-

×

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00 -

×

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00 -

×

Toni’s Market Club with Toni Turner

1 × $6.00

Toni’s Market Club with Toni Turner

1 × $6.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Investments (6th Ed.)

1 × $6.00

Investments (6th Ed.)

1 × $6.00 -

×

Rule Based Price Action with Trader Divergent

1 × $5.00

Rule Based Price Action with Trader Divergent

1 × $5.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

Sacredscience - Paul Councel – X Marks My Place

1 × $6.00

Sacredscience - Paul Councel – X Marks My Place

1 × $6.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00 -

×

FXJake Webinars with Walter Peters

1 × $6.00

FXJake Webinars with Walter Peters

1 × $6.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

Spotting Solid Short-Term Opportunities

1 × $6.00

Spotting Solid Short-Term Opportunities

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00 -

×

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

Advance Courses for Members

1 × $15.00

Advance Courses for Members

1 × $15.00 -

×

The Student Guide to Minitab Release 14 with John McKenzie, Robert Goldman

1 × $6.00

The Student Guide to Minitab Release 14 with John McKenzie, Robert Goldman

1 × $6.00 -

×

The Trading Room Video Course

1 × $23.00

The Trading Room Video Course

1 × $23.00 -

×

Linear Regression 3030 with David Elliott

1 × $6.00

Linear Regression 3030 with David Elliott

1 × $6.00 -

×

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00 -

×

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

Mind of a Trader with Alpesh Patel

1 × $6.00

Mind of a Trader with Alpesh Patel

1 × $6.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

Super Structure Trading Home Study Course

1 × $23.00

Super Structure Trading Home Study Course

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Securities Industry Essentials (SIE) with Brian Lee

1 × $6.00

Securities Industry Essentials (SIE) with Brian Lee

1 × $6.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

Scalp Trading Mini Course with Jayson Casper

1 × $23.00

Scalp Trading Mini Course with Jayson Casper

1 × $23.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

Daytraders Survival Guide with Christopher Farrell

1 × $6.00

Daytraders Survival Guide with Christopher Farrell

1 × $6.00 -

×

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00 -

×

Profitable DayTrading with Precision - George Angell

1 × $6.00

Profitable DayTrading with Precision - George Angell

1 × $6.00 -

×

OrderFlows Trader Package, (Sep 2015)

1 × $54.00

OrderFlows Trader Package, (Sep 2015)

1 × $54.00 -

×

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00 -

×

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00 -

×

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Gann Course (Video & Audio 1.1 GB)

1 × $6.00

Gann Course (Video & Audio 1.1 GB)

1 × $6.00 -

×

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00 -

×

The Way to Trade with John Piper

1 × $6.00

The Way to Trade with John Piper

1 × $6.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00 -

×

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00 -

×

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00 -

×

Price Action Room - The Scalper’s Boot Camp

1 × $15.00

Price Action Room - The Scalper’s Boot Camp

1 × $15.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

Currency Trading Seminar with Peter Bain

1 × $6.00

Currency Trading Seminar with Peter Bain

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

MATS Market Auction Trading System with Ryan Watts

1 × $6.00

MATS Market Auction Trading System with Ryan Watts

1 × $6.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

Day Trading For A Living

1 × $31.00

Day Trading For A Living

1 × $31.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 102623Nf8Hx6S

Category: Forex Trading

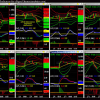

You may check content proof of “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” below:

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

In the dynamic world of trading, having the right tools can make all the difference. Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, offer traders advanced analytical capabilities to enhance their trading strategies. This article explores the features, benefits, and practical applications of these indicators, helping you understand how to leverage them for optimal trading performance.

Introduction

What Are Hamzei Analytics Indicators?

Hamzei Analytics Indicators are a suite of technical analysis tools designed to help traders identify market trends, volatility, and potential trading opportunities. These indicators are tailored for use with the eSignal trading platform, providing comprehensive market insights.

Why Choose Hamzei Analytics Indicators?

- Advanced Analysis: Provides deep market insights.

- User-Friendly: Easy integration with the eSignal platform.

- Proven Performance: Trusted by professional traders for their reliability and accuracy.

Key Features of Hamzei Analytics Indicators

Volatility Analysis

Volatility Bands

- Market Sentiment: Measures market volatility and sentiment.

- Trend Confirmation: Confirms trends through volatility patterns.

ATR (Average True Range)

- Volatility Measurement: Tracks market volatility over a specific period.

- Risk Management: Helps set stop-loss levels based on volatility.

Trend Analysis

Directional Movement Index (DMI)

- Trend Strength: Measures the strength of a market trend.

- Directional Indicators: Uses +DI and -DI to indicate trend direction.

Moving Averages

- Trend Identification: Identifies trends using different types of moving averages (simple, exponential).

- Crossover Signals: Generates buy and sell signals based on moving average crossovers.

Momentum Analysis

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Identifies potential reversal points.

- Momentum Strength: Measures the speed and change of price movements.

MACD (Moving Average Convergence Divergence)

- Trend and Momentum: Combines trend and momentum analysis.

- Signal Line Crossovers: Provides buy and sell signals based on MACD line crossovers.

Setting Up Hamzei Analytics Indicators on eSignal

Installation Process

- Download: Obtain the indicators from hamzeianalytics.com.

- Install: Follow the installation instructions to add the indicators to your eSignal platform.

- Configure: Customize the settings according to your trading preferences.

Configuration Options

- Indicator Settings: Adjust parameters such as periods, thresholds, and colors.

- Workspace Layout: Arrange your workspace to display the indicators effectively.

Using Hamzei Analytics Indicators for Trading

Identifying Trends

Trend Confirmation

- DMI and Moving Averages: Use these indicators to confirm the direction and strength of a trend.

- Volatility Bands: Confirm trends through volatility patterns.

Trend Reversals

- RSI and MACD: Monitor for signals indicating potential trend reversals.

- Support and Resistance Levels: Use volatility bands to identify key levels.

Executing Trades

Entry Points

- Moving Average Crossovers: Enter trades based on moving average crossover signals.

- RSI Signals: Use RSI to identify overbought or oversold conditions for entry points.

Exit Points

- ATR for Stop-Loss: Set stop-loss levels based on ATR to manage risk.

- MACD Crossovers: Use MACD line crossovers to identify exit points.

Advantages of Using Hamzei Analytics Indicators

Enhanced Market Analysis

- Comprehensive Insights: Gain a deeper understanding of market trends and volatility.

- Accurate Predictions: Make informed decisions based on reliable data.

Improved Trading Performance

- Consistency: Achieve more consistent trading results.

- Risk Management: Implement effective risk management strategies with volatility analysis.

User-Friendly Interface

- Ease of Use: Intuitive interface makes it easy to interpret indicators.

- Customization: Tailor the indicators to suit your specific trading style.

Practical Applications

Day Trading

- Real-Time Analysis: Utilize real-time data for quick decision-making.

- Volume Patterns: Focus on volume patterns to identify short-term trading opportunities.

Swing Trading

- Trend Following: Use trend analysis tools to identify medium-term trends.

- Support and Resistance: Rely on volatility bands to find optimal entry and exit points.

Long-Term Investing

- Market Trends: Monitor long-term trends with DMI and moving averages.

- Volatility Analysis: Use ATR to assess long-term market volatility.

Common Challenges and Solutions

Data Overload

- Challenge: Managing and interpreting large volumes of data.

- Solution: Focus on the most relevant indicators and customize settings to filter out noise.

Market Volatility

- Challenge: High volatility can lead to false signals.

- Solution: Use multiple indicators to confirm signals and avoid false positives.

Technical Issues

- Challenge: Software glitches can disrupt trading.

- Solution: Ensure regular updates and maintain your eSignal platform.

Case Study: Successful Implementation

Background

- Setup: A trader integrates Hamzei Analytics Indicators into their eSignal platform.

- Execution: Uses volatility, trend, and momentum analysis to guide trading decisions.

Outcome

- Profitability: Achieves consistent profits through accurate trend identification.

- Confidence: Gains confidence in trading decisions by relying on reliable indicators.

Tips for Maximizing the Use of Hamzei Analytics Indicators

Regular Monitoring

- Performance Review: Regularly review the performance of your indicators.

- Market Updates: Stay updated with market conditions and adjust settings accordingly.

Continuous Learning

- Expand Knowledge: Keep learning about new features and trading strategies.

- Practice: Use a demo account to practice and refine your skills.

Conclusion

Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, provide a robust suite of tools for traders seeking to enhance their market analysis and trading performance. By leveraging these indicators, traders can gain deeper insights, improve decision-making, and achieve consistent results. Embrace the power of Hamzei Analytics Indicators to elevate your trading strategy and navigate the markets with confidence.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.