-

×

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Crypto and Blockchain with MasterClass

1 × $6.00

Crypto and Blockchain with MasterClass

1 × $6.00 -

×

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

European Members - March 2023 with Stockbee

1 × $5.00

European Members - March 2023 with Stockbee

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Breakout Trading Systems with Chris Tate

1 × $6.00

Breakout Trading Systems with Chris Tate

1 × $6.00 -

×

AstroFibonacci 7.3722 magisociety

1 × $6.00

AstroFibonacci 7.3722 magisociety

1 × $6.00 -

×

Option Profits Success System

1 × $54.00

Option Profits Success System

1 × $54.00 -

×

Risk Free Projections Course

1 × $85.00

Risk Free Projections Course

1 × $85.00 -

×

Ichimoku 101 Cloud Trading Secrets

1 × $24.00

Ichimoku 101 Cloud Trading Secrets

1 × $24.00 -

×

Market Wizards with Jack Schwager

1 × $6.00

Market Wizards with Jack Schwager

1 × $6.00 -

×

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

FXJake Webinars with Walter Peters

1 × $6.00

FXJake Webinars with Walter Peters

1 × $6.00 -

×

Dhia’s Journal 2022

1 × $6.00

Dhia’s Journal 2022

1 × $6.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

Portfolio Management in Practice with Christine Brentani

1 × $6.00

Portfolio Management in Practice with Christine Brentani

1 × $6.00 -

×

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00 -

×

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00 -

×

LT Pulse and LT Trend/Ultra

1 × $23.00

LT Pulse and LT Trend/Ultra

1 × $23.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

Making a 2021 Trading Plan and Trading it for 3 Weeks with Sheridan Options Mentoring

1 × $39.00

Making a 2021 Trading Plan and Trading it for 3 Weeks with Sheridan Options Mentoring

1 × $39.00 -

×

Charting Made Easy with John J.Murphy

1 × $6.00

Charting Made Easy with John J.Murphy

1 × $6.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Private Seminar with Alan Andrew

1 × $6.00

Private Seminar with Alan Andrew

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

Flipping Markets Video Course (2022)

1 × $5.00

Flipping Markets Video Course (2022)

1 × $5.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

The Candlestick Training Series with Timon Weller

1 × $6.00

The Candlestick Training Series with Timon Weller

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

The Inner Circle Seminar

1 × $15.00

The Inner Circle Seminar

1 × $15.00 -

×

Money Management Strategies for Futures Traders with Nauzer Balsara

1 × $6.00

Money Management Strategies for Futures Traders with Nauzer Balsara

1 × $6.00 -

×

Simple Cyclical Analysis with Stan Erlich

1 × $6.00

Simple Cyclical Analysis with Stan Erlich

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Big Volatility Short - The Best Trade On Wall Street

1 × $15.00

The Big Volatility Short - The Best Trade On Wall Street

1 × $15.00 -

×

Currency Trading for Dummies with Mark Galant

1 × $6.00

Currency Trading for Dummies with Mark Galant

1 × $6.00 -

×

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00 -

×

Range Trading with D.Singleton

1 × $6.00

Range Trading with D.Singleton

1 × $6.00 -

×

Vertex Investing Course

1 × $6.00

Vertex Investing Course

1 × $6.00 -

×

Bear Market Investing Strategies with Harry Schultz

1 × $6.00

Bear Market Investing Strategies with Harry Schultz

1 × $6.00 -

×

Common Sense Commodities with David Duty

1 × $6.00

Common Sense Commodities with David Duty

1 × $6.00 -

×

Spread Trading Webinar

1 × $6.00

Spread Trading Webinar

1 × $6.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

The Pattern Trader with Mark Shawzin

1 × $6.00

The Pattern Trader with Mark Shawzin

1 × $6.00 -

×

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

ProfileTraders - 5 course bundle

1 × $23.00

ProfileTraders - 5 course bundle

1 × $23.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Market Maker’s Edge with Josh Lukeman

1 × $6.00

The Market Maker’s Edge with Josh Lukeman

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00 -

×

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00 -

×

Backtrade Marathon NEW with Real Life Trading

1 × $23.00

Backtrade Marathon NEW with Real Life Trading

1 × $23.00 -

×

The Zurich Axioms with Max Gunther

1 × $6.00

The Zurich Axioms with Max Gunther

1 × $6.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

Seller Specialist Program with Chris Prefontaine

1 × $62.00

Seller Specialist Program with Chris Prefontaine

1 × $62.00 -

×

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00 -

×

Emini Volume Break Out System

1 × $6.00

Emini Volume Break Out System

1 × $6.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00 -

×

I3T3 Complete Course with All Modules

1 × $10.00

I3T3 Complete Course with All Modules

1 × $10.00 -

×

Trade Like Warren Buffett with James Altucher

1 × $6.00

Trade Like Warren Buffett with James Altucher

1 × $6.00 -

×

JeaFx 2023 with James Allen

1 × $5.00

JeaFx 2023 with James Allen

1 × $5.00 -

×

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 102623Nf8Hx6S

Category: Forex Trading

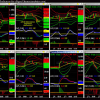

You may check content proof of “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” below:

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

In the dynamic world of trading, having the right tools can make all the difference. Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, offer traders advanced analytical capabilities to enhance their trading strategies. This article explores the features, benefits, and practical applications of these indicators, helping you understand how to leverage them for optimal trading performance.

Introduction

What Are Hamzei Analytics Indicators?

Hamzei Analytics Indicators are a suite of technical analysis tools designed to help traders identify market trends, volatility, and potential trading opportunities. These indicators are tailored for use with the eSignal trading platform, providing comprehensive market insights.

Why Choose Hamzei Analytics Indicators?

- Advanced Analysis: Provides deep market insights.

- User-Friendly: Easy integration with the eSignal platform.

- Proven Performance: Trusted by professional traders for their reliability and accuracy.

Key Features of Hamzei Analytics Indicators

Volatility Analysis

Volatility Bands

- Market Sentiment: Measures market volatility and sentiment.

- Trend Confirmation: Confirms trends through volatility patterns.

ATR (Average True Range)

- Volatility Measurement: Tracks market volatility over a specific period.

- Risk Management: Helps set stop-loss levels based on volatility.

Trend Analysis

Directional Movement Index (DMI)

- Trend Strength: Measures the strength of a market trend.

- Directional Indicators: Uses +DI and -DI to indicate trend direction.

Moving Averages

- Trend Identification: Identifies trends using different types of moving averages (simple, exponential).

- Crossover Signals: Generates buy and sell signals based on moving average crossovers.

Momentum Analysis

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Identifies potential reversal points.

- Momentum Strength: Measures the speed and change of price movements.

MACD (Moving Average Convergence Divergence)

- Trend and Momentum: Combines trend and momentum analysis.

- Signal Line Crossovers: Provides buy and sell signals based on MACD line crossovers.

Setting Up Hamzei Analytics Indicators on eSignal

Installation Process

- Download: Obtain the indicators from hamzeianalytics.com.

- Install: Follow the installation instructions to add the indicators to your eSignal platform.

- Configure: Customize the settings according to your trading preferences.

Configuration Options

- Indicator Settings: Adjust parameters such as periods, thresholds, and colors.

- Workspace Layout: Arrange your workspace to display the indicators effectively.

Using Hamzei Analytics Indicators for Trading

Identifying Trends

Trend Confirmation

- DMI and Moving Averages: Use these indicators to confirm the direction and strength of a trend.

- Volatility Bands: Confirm trends through volatility patterns.

Trend Reversals

- RSI and MACD: Monitor for signals indicating potential trend reversals.

- Support and Resistance Levels: Use volatility bands to identify key levels.

Executing Trades

Entry Points

- Moving Average Crossovers: Enter trades based on moving average crossover signals.

- RSI Signals: Use RSI to identify overbought or oversold conditions for entry points.

Exit Points

- ATR for Stop-Loss: Set stop-loss levels based on ATR to manage risk.

- MACD Crossovers: Use MACD line crossovers to identify exit points.

Advantages of Using Hamzei Analytics Indicators

Enhanced Market Analysis

- Comprehensive Insights: Gain a deeper understanding of market trends and volatility.

- Accurate Predictions: Make informed decisions based on reliable data.

Improved Trading Performance

- Consistency: Achieve more consistent trading results.

- Risk Management: Implement effective risk management strategies with volatility analysis.

User-Friendly Interface

- Ease of Use: Intuitive interface makes it easy to interpret indicators.

- Customization: Tailor the indicators to suit your specific trading style.

Practical Applications

Day Trading

- Real-Time Analysis: Utilize real-time data for quick decision-making.

- Volume Patterns: Focus on volume patterns to identify short-term trading opportunities.

Swing Trading

- Trend Following: Use trend analysis tools to identify medium-term trends.

- Support and Resistance: Rely on volatility bands to find optimal entry and exit points.

Long-Term Investing

- Market Trends: Monitor long-term trends with DMI and moving averages.

- Volatility Analysis: Use ATR to assess long-term market volatility.

Common Challenges and Solutions

Data Overload

- Challenge: Managing and interpreting large volumes of data.

- Solution: Focus on the most relevant indicators and customize settings to filter out noise.

Market Volatility

- Challenge: High volatility can lead to false signals.

- Solution: Use multiple indicators to confirm signals and avoid false positives.

Technical Issues

- Challenge: Software glitches can disrupt trading.

- Solution: Ensure regular updates and maintain your eSignal platform.

Case Study: Successful Implementation

Background

- Setup: A trader integrates Hamzei Analytics Indicators into their eSignal platform.

- Execution: Uses volatility, trend, and momentum analysis to guide trading decisions.

Outcome

- Profitability: Achieves consistent profits through accurate trend identification.

- Confidence: Gains confidence in trading decisions by relying on reliable indicators.

Tips for Maximizing the Use of Hamzei Analytics Indicators

Regular Monitoring

- Performance Review: Regularly review the performance of your indicators.

- Market Updates: Stay updated with market conditions and adjust settings accordingly.

Continuous Learning

- Expand Knowledge: Keep learning about new features and trading strategies.

- Practice: Use a demo account to practice and refine your skills.

Conclusion

Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, provide a robust suite of tools for traders seeking to enhance their market analysis and trading performance. By leveraging these indicators, traders can gain deeper insights, improve decision-making, and achieve consistent results. Embrace the power of Hamzei Analytics Indicators to elevate your trading strategy and navigate the markets with confidence.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.