-

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Forex Secrets Exposed

1 × $15.00

Forex Secrets Exposed

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

Smart Money Concepts with JordyBanks

1 × $6.00

Smart Money Concepts with JordyBanks

1 × $6.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal. Market Timing with Larry Connors

1 × $6.00 -

×

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00 -

×

Candlesticks Trading Course

1 × $31.00

Candlesticks Trading Course

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

How the Stock Market Works with Ramon DeGennaro

1 × $5.00

How the Stock Market Works with Ramon DeGennaro

1 × $5.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00 -

×

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

Quantitative Business Valuation with Jay Abrams

1 × $6.00

Quantitative Business Valuation with Jay Abrams

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

Get to know the VIX Index (aka The Fear Index)

1 × $15.00

Get to know the VIX Index (aka The Fear Index)

1 × $15.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Handbook on the Knowledge Economy with David Rooney

1 × $6.00

Handbook on the Knowledge Economy with David Rooney

1 × $6.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00 -

×

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Master The Markets 2.0 with French Trader

1 × $6.00

Master The Markets 2.0 with French Trader

1 × $6.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 102623Nf8Hx6S

Category: Forex Trading

You may check content proof of “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” below:

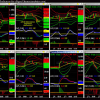

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

In the dynamic world of trading, having the right tools can make all the difference. Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, offer traders advanced analytical capabilities to enhance their trading strategies. This article explores the features, benefits, and practical applications of these indicators, helping you understand how to leverage them for optimal trading performance.

Introduction

What Are Hamzei Analytics Indicators?

Hamzei Analytics Indicators are a suite of technical analysis tools designed to help traders identify market trends, volatility, and potential trading opportunities. These indicators are tailored for use with the eSignal trading platform, providing comprehensive market insights.

Why Choose Hamzei Analytics Indicators?

- Advanced Analysis: Provides deep market insights.

- User-Friendly: Easy integration with the eSignal platform.

- Proven Performance: Trusted by professional traders for their reliability and accuracy.

Key Features of Hamzei Analytics Indicators

Volatility Analysis

Volatility Bands

- Market Sentiment: Measures market volatility and sentiment.

- Trend Confirmation: Confirms trends through volatility patterns.

ATR (Average True Range)

- Volatility Measurement: Tracks market volatility over a specific period.

- Risk Management: Helps set stop-loss levels based on volatility.

Trend Analysis

Directional Movement Index (DMI)

- Trend Strength: Measures the strength of a market trend.

- Directional Indicators: Uses +DI and -DI to indicate trend direction.

Moving Averages

- Trend Identification: Identifies trends using different types of moving averages (simple, exponential).

- Crossover Signals: Generates buy and sell signals based on moving average crossovers.

Momentum Analysis

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Identifies potential reversal points.

- Momentum Strength: Measures the speed and change of price movements.

MACD (Moving Average Convergence Divergence)

- Trend and Momentum: Combines trend and momentum analysis.

- Signal Line Crossovers: Provides buy and sell signals based on MACD line crossovers.

Setting Up Hamzei Analytics Indicators on eSignal

Installation Process

- Download: Obtain the indicators from hamzeianalytics.com.

- Install: Follow the installation instructions to add the indicators to your eSignal platform.

- Configure: Customize the settings according to your trading preferences.

Configuration Options

- Indicator Settings: Adjust parameters such as periods, thresholds, and colors.

- Workspace Layout: Arrange your workspace to display the indicators effectively.

Using Hamzei Analytics Indicators for Trading

Identifying Trends

Trend Confirmation

- DMI and Moving Averages: Use these indicators to confirm the direction and strength of a trend.

- Volatility Bands: Confirm trends through volatility patterns.

Trend Reversals

- RSI and MACD: Monitor for signals indicating potential trend reversals.

- Support and Resistance Levels: Use volatility bands to identify key levels.

Executing Trades

Entry Points

- Moving Average Crossovers: Enter trades based on moving average crossover signals.

- RSI Signals: Use RSI to identify overbought or oversold conditions for entry points.

Exit Points

- ATR for Stop-Loss: Set stop-loss levels based on ATR to manage risk.

- MACD Crossovers: Use MACD line crossovers to identify exit points.

Advantages of Using Hamzei Analytics Indicators

Enhanced Market Analysis

- Comprehensive Insights: Gain a deeper understanding of market trends and volatility.

- Accurate Predictions: Make informed decisions based on reliable data.

Improved Trading Performance

- Consistency: Achieve more consistent trading results.

- Risk Management: Implement effective risk management strategies with volatility analysis.

User-Friendly Interface

- Ease of Use: Intuitive interface makes it easy to interpret indicators.

- Customization: Tailor the indicators to suit your specific trading style.

Practical Applications

Day Trading

- Real-Time Analysis: Utilize real-time data for quick decision-making.

- Volume Patterns: Focus on volume patterns to identify short-term trading opportunities.

Swing Trading

- Trend Following: Use trend analysis tools to identify medium-term trends.

- Support and Resistance: Rely on volatility bands to find optimal entry and exit points.

Long-Term Investing

- Market Trends: Monitor long-term trends with DMI and moving averages.

- Volatility Analysis: Use ATR to assess long-term market volatility.

Common Challenges and Solutions

Data Overload

- Challenge: Managing and interpreting large volumes of data.

- Solution: Focus on the most relevant indicators and customize settings to filter out noise.

Market Volatility

- Challenge: High volatility can lead to false signals.

- Solution: Use multiple indicators to confirm signals and avoid false positives.

Technical Issues

- Challenge: Software glitches can disrupt trading.

- Solution: Ensure regular updates and maintain your eSignal platform.

Case Study: Successful Implementation

Background

- Setup: A trader integrates Hamzei Analytics Indicators into their eSignal platform.

- Execution: Uses volatility, trend, and momentum analysis to guide trading decisions.

Outcome

- Profitability: Achieves consistent profits through accurate trend identification.

- Confidence: Gains confidence in trading decisions by relying on reliable indicators.

Tips for Maximizing the Use of Hamzei Analytics Indicators

Regular Monitoring

- Performance Review: Regularly review the performance of your indicators.

- Market Updates: Stay updated with market conditions and adjust settings accordingly.

Continuous Learning

- Expand Knowledge: Keep learning about new features and trading strategies.

- Practice: Use a demo account to practice and refine your skills.

Conclusion

Hamzei Analytics Indicators for eSignal, available on hamzeianalytics.com, provide a robust suite of tools for traders seeking to enhance their market analysis and trading performance. By leveraging these indicators, traders can gain deeper insights, improve decision-making, and achieve consistent results. Embrace the power of Hamzei Analytics Indicators to elevate your trading strategy and navigate the markets with confidence.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.