-

×

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00 -

×

Getting Rich in America with Dwight Lee

1 × $6.00

Getting Rich in America with Dwight Lee

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Time Trap System with Alex Krzhechevsky

1 × $6.00

Time Trap System with Alex Krzhechevsky

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

PiScaled

1 × $6.00

PiScaled

1 × $6.00 -

×

The Wizard Training Course with Mitch King

1 × $6.00

The Wizard Training Course with Mitch King

1 × $6.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00 -

×

AnkhFX Academy Course

1 × $17.00

AnkhFX Academy Course

1 × $17.00 -

×

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Grand Slam Options

1 × $23.00

Grand Slam Options

1 × $23.00 -

×

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00 -

×

Futures & Options 101 with Talkin Options

1 × $8.00

Futures & Options 101 with Talkin Options

1 × $8.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Wave Trading

1 × $23.00

Wave Trading

1 × $23.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

Complete Set of Members Area Files

1 × $6.00

Complete Set of Members Area Files

1 × $6.00 -

×

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Futures Masterclass with Market Flow Trader

1 × $17.00

Futures Masterclass with Market Flow Trader

1 × $17.00 -

×

Top 20 VSA Principles & How to Trade Them

1 × $31.00

Top 20 VSA Principles & How to Trade Them

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

Futures Broker Home Study Course CTA Series 3 (Fourteenth Ed.) with Center for Futures Education

1 × $6.00

Futures Broker Home Study Course CTA Series 3 (Fourteenth Ed.) with Center for Futures Education

1 × $6.00 -

×

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00 -

×

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

Charles Cottle Package ( Discount 50% )

1 × $23.00

Charles Cottle Package ( Discount 50% )

1 × $23.00 -

×

Trading Rules that Work

1 × $6.00

Trading Rules that Work

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Options Trading Accelerator with Base Camp Trading

1 × $23.00

Options Trading Accelerator with Base Camp Trading

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00 -

×

Footprint Day Trading Blueprint with Futures Flow

1 × $5.00

Footprint Day Trading Blueprint with Futures Flow

1 × $5.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00 -

×

David Landry On Swing Trading

1 × $6.00

David Landry On Swing Trading

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

Security Analysis (The Classic 1934 Ed.) with Benjamin Graham

1 × $6.00

Security Analysis (The Classic 1934 Ed.) with Benjamin Graham

1 × $6.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

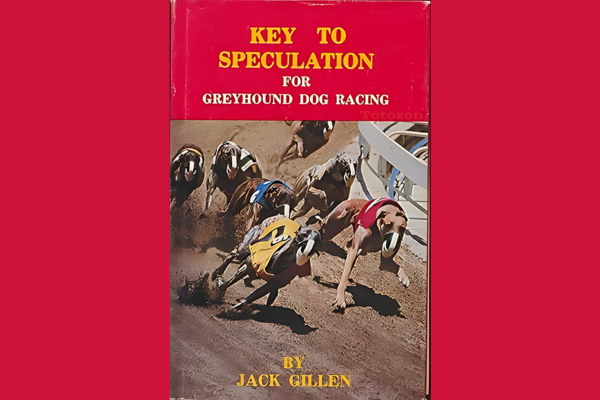

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00 -

×

The Science of Trading with Mark Boucher

1 × $6.00

The Science of Trading with Mark Boucher

1 × $6.00 -

×

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00 -

×

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty” below:

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

Trading strategies come and go, but few stand the test of time and market conditions like the Haggerty Slim Jim Strategy. Developed by the seasoned trader Kevin Haggerty, this strategy promises explosive gains for those who master its intricacies. In this article, we dive deep into the Slim Jim Strategy, providing a comprehensive guide to trading it successfully.

Understanding the Haggerty Slim Jim Strategy

The Slim Jim Strategy is a short-term trading technique designed to capitalize on narrow price ranges before a breakout. It focuses on identifying periods of low volatility, which precede significant price movements.

Why the Slim Jim Strategy?

- Low-Risk Entry Points: Identifying periods of low volatility offers low-risk entry points.

- High Reward Potential: Breakouts from narrow ranges often lead to substantial price movements.

- Simplicity: The strategy is straightforward, making it accessible even to novice traders.

Kevin Haggerty’s Approach to Trading

Kevin Haggerty, a former head of trading for Fidelity Capital Markets, emphasizes the importance of discipline and patience in trading. His Slim Jim Strategy is a testament to his trading philosophy.

Discipline and Patience

Haggerty believes that waiting for the right setup is crucial. Traders must resist the urge to jump into trades impulsively.

Technical Analysis

Technical analysis forms the backbone of the Slim Jim Strategy. Haggerty advises traders to use technical indicators and chart patterns to identify potential Slim Jim setups.

Identifying Slim Jim Setups

Key Characteristics of Slim Jim Setups

- Narrow Price Range: The stock trades within a tight range for an extended period.

- Low Volume: Trading volume decreases during the consolidation phase.

- Support and Resistance Levels: Clear support and resistance levels are visible on the chart.

Tools for Identifying Setups

- Candlestick Charts: Use candlestick charts to visualize price movements.

- Moving Averages: Employ moving averages to identify trends and potential breakout points.

- Volume Indicators: Analyze volume patterns to confirm the validity of a Slim Jim setup.

Trading the Slim Jim Strategy

Entry Points

- Breakout Confirmation: Enter the trade when the price breaks out of the narrow range.

- Volume Spike: Ensure there is a significant increase in volume during the breakout.

Exit Points

- Target Prices: Set target prices based on historical price movements and resistance levels.

- Trailing Stops: Use trailing stops to lock in profits as the price moves in your favor.

Risk Management

- Stop-Loss Orders: Place stop-loss orders just below the support level to limit potential losses.

- Position Sizing: Adjust your position size based on your risk tolerance and account size.

Common Mistakes to Avoid

Impulsive Trading

Avoid entering trades without proper confirmation. Wait for clear breakouts and volume spikes.

Overlooking Volume

Volume is a critical component of the Slim Jim Strategy. Ensure that there is a substantial increase in volume during the breakout.

Ignoring Risk Management

Never neglect risk management. Always use stop-loss orders and adjust your position size accordingly.

Case Studies of Slim Jim Success

Example 1: Tech Stocks

In the tech sector, several stocks have shown Slim Jim patterns before significant rallies. By identifying these setups, traders have capitalized on explosive gains.

Example 2: Energy Sector

Energy stocks often experience periods of low volatility before major moves. The Slim Jim Strategy has proven effective in this sector as well.

Tips for Mastering the Slim Jim Strategy

Stay Informed

Keep abreast of market news and events that could impact stock prices.

Practice Makes Perfect

Utilize paper trading to practice identifying and trading Slim Jim setups without risking real money.

Continuous Learning

Stay updated on new developments in technical analysis and trading strategies. Continuous learning is key to long-term success.

Conclusion

The Haggerty Slim Jim Strategy offers a powerful approach to trading for explosive gains. By understanding its principles and applying them with discipline and patience, traders can significantly enhance their trading performance. Kevin Haggerty’s insights and methodologies provide a solid foundation for mastering this strategy.

FAQs

1. What is the Slim Jim Strategy?

The Slim Jim Strategy is a short-term trading technique that capitalizes on narrow price ranges before a breakout.

2. How do I identify a Slim Jim setup?

Look for narrow price ranges, low trading volume, and clear support and resistance levels.

3. What tools do I need to trade the Slim Jim Strategy?

Use candlestick charts, moving averages, and volume indicators to identify and confirm Slim Jim setups.

4. What are the key entry and exit points for the Slim Jim Strategy?

Enter on a confirmed breakout with increased volume, and exit using target prices and trailing stops.

5. How can I manage risk when trading the Slim Jim Strategy?

Use stop-loss orders and position sizing to manage risk effectively.

Be the first to review “How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.