive Wave Structure with Ian Copsey

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott’s Impulsive Wave Structure with Ian Copsey

Introduction

In the intricate world of technical analysis, the Elliott Wave Theory has stood as a cornerstone for understanding market cycles. Ian Copsey, a distinguished analyst, has introduced a compelling modification to this theory through his concept of the Harmonic Elliott Wave. This article explores Copsey’s innovative approach, which refines and extends R. N. Elliott’s original impulsive wave structure.

Who is Ian Copsey?

A Veteran in Market Analysis Ian Copsey is a seasoned technical analyst who has dedicated his career to enhancing and applying the Elliott Wave Theory in contemporary financial markets.

Understanding Elliott Wave Theory

The Basics of R. N. Elliott’s Theory R. N. Elliott proposed that market movements follow a predictable, natural rhythm of five waves in the direction of the trend followed by three corrective waves. This fractal model has been used to forecast financial markets with remarkable accuracy.

The Need for Modification

Why Modify Elliott’s Wave Theory? While Elliott’s original theory has been incredibly influential, Copsey argues that certain market conditions have evolved in ways that Elliott’s initial model does not fully account for.

Harmonic Elliott Wave Explained

Defining the Harmonic Modifications Ian Copsey’s Harmonic Elliott Wave introduces adjustments that account for more complex market dynamics, ensuring that the wave theory remains robust in today’s volatile trading environments.

Key Components of Copsey’s Model

- Adjustment of Wave Structures: Copsey modifies the count of waves in certain phases to reflect modern market behaviors.

- Integration of Fibonacci Ratios: Harmonic patterns rely heavily on Fibonacci ratios to predict the end points of waves more accurately.

Applying Harmonic Elliott Wave in Trading

Practical Application for Traders Understanding how to apply these modifications can significantly enhance a trader’s ability to predict market turns and trends.

Case Studies and Examples We will review real-world applications of the Harmonic Elliott Wave method to illustrate its effectiveness in live market conditions.

Benefits of Harmonic Elliott Wave

Enhanced Accuracy and Reliability Traders who use the Harmonic Elliott Wave method often report improved accuracy in their predictive models, leading to better trading outcomes.

Challenges and Considerations

Learning Curve Adopting Copsey’s modifications requires an understanding of both basic and advanced concepts in wave theory, which may be challenging for newcomers.

The Future of Wave Analysis

Evolving with the Markets As financial markets continue to evolve, so too must the analytical tools we use, a philosophy that Ian Copsey champions with his modifications.

Conclusion

Ian Copsey’s Harmonic Elliott Wave represents a significant evolution in the application of Elliott Wave Theory. By adapting the classic model to better fit modern market conditions, Copsey has enhanced the toolset available to technical analysts and traders worldwide.

FAQs

1. What is the Elliott Wave Theory?

The Elliott Wave Theory is a form of technical analysis that predicts future price movements by identifying crowd psychology that manifests in waves.

2. How does the Harmonic Elliott Wave differ from the traditional model?

The Harmonic Elliott Wave incorporates modifications to the wave structures and integrates Fibonacci ratios to improve prediction accuracy.

3. Who can benefit from using the Harmonic Elliott Wave?

Both novice and experienced traders can benefit from the Harmonic Elliott Wave, especially those looking for a deeper understanding of market dynamics.

4. What are Fibonacci ratios?

Fibonacci ratios are mathematical relationships derived from the Fibonacci sequence, widely used in technical analysis to predict areas of support and resistance.

5. How can one learn the Harmonic Elliott Wave method?

Learning the Harmonic Elliott Wave method typically involves studying technical analysis literature, attending workshops, and practicing under experienced traders.

Be the first to review “Harmonic Elliott Wave: The Case for Modification of R. N. Elliott’s Impulsive Wave Structure with Ian Copsey” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.