-

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

AnkhFX Academy Course

1 × $17.00

AnkhFX Academy Course

1 × $17.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

The Internet Trading Course with Alpesh Patel

1 × $6.00

The Internet Trading Course with Alpesh Patel

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00 -

×

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

Volatility Trading with Fractal Flow Pro

1 × $15.00

Volatility Trading with Fractal Flow Pro

1 × $15.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

Trend Trading My Way with Markay Latimer

1 × $15.00

Trend Trading My Way with Markay Latimer

1 × $15.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

Weekly Options Windfall and Bonus with James Preston

1 × $54.00

Weekly Options Windfall and Bonus with James Preston

1 × $54.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

Dynamic Gann Levels with Don Fisher

1 × $6.00

Dynamic Gann Levels with Don Fisher

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Master Class with Gerald Appel

1 × $6.00

Master Class with Gerald Appel

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00 -

×

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00 -

×

The Correlation Code with Jason Fielder

1 × $6.00

The Correlation Code with Jason Fielder

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Advanced Group Analysis Turorial with David Vomund

1 × $6.00

Advanced Group Analysis Turorial with David Vomund

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

EFT – The Art of Delivery with Gary Craig

1 × $5.00

EFT – The Art of Delivery with Gary Craig

1 × $5.00 -

×

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

The Janus Factor with Gary Anderson

1 × $6.00

The Janus Factor with Gary Anderson

1 × $6.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

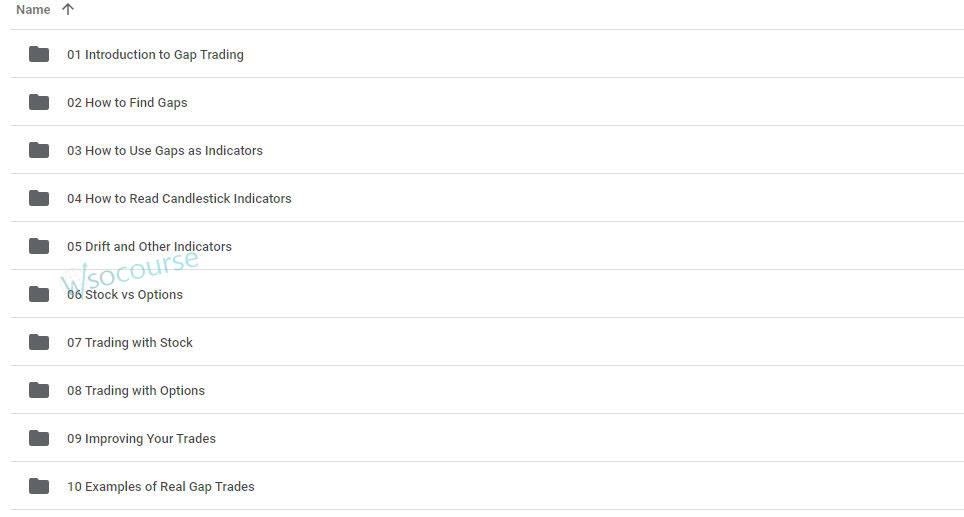

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.