-

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The PPS Trading System with Curtis Arnold

1 × $6.00

The PPS Trading System with Curtis Arnold

1 × $6.00 -

×

Naked Trading Mastery

1 × $39.00

Naked Trading Mastery

1 × $39.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

Practical Introduction to Bollinger Bands 2013

1 × $6.00

Practical Introduction to Bollinger Bands 2013

1 × $6.00 -

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00 -

×

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

The Futures Edge with Joshua Martinez

1 × $155.00

The Futures Edge with Joshua Martinez

1 × $155.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

Power Charting - Robert’s Indicator Webinar

1 × $6.00

Power Charting - Robert’s Indicator Webinar

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

NetPicks - Universal Market Trader Course

1 × $6.00

NetPicks - Universal Market Trader Course

1 × $6.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

Forex Secrets Exposed

1 × $15.00

Forex Secrets Exposed

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Live Online Masterclass with XSPY Trader

1 × $5.00

Live Online Masterclass with XSPY Trader

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00 -

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

Team Bull Trading Academy

1 × $5.00

Team Bull Trading Academy

1 × $5.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

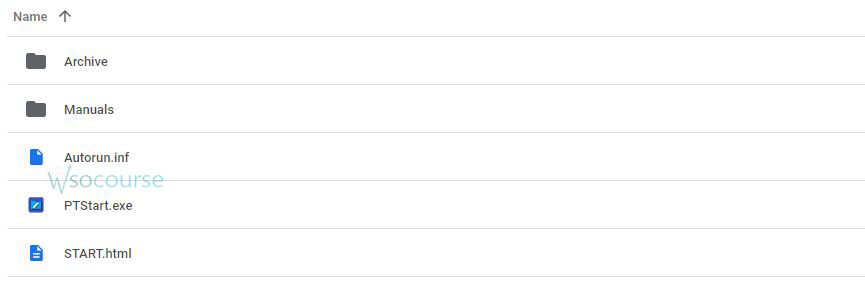

You may check content proof of “Better Trading with the Guppy Multiple Moving Average by Daryl Guppy” below:

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

Introduction

When it comes to trading, finding the right strategy can make all the difference. One method that has gained significant attention is the Guppy Multiple Moving Average (GMMA), developed by the renowned trader Daryl Guppy. This article dives into how you can enhance your trading with the GMMA, providing a comprehensive guide to understanding and utilizing this powerful tool.

What is the Guppy Multiple Moving Average?

The Guppy Multiple Moving Average is a trading indicator that utilizes multiple moving averages to analyze market trends and make informed trading decisions. It combines short-term and long-term moving averages to provide a clear picture of market behavior.

The Concept Behind GMMA

Daryl Guppy developed GMMA to identify the strength and direction of a trend. By observing the interaction between two groups of moving averages, traders can determine the best times to enter or exit a trade.

Components of GMMA

Short-term Moving Averages

The short-term group consists of six moving averages with periods of 3, 5, 8, 10, 12, and 15. These averages respond quickly to market changes, representing the behavior of traders.

Long-term Moving Averages

The long-term group includes six moving averages with periods of 30, 35, 40, 45, 50, and 60. These averages respond slower and reflect the views of investors.

How to Set Up GMMA

Step 1: Choose a Trading Platform

Ensure your trading platform supports multiple moving averages. Popular platforms like MetaTrader 4 and TradingView are great options.

Step 2: Apply the Moving Averages

Add the twelve moving averages to your chart, categorizing them into short-term and long-term groups.

Step 3: Customize Your Chart

Adjust the colors and styles of the moving averages to easily distinguish between the short-term and long-term groups.

Interpreting GMMA

Trend Identification

- Uptrend: Short-term averages are above long-term averages and both sets are diverging upwards.

- Downtrend: Short-term averages are below long-term averages and both sets are diverging downwards.

Trend Reversals

- Bullish Reversal: Short-term averages cross above the long-term averages.

- Bearish Reversal: Short-term averages cross below the long-term averages.

Consolidation Periods

When the short-term and long-term averages converge, it indicates a consolidation period, suggesting the market is preparing for a breakout.

Trading Strategies with GMMA

Breakout Strategy

- Identify Consolidation: Look for periods where moving averages are converging.

- Enter Trade: Once the short-term averages break away from the long-term averages, enter a trade in the direction of the breakout.

Trend Following Strategy

- Confirm Trend: Ensure the short-term averages are consistently above or below the long-term averages.

- Stay in the Trade: Ride the trend as long as the moving averages remain aligned.

Advantages of Using GMMA

Clarity in Trend Identification

GMMA provides a clear visual representation of market trends, making it easier for traders to make informed decisions.

Versatility

Suitable for various trading styles, including day trading, swing trading, and long-term investing.

Risk Management

By identifying strong trends and potential reversals, GMMA helps traders manage risks effectively.

Common Mistakes to Avoid

Ignoring Long-term Averages

Relying solely on short-term averages can lead to premature entries and exits. Always consider the long-term averages.

Overtrading

Avoid jumping in and out of trades based on minor fluctuations. Wait for clear signals from GMMA.

Real-world Examples

Successful Trades

- Example 1: In an uptrend, a trader enters a trade when short-term averages cross above long-term averages, leading to substantial profits.

- Example 2: During a consolidation period, a trader waits for a breakout before entering a trade, minimizing risks.

Failed Trades

- Example 1: A trader enters a trade based on short-term averages without considering long-term trends, resulting in losses.

- Example 2: Overtrading during minor fluctuations leads to multiple small losses.

Conclusion

The Guppy Multiple Moving Average is a powerful tool that can significantly enhance your trading strategy. By understanding and correctly implementing GMMA, traders can identify trends, make informed decisions, and ultimately achieve better trading results.

FAQs

1. What makes GMMA different from other moving averages?

GMMA uses multiple short-term and long-term moving averages, providing a clearer picture of market trends.

2. Can GMMA be used for all types of trading?

Yes, GMMA is versatile and can be applied to day trading, swing trading, and long-term investing.

3. How do I avoid common mistakes when using GMMA?

Always consider both short-term and long-term averages and avoid overtrading based on minor fluctuations.

4. What platforms support GMMA?

Popular trading platforms like MetaTrader 4 and TradingView support GMMA.

5. Is GMMA suitable for beginners?

Yes, GMMA is user-friendly and provides clear visual signals, making it suitable for traders of all levels.

Be the first to review “Better Trading with the Guppy Multiple Moving Average by Daryl Guppy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.