-

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Diary of an Internet Trader with Alpesh Patel

1 × $6.00

Diary of an Internet Trader with Alpesh Patel

1 × $6.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

Fractal Markets FX (SMC)

1 × $5.00

Fractal Markets FX (SMC)

1 × $5.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00 -

×

Handbook on the Knowledge Economy with David Rooney

1 × $6.00

Handbook on the Knowledge Economy with David Rooney

1 × $6.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

STERLING SUHR’S ADVANCED FOREX BANK TRADING COURSE (DAYTRADING FOREX LIVE COURSE) 2017

1 × $15.00

STERLING SUHR’S ADVANCED FOREX BANK TRADING COURSE (DAYTRADING FOREX LIVE COURSE) 2017

1 × $15.00 -

×

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00 -

×

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Candlestick Secrets For Profiting In Options

1 × $23.00

Candlestick Secrets For Profiting In Options

1 × $23.00 -

×

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Trading Academy 2024 with Tradeciety

1 × $5.00

Trading Academy 2024 with Tradeciety

1 × $5.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

The Master Indicator 2023 with Lance Ippolito

1 × $101.00

The Master Indicator 2023 with Lance Ippolito

1 × $101.00 -

×

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00 -

×

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

Cheatcode Trend System with Dominique Woodson

1 × $15.00

Cheatcode Trend System with Dominique Woodson

1 × $15.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The 13-Week Cash Flow Model

1 × $15.00

The 13-Week Cash Flow Model

1 × $15.00 -

×

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

Swing Trading College IX 2010 with Larry Connors

1 × $15.00

Swing Trading College IX 2010 with Larry Connors

1 × $15.00 -

×

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

My Forex League - The Course

1 × $5.00

My Forex League - The Course

1 × $5.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 102623Nf8Hx6S

Category: Forex Trading

You may check content proof of “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” below:

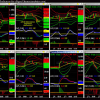

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

In the dynamic world of trading, having the right tools can make all the difference. Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, offer traders advanced analytical capabilities to enhance their trading strategies. This article explores the features, benefits, and practical applications of these indicators, helping you understand how to leverage them for optimal trading performance.

Introduction

What Are Hamzei Analytics Indicators?

Hamzei Analytics Indicators are a suite of technical analysis tools designed to help traders identify market trends, volatility, and potential trading opportunities. These indicators are tailored for use with the eSignal trading platform, providing comprehensive market insights.

Why Choose Hamzei Analytics Indicators?

- Advanced Analysis: Provides deep market insights.

- User-Friendly: Easy integration with the eSignal platform.

- Proven Performance: Trusted by professional traders for their reliability and accuracy.

Key Features of Hamzei Analytics Indicators

Volatility Analysis

Volatility Bands

- Market Sentiment: Measures market volatility and sentiment.

- Trend Confirmation: Confirms trends through volatility patterns.

ATR (Average True Range)

- Volatility Measurement: Tracks market volatility over a specific period.

- Risk Management: Helps set stop-loss levels based on volatility.

Trend Analysis

Directional Movement Index (DMI)

- Trend Strength: Measures the strength of a market trend.

- Directional Indicators: Uses +DI and -DI to indicate trend direction.

Moving Averages

- Trend Identification: Identifies trends using different types of moving averages (simple, exponential).

- Crossover Signals: Generates buy and sell signals based on moving average crossovers.

Momentum Analysis

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Identifies potential reversal points.

- Momentum Strength: Measures the speed and change of price movements.

MACD (Moving Average Convergence Divergence)

- Trend and Momentum: Combines trend and momentum analysis.

- Signal Line Crossovers: Provides buy and sell signals based on MACD line crossovers.

Setting Up Hamzei Analytics Indicators on eSignal

Installation Process

- Download: Obtain the indicators from hamzeianalytics.com.

- Install: Follow the installation instructions to add the indicators to your eSignal platform.

- Configure: Customize the settings according to your trading preferences.

Configuration Options

- Indicator Settings: Adjust parameters such as periods, thresholds, and colors.

- Workspace Layout: Arrange your workspace to display the indicators effectively.

Using Hamzei Analytics Indicators for Trading

Identifying Trends

Trend Confirmation

- DMI and Moving Averages: Use these indicators to confirm the direction and strength of a trend.

- Volatility Bands: Confirm trends through volatility patterns.

Trend Reversals

- RSI and MACD: Monitor for signals indicating potential trend reversals.

- Support and Resistance Levels: Use volatility bands to identify key levels.

Executing Trades

Entry Points

- Moving Average Crossovers: Enter trades based on moving average crossover signals.

- RSI Signals: Use RSI to identify overbought or oversold conditions for entry points.

Exit Points

- ATR for Stop-Loss: Set stop-loss levels based on ATR to manage risk.

- MACD Crossovers: Use MACD line crossovers to identify exit points.

Advantages of Using Hamzei Analytics Indicators

Enhanced Market Analysis

- Comprehensive Insights: Gain a deeper understanding of market trends and volatility.

- Accurate Predictions: Make informed decisions based on reliable data.

Improved Trading Performance

- Consistency: Achieve more consistent trading results.

- Risk Management: Implement effective risk management strategies with volatility analysis.

User-Friendly Interface

- Ease of Use: Intuitive interface makes it easy to interpret indicators.

- Customization: Tailor the indicators to suit your specific trading style.

Practical Applications

Day Trading

- Real-Time Analysis: Utilize real-time data for quick decision-making.

- Volume Patterns: Focus on volume patterns to identify short-term trading opportunities.

Swing Trading

- Trend Following: Use trend analysis tools to identify medium-term trends.

- Support and Resistance: Rely on volatility bands to find optimal entry and exit points.

Long-Term Investing

- Market Trends: Monitor long-term trends with DMI and moving averages.

- Volatility Analysis: Use ATR to assess long-term market volatility.

Common Challenges and Solutions

Data Overload

- Challenge: Managing and interpreting large volumes of data.

- Solution: Focus on the most relevant indicators and customize settings to filter out noise.

Market Volatility

- Challenge: High volatility can lead to false signals.

- Solution: Use multiple indicators to confirm signals and avoid false positives.

Technical Issues

- Challenge: Software glitches can disrupt trading.

- Solution: Ensure regular updates and maintain your eSignal platform.

Case Study: Successful Implementation

Background

- Setup: A trader integrates Hamzei Analytics Indicators into their eSignal platform.

- Execution: Uses volatility, trend, and momentum analysis to guide trading decisions.

Outcome

- Profitability: Achieves consistent profits through accurate trend identification.

- Confidence: Gains confidence in trading decisions by relying on reliable indicators.

Tips for Maximizing the Use of Hamzei Analytics Indicators

Regular Monitoring

- Performance Review: Regularly review the performance of your indicators.

- Market Updates: Stay updated with market conditions and adjust settings accordingly.

Continuous Learning

- Expand Knowledge: Keep learning about new features and trading strategies.

- Practice: Use a demo account to practice and refine your skills.

Conclusion

Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, provide a robust suite of tools for traders seeking to enhance their market analysis and trading performance. By leveraging these indicators, traders can gain deeper insights, improve decision-making, and achieve consistent results. Embrace the power of Hamzei Analytics Indicators to elevate your trading strategy and navigate the markets with confidence.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.