-

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Forex Master Method Evolution with Russ Horn

1 × $6.00

Forex Master Method Evolution with Russ Horn

1 × $6.00 -

×

Profitable DayTrading with Precision - George Angell

1 × $6.00

Profitable DayTrading with Precision - George Angell

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00 -

×

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Prometheus Course with QuantProgram

1 × $13.00

Prometheus Course with QuantProgram

1 × $13.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Smart Money Course with Forex XL

1 × $6.00

Smart Money Course with Forex XL

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Stock Trading Wizard

1 × $6.00

Stock Trading Wizard

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

Team Bull Trading Academy

1 × $5.00

Team Bull Trading Academy

1 × $5.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Securities Industry Essentials (SIE) with Brian Lee

1 × $6.00

Securities Industry Essentials (SIE) with Brian Lee

1 × $6.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

Pattern Cycles with Alan Farley

1 × $6.00

Pattern Cycles with Alan Farley

1 × $6.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Euro Trading Course with Bkforex

1 × $6.00

Euro Trading Course with Bkforex

1 × $6.00 -

×

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00 -

×

Inside the House of Money (2006) with Steven Drobny

1 × $6.00

Inside the House of Money (2006) with Steven Drobny

1 × $6.00 -

×

Advanced Trader with Nikos Trading Academy

1 × $5.00

Advanced Trader with Nikos Trading Academy

1 × $5.00 -

×

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00 -

×

Precise Planetary Timing for Stock Trading

1 × $6.00

Precise Planetary Timing for Stock Trading

1 × $6.00 -

×

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

FX Pips Predator

1 × $54.00

FX Pips Predator

1 × $54.00 -

×

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

How the Stock Market Works with Ramon DeGennaro

1 × $5.00

How the Stock Market Works with Ramon DeGennaro

1 × $5.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

Dan Sheridan 2011 Calendar Workshop

1 × $6.00

Dan Sheridan 2011 Calendar Workshop

1 × $6.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

European Members - March 2023 with Stockbee

1 × $5.00

European Members - March 2023 with Stockbee

1 × $5.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

Super Structure Trading Home Study Course

1 × $23.00

Super Structure Trading Home Study Course

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 102623Nf8Hx6S

Category: Forex Trading

You may check content proof of “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” below:

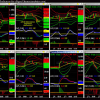

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

In the dynamic world of trading, having the right tools can make all the difference. Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, offer traders advanced analytical capabilities to enhance their trading strategies. This article explores the features, benefits, and practical applications of these indicators, helping you understand how to leverage them for optimal trading performance.

Introduction

What Are Hamzei Analytics Indicators?

Hamzei Analytics Indicators are a suite of technical analysis tools designed to help traders identify market trends, volatility, and potential trading opportunities. These indicators are tailored for use with the eSignal trading platform, providing comprehensive market insights.

Why Choose Hamzei Analytics Indicators?

- Advanced Analysis: Provides deep market insights.

- User-Friendly: Easy integration with the eSignal platform.

- Proven Performance: Trusted by professional traders for their reliability and accuracy.

Key Features of Hamzei Analytics Indicators

Volatility Analysis

Volatility Bands

- Market Sentiment: Measures market volatility and sentiment.

- Trend Confirmation: Confirms trends through volatility patterns.

ATR (Average True Range)

- Volatility Measurement: Tracks market volatility over a specific period.

- Risk Management: Helps set stop-loss levels based on volatility.

Trend Analysis

Directional Movement Index (DMI)

- Trend Strength: Measures the strength of a market trend.

- Directional Indicators: Uses +DI and -DI to indicate trend direction.

Moving Averages

- Trend Identification: Identifies trends using different types of moving averages (simple, exponential).

- Crossover Signals: Generates buy and sell signals based on moving average crossovers.

Momentum Analysis

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Identifies potential reversal points.

- Momentum Strength: Measures the speed and change of price movements.

MACD (Moving Average Convergence Divergence)

- Trend and Momentum: Combines trend and momentum analysis.

- Signal Line Crossovers: Provides buy and sell signals based on MACD line crossovers.

Setting Up Hamzei Analytics Indicators on eSignal

Installation Process

- Download: Obtain the indicators from hamzeianalytics.com.

- Install: Follow the installation instructions to add the indicators to your eSignal platform.

- Configure: Customize the settings according to your trading preferences.

Configuration Options

- Indicator Settings: Adjust parameters such as periods, thresholds, and colors.

- Workspace Layout: Arrange your workspace to display the indicators effectively.

Using Hamzei Analytics Indicators for Trading

Identifying Trends

Trend Confirmation

- DMI and Moving Averages: Use these indicators to confirm the direction and strength of a trend.

- Volatility Bands: Confirm trends through volatility patterns.

Trend Reversals

- RSI and MACD: Monitor for signals indicating potential trend reversals.

- Support and Resistance Levels: Use volatility bands to identify key levels.

Executing Trades

Entry Points

- Moving Average Crossovers: Enter trades based on moving average crossover signals.

- RSI Signals: Use RSI to identify overbought or oversold conditions for entry points.

Exit Points

- ATR for Stop-Loss: Set stop-loss levels based on ATR to manage risk.

- MACD Crossovers: Use MACD line crossovers to identify exit points.

Advantages of Using Hamzei Analytics Indicators

Enhanced Market Analysis

- Comprehensive Insights: Gain a deeper understanding of market trends and volatility.

- Accurate Predictions: Make informed decisions based on reliable data.

Improved Trading Performance

- Consistency: Achieve more consistent trading results.

- Risk Management: Implement effective risk management strategies with volatility analysis.

User-Friendly Interface

- Ease of Use: Intuitive interface makes it easy to interpret indicators.

- Customization: Tailor the indicators to suit your specific trading style.

Practical Applications

Day Trading

- Real-Time Analysis: Utilize real-time data for quick decision-making.

- Volume Patterns: Focus on volume patterns to identify short-term trading opportunities.

Swing Trading

- Trend Following: Use trend analysis tools to identify medium-term trends.

- Support and Resistance: Rely on volatility bands to find optimal entry and exit points.

Long-Term Investing

- Market Trends: Monitor long-term trends with DMI and moving averages.

- Volatility Analysis: Use ATR to assess long-term market volatility.

Common Challenges and Solutions

Data Overload

- Challenge: Managing and interpreting large volumes of data.

- Solution: Focus on the most relevant indicators and customize settings to filter out noise.

Market Volatility

- Challenge: High volatility can lead to false signals.

- Solution: Use multiple indicators to confirm signals and avoid false positives.

Technical Issues

- Challenge: Software glitches can disrupt trading.

- Solution: Ensure regular updates and maintain your eSignal platform.

Case Study: Successful Implementation

Background

- Setup: A trader integrates Hamzei Analytics Indicators into their eSignal platform.

- Execution: Uses volatility, trend, and momentum analysis to guide trading decisions.

Outcome

- Profitability: Achieves consistent profits through accurate trend identification.

- Confidence: Gains confidence in trading decisions by relying on reliable indicators.

Tips for Maximizing the Use of Hamzei Analytics Indicators

Regular Monitoring

- Performance Review: Regularly review the performance of your indicators.

- Market Updates: Stay updated with market conditions and adjust settings accordingly.

Continuous Learning

- Expand Knowledge: Keep learning about new features and trading strategies.

- Practice: Use a demo account to practice and refine your skills.

Conclusion

Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, provide a robust suite of tools for traders seeking to enhance their market analysis and trading performance. By leveraging these indicators, traders can gain deeper insights, improve decision-making, and achieve consistent results. Embrace the power of Hamzei Analytics Indicators to elevate your trading strategy and navigate the markets with confidence.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.