-

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

Quarterly Theory with Trader Daye

1 × $20.00

Quarterly Theory with Trader Daye

1 × $20.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Market Matrix

1 × $6.00

The Market Matrix

1 × $6.00 -

×

All About High-Frequency Trading with Michael Durbin

1 × $6.00

All About High-Frequency Trading with Michael Durbin

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00 -

×

The Day Traders Fast Track Program

1 × $23.00

The Day Traders Fast Track Program

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

TradeWithChris - TWC Forex Trading Course

1 × $6.00

TradeWithChris - TWC Forex Trading Course

1 × $6.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Beat the Market with Edward O.Thorp

1 × $6.00

Beat the Market with Edward O.Thorp

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Candlestick Secrets For Profiting In Options

1 × $23.00

Candlestick Secrets For Profiting In Options

1 × $23.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

Larry Connors Professional Day Trading for Success Program

1 × $62.00

Larry Connors Professional Day Trading for Success Program

1 × $62.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

Option, Futures and Other Derivates 9th Edition

1 × $6.00

Option, Futures and Other Derivates 9th Edition

1 × $6.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

Advanced Pattern Recognition with John Cameron

1 × $23.00

Advanced Pattern Recognition with John Cameron

1 × $23.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

Profit.ly - Bitcoin Basics

1 × $6.00

Profit.ly - Bitcoin Basics

1 × $6.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

The 10%ers with Trader Mike

1 × $5.00

The 10%ers with Trader Mike

1 × $5.00 -

×

Practical Introduction to Bollinger Bands 2013

1 × $6.00

Practical Introduction to Bollinger Bands 2013

1 × $6.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Advanced Trading Course with Edney Pinheiro

1 × $5.00

Advanced Trading Course with Edney Pinheiro

1 × $5.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

A Bull in China with Jim Rogers

1 × $6.00

A Bull in China with Jim Rogers

1 × $6.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

FMG Online Course with FMG Traders

1 × $6.00

FMG Online Course with FMG Traders

1 × $6.00 -

×

Future Energy with Bill Paul

1 × $6.00

Future Energy with Bill Paul

1 × $6.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00

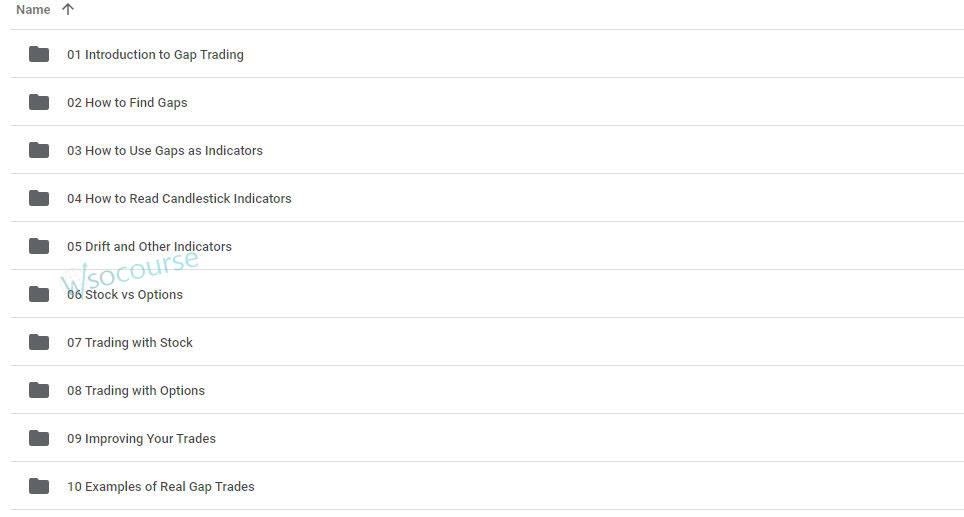

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.