-

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00 -

×

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00 -

×

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Rocking Wall Street with Gary Marks

1 × $6.00

Rocking Wall Street with Gary Marks

1 × $6.00 -

×

The TLM Playbook 2022 with Trade Like Mike

1 × $39.00

The TLM Playbook 2022 with Trade Like Mike

1 × $39.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00 -

×

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

How To Write High Converting Copy with Tej Dosa

1 × $6.00

How To Write High Converting Copy with Tej Dosa

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00 -

×

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

Pablo Order Flow Education with Pablo

1 × $6.00

Pablo Order Flow Education with Pablo

1 × $6.00 -

×

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

Rockwell Day Trading - Starter Package

1 × $6.00

Rockwell Day Trading - Starter Package

1 × $6.00 -

×

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Weekly Options Boot Camp with Price Headley

1 × $15.00

Weekly Options Boot Camp with Price Headley

1 × $15.00 -

×

Fierce 10 with Mandi Rafsendjani

1 × $5.00

Fierce 10 with Mandi Rafsendjani

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

Day Trading Institution 2.0 with Raul Gonzalez

1 × $5.00

Day Trading Institution 2.0 with Raul Gonzalez

1 × $5.00 -

×

Core Concepts Mastery with DreamsFX

1 × $5.00

Core Concepts Mastery with DreamsFX

1 × $5.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

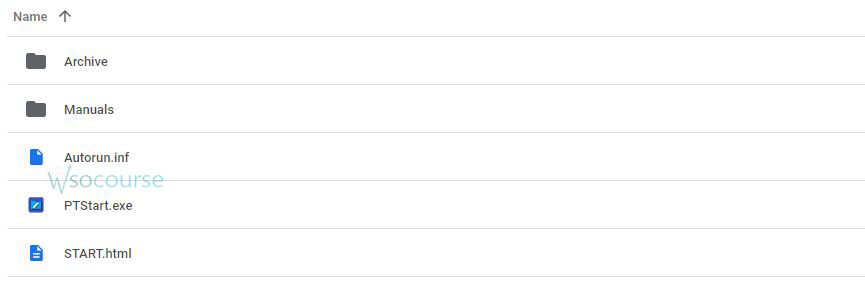

Content Proof: Watch Here!

You may check content proof of “Better Trading with the Guppy Multiple Moving Average by Daryl Guppy” below:

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

Introduction

When it comes to trading, finding the right strategy can make all the difference. One method that has gained significant attention is the Guppy Multiple Moving Average (GMMA), developed by the renowned trader Daryl Guppy. This article dives into how you can enhance your trading with the GMMA, providing a comprehensive guide to understanding and utilizing this powerful tool.

What is the Guppy Multiple Moving Average?

The Guppy Multiple Moving Average is a trading indicator that utilizes multiple moving averages to analyze market trends and make informed trading decisions. It combines short-term and long-term moving averages to provide a clear picture of market behavior.

The Concept Behind GMMA

Daryl Guppy developed GMMA to identify the strength and direction of a trend. By observing the interaction between two groups of moving averages, traders can determine the best times to enter or exit a trade.

Components of GMMA

Short-term Moving Averages

The short-term group consists of six moving averages with periods of 3, 5, 8, 10, 12, and 15. These averages respond quickly to market changes, representing the behavior of traders.

Long-term Moving Averages

The long-term group includes six moving averages with periods of 30, 35, 40, 45, 50, and 60. These averages respond slower and reflect the views of investors.

How to Set Up GMMA

Step 1: Choose a Trading Platform

Ensure your trading platform supports multiple moving averages. Popular platforms like MetaTrader 4 and TradingView are great options.

Step 2: Apply the Moving Averages

Add the twelve moving averages to your chart, categorizing them into short-term and long-term groups.

Step 3: Customize Your Chart

Adjust the colors and styles of the moving averages to easily distinguish between the short-term and long-term groups.

Interpreting GMMA

Trend Identification

- Uptrend: Short-term averages are above long-term averages and both sets are diverging upwards.

- Downtrend: Short-term averages are below long-term averages and both sets are diverging downwards.

Trend Reversals

- Bullish Reversal: Short-term averages cross above the long-term averages.

- Bearish Reversal: Short-term averages cross below the long-term averages.

Consolidation Periods

When the short-term and long-term averages converge, it indicates a consolidation period, suggesting the market is preparing for a breakout.

Trading Strategies with GMMA

Breakout Strategy

- Identify Consolidation: Look for periods where moving averages are converging.

- Enter Trade: Once the short-term averages break away from the long-term averages, enter a trade in the direction of the breakout.

Trend Following Strategy

- Confirm Trend: Ensure the short-term averages are consistently above or below the long-term averages.

- Stay in the Trade: Ride the trend as long as the moving averages remain aligned.

Advantages of Using GMMA

Clarity in Trend Identification

GMMA provides a clear visual representation of market trends, making it easier for traders to make informed decisions.

Versatility

Suitable for various trading styles, including day trading, swing trading, and long-term investing.

Risk Management

By identifying strong trends and potential reversals, GMMA helps traders manage risks effectively.

Common Mistakes to Avoid

Ignoring Long-term Averages

Relying solely on short-term averages can lead to premature entries and exits. Always consider the long-term averages.

Overtrading

Avoid jumping in and out of trades based on minor fluctuations. Wait for clear signals from GMMA.

Real-world Examples

Successful Trades

- Example 1: In an uptrend, a trader enters a trade when short-term averages cross above long-term averages, leading to substantial profits.

- Example 2: During a consolidation period, a trader waits for a breakout before entering a trade, minimizing risks.

Failed Trades

- Example 1: A trader enters a trade based on short-term averages without considering long-term trends, resulting in losses.

- Example 2: Overtrading during minor fluctuations leads to multiple small losses.

Conclusion

The Guppy Multiple Moving Average is a powerful tool that can significantly enhance your trading strategy. By understanding and correctly implementing GMMA, traders can identify trends, make informed decisions, and ultimately achieve better trading results.

FAQs

1. What makes GMMA different from other moving averages?

GMMA uses multiple short-term and long-term moving averages, providing a clearer picture of market trends.

2. Can GMMA be used for all types of trading?

Yes, GMMA is versatile and can be applied to day trading, swing trading, and long-term investing.

3. How do I avoid common mistakes when using GMMA?

Always consider both short-term and long-term averages and avoid overtrading based on minor fluctuations.

4. What platforms support GMMA?

Popular trading platforms like MetaTrader 4 and TradingView support GMMA.

5. Is GMMA suitable for beginners?

Yes, GMMA is user-friendly and provides clear visual signals, making it suitable for traders of all levels.

Be the first to review “Better Trading with the Guppy Multiple Moving Average by Daryl Guppy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.