-

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Trading Trainer - 6 Percent Protocol

1 × $39.00

Trading Trainer - 6 Percent Protocol

1 × $39.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00 -

×

FX GOAT 3.0 (STRATEGIES) with FX GOAT FOREX TRADING ACADEMY

1 × $15.00

FX GOAT 3.0 (STRATEGIES) with FX GOAT FOREX TRADING ACADEMY

1 × $15.00 -

×

Trading Analysis Crash Course

1 × $23.00

Trading Analysis Crash Course

1 × $23.00 -

×

OFA Ninja Full Software Suite v7.9.1.5

1 × $54.00

OFA Ninja Full Software Suite v7.9.1.5

1 × $54.00 -

×

eASCTrend Traning CD. Hybrid Trading Method with Ablesys

1 × $6.00

eASCTrend Traning CD. Hybrid Trading Method with Ablesys

1 × $6.00 -

×

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00 -

×

Pro Tradeciety FOREX TRADING ACADEMY

1 × $31.00

Pro Tradeciety FOREX TRADING ACADEMY

1 × $31.00 -

×

My Favorite Trades – Trading Mastery

1 × $6.00

My Favorite Trades – Trading Mastery

1 × $6.00 -

×

Marus FX 2023

1 × $5.00

Marus FX 2023

1 × $5.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00 -

×

The Market Matrix

1 × $6.00

The Market Matrix

1 × $6.00 -

×

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00 -

×

Code 1 with Oil Trading Academy

1 × $31.00

Code 1 with Oil Trading Academy

1 × $31.00 -

×

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00 -

×

The Internet Trading Course with Alpesh Patel

1 × $6.00

The Internet Trading Course with Alpesh Patel

1 × $6.00 -

×

The Complete 12 Week Transformation Course

1 × $31.00

The Complete 12 Week Transformation Course

1 × $31.00 -

×

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00 -

×

Forex Master Method Evolution with Russ Horn

1 × $6.00

Forex Master Method Evolution with Russ Horn

1 × $6.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00 -

×

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00 -

×

Wyckoff simplified from Michael Z

1 × $6.00

Wyckoff simplified from Michael Z

1 × $6.00 -

×

RSI Unleashed Class: Building a Comprehensive Trading Framework

1 × $54.00

RSI Unleashed Class: Building a Comprehensive Trading Framework

1 × $54.00 -

×

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00 -

×

Stock Patterns for Day Trading Home Study Course

1 × $23.00

Stock Patterns for Day Trading Home Study Course

1 × $23.00 -

×

Advanced Stock Trading Course + Strategies

1 × $15.00

Advanced Stock Trading Course + Strategies

1 × $15.00 -

×

Core Strategy Program with Ota Courses

1 × $174.00

Core Strategy Program with Ota Courses

1 × $174.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

Module I - Foundation with FX MindShift

1 × $6.00

Module I - Foundation with FX MindShift

1 × $6.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

The New Trading For a Living with Alexander Elder

1 × $23.00

The New Trading For a Living with Alexander Elder

1 × $23.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

Computational Financial Mathematics with Mathematica

1 × $6.00

Computational Financial Mathematics with Mathematica

1 × $6.00 -

×

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Sami Abusaad Elite Mentorship

1 × $31.00

Sami Abusaad Elite Mentorship

1 × $31.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

Behavior and Performance of Investment Newsletter Analysts (Article) with Alok Kumar

1 × $6.00

Behavior and Performance of Investment Newsletter Analysts (Article) with Alok Kumar

1 × $6.00 -

×

Beginner Boot Camp with Optionpit

1 × $62.00

Beginner Boot Camp with Optionpit

1 × $62.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

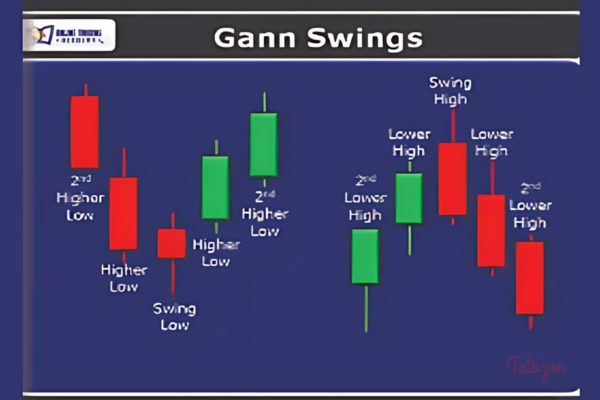

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

The Student Guide to Minitab Release 14 with John McKenzie, Robert Goldman

1 × $6.00

The Student Guide to Minitab Release 14 with John McKenzie, Robert Goldman

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00 -

×

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Trading Forex Exchange with Clifford Bennett

1 × $6.00

Trading Forex Exchange with Clifford Bennett

1 × $6.00 -

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

Investors Underground - Tandem Trader

1 × $5.00

Investors Underground - Tandem Trader

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Elev8 Trading Complete Course

1 × $10.00

Elev8 Trading Complete Course

1 × $10.00 -

×

Beginner Options Trading Class with Bill Johnson

1 × $6.00

Beginner Options Trading Class with Bill Johnson

1 × $6.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

BearProof Investing with Kenneth Little

1 × $6.00

BearProof Investing with Kenneth Little

1 × $6.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

The Best of the Professional Traders Journal: Options Trading and Volatility Trading with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal: Options Trading and Volatility Trading with Larry Connors

1 × $6.00 -

×

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00 -

×

Base Camp Trading – Bundle 5 Courses

1 × $5.00

Base Camp Trading – Bundle 5 Courses

1 × $5.00 -

×

Forex 800k Workshop with Spartan Trader

1 × $23.00

Forex 800k Workshop with Spartan Trader

1 × $23.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

Introduction to Macro Investing with Mike Singleton

1 × $31.00

Introduction to Macro Investing with Mike Singleton

1 × $31.00 -

×

The 3 Dimensional Trading Breakthrough with Brian Schad

1 × $6.00

The 3 Dimensional Trading Breakthrough with Brian Schad

1 × $6.00 -

×

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00 -

×

Daryl Guppy Tutorials In Technical Analysis (2000-2001-2003-2004)

1 × $6.00

Daryl Guppy Tutorials In Technical Analysis (2000-2001-2003-2004)

1 × $6.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

The Future of Investing with Chris Skinner

1 × $6.00

The Future of Investing with Chris Skinner

1 × $6.00 -

×

Hidden Cash Flow Fortunes

1 × $54.00

Hidden Cash Flow Fortunes

1 × $54.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

How You Can Identify Turning Points Using Fibonacci

1 × $6.00

How You Can Identify Turning Points Using Fibonacci

1 × $6.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Random Walk Trading Options Professional

1 × $31.00

Random Walk Trading Options Professional

1 × $31.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00 -

×

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00 -

×

Precise Planetary Timing for Stock Trading

1 × $6.00

Precise Planetary Timing for Stock Trading

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00 -

×

Candlesticks Re-Ignited Workshop

1 × $23.00

Candlesticks Re-Ignited Workshop

1 × $23.00 -

×

Weekly Options Windfall and Bonus with James Preston

1 × $54.00

Weekly Options Windfall and Bonus with James Preston

1 × $54.00 -

×

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00 -

×

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00 -

×

Manage By The Greeks 2016 with Sheridan

1 × $6.00

Manage By The Greeks 2016 with Sheridan

1 × $6.00 -

×

Quality FX Academy

1 × $5.00

Quality FX Academy

1 × $5.00 -

×

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00 -

×

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00 -

×

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TIMfundamentals with Timothy Sykes

1 × $5.00

TIMfundamentals with Timothy Sykes

1 × $5.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

Super CD Companion for Metastock with Martin Pring

1 × $6.00

Super CD Companion for Metastock with Martin Pring

1 × $6.00 -

×

The GBP USD Trading System with A.Heuscher

1 × $6.00

The GBP USD Trading System with A.Heuscher

1 × $6.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

One Shot One Kill Trading with John Netto

1 × $6.00

One Shot One Kill Trading with John Netto

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Creating & Using a Trading Plan with Paul Lange

1 × $8.00

Creating & Using a Trading Plan with Paul Lange

1 × $8.00 -

×

To Hell & Back with Ken Stern

1 × $6.00

To Hell & Back with Ken Stern

1 × $6.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

Stock Market Investing Mastery with Jeremy

1 × $39.00

Stock Market Investing Mastery with Jeremy

1 × $39.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

The Ten Most Powerful Option Trading Secrets with Bernie Schaeffer

1 × $6.00

The Ten Most Powerful Option Trading Secrets with Bernie Schaeffer

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Inve$tment A$trology Articles with Alan Richter

1 × $6.00

The Inve$tment A$trology Articles with Alan Richter

1 × $6.00 -

×

MambaFX - Bundle - Trading/Scalping

1 × $23.00

MambaFX - Bundle - Trading/Scalping

1 × $23.00 -

×

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00 -

×

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Grand Slam Options

$497.00 Original price was: $497.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Grand Slam Options: Maximize Your Trading Profits

Introduction

Are you ready to elevate your trading game and hit a financial home run? Grand Slam Options is a dynamic trading strategy designed to maximize profits while minimizing risks. This comprehensive guide will walk you through the essential components of Grand Slam Options, offering insights and strategies to help you achieve consistent success in the options market.

What are Grand Slam Options?

Definition and Overview

Grand Slam Options is a robust trading strategy that combines multiple options techniques to create a high-probability, high-reward trading plan. This approach leverages the strengths of various options strategies to generate significant returns.

Why Choose Grand Slam Options?

The Grand Slam Options strategy is ideal for traders seeking substantial gains while effectively managing risk. By diversifying your options plays, you can take advantage of various market conditions and maximize your profit potential.

Core Components of Grand Slam Options

1. Covered Calls

Definition and Purpose

A covered call involves holding a long position in an underlying asset while selling a call option on the same asset. This strategy generates income through the premium received from selling the call.

When to Use Covered Calls

Covered calls are best used in a neutral to mildly bullish market where you expect minimal upward movement in the underlying asset.

2. Protective Puts

Definition and Purpose

A protective put involves buying a put option for an asset you already own. This strategy acts as an insurance policy, protecting against significant downside risk.

When to Use Protective Puts

Protective puts are ideal during periods of market uncertainty or when you anticipate potential declines in the asset’s value.

3. Iron Condors

Definition and Purpose

An iron condor involves selling a lower strike put, buying an even lower strike put, selling a higher strike call, and buying an even higher strike call. This strategy profits from low volatility and a stable market.

When to Use Iron Condors

Iron condors are best employed in a low-volatility market where you expect minimal price movement.

4. Straddles and Strangles

Definition and Purpose

Straddles involve buying a call and a put at the same strike price, while strangles involve buying a call and a put at different strike prices. Both strategies profit from significant price movements in either direction.

When to Use Straddles and Strangles

These strategies are ideal for high-volatility markets where you expect substantial price changes.

Implementing Grand Slam Options

Step-by-Step Guide

Step 1: Market Analysis

Conduct thorough market analysis to understand current trends and volatility. Use technical and fundamental analysis to identify potential opportunities.

Step 2: Strategy Selection

Choose the appropriate options strategies based on your market analysis. Consider factors such as market direction, volatility, and your risk tolerance.

Step 3: Position Sizing

Determine the size of your positions to manage risk effectively. Use position sizing techniques to ensure that no single trade can significantly impact your portfolio.

Step 4: Entry and Exit Points

Set clear entry and exit points for each trade. Use stop-loss orders and profit targets to manage your trades and lock in gains.

Step 5: Monitoring and Adjustment

Regularly monitor your positions and adjust your strategies as needed. Be prepared to modify your trades based on changing market conditions.

Benefits of Grand Slam Options

High Profit Potential

By combining multiple options strategies, Grand Slam Options offers the potential for substantial profits in various market conditions.

Risk Management

This approach emphasizes risk management through diversified strategies and position sizing, helping to protect your capital.

Flexibility

Grand Slam Options provides flexibility to adapt to different market environments, allowing you to capitalize on a wide range of opportunities.

Case Studies and Examples

Case Study 1: Bullish Market

In a bullish market, using covered calls and protective puts helped achieve steady gains while mitigating risks from market fluctuations.

Case Study 2: Low Volatility Market

During periods of low volatility, iron condors provided consistent income through the premium received from selling options.

Case Study 3: High Volatility Market

Straddles and strangles were effective in high-volatility markets, capturing significant price movements and generating substantial returns.

Common Mistakes to Avoid

Overtrading

Avoid the temptation to overtrade by being selective with your trades. Focus on quality over quantity to enhance your success rate.

Ignoring Market Conditions

Always consider the broader market context. Ignoring market conditions can lead to poor strategy selection and increased risk.

Poor Risk Management

Implement proper risk management techniques, such as position sizing and stop-loss orders, to protect your capital.

Tools and Resources

Trading Platforms

Choose a reliable trading platform that offers advanced options trading tools and real-time data. Popular platforms include Thinkorswim, Interactive Brokers, and TradeStation.

Analytical Tools

Utilize analytical tools to enhance your trading decisions. These tools can include options analysis software, charting tools, and market data feeds.

Educational Resources

Access educational resources, such as webinars, courses, and trading forums, to continuously improve your trading skills and knowledge.

Developing a Trading Plan

Setting Goals

Set clear, achievable goals for your trading journey. Whether it’s a daily profit target or long-term financial independence, having goals will keep you focused.

Backtesting Strategies

Before deploying a strategy in the live market, backtest it using historical data. This helps you understand its potential performance and refine your approach.

Continuous Improvement

Trading requires continuous learning and adaptation. Stay updated with market trends and refine your strategies regularly.

Conclusion

Grand Slam Options is a powerful trading strategy that combines multiple options techniques to maximize profits and manage risks effectively. By leveraging the strengths of various strategies, you can navigate different market conditions and achieve consistent success. Start your journey towards trading mastery today and unlock the full potential of Grand Slam Options.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Grand Slam Options” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.