-

×

Weekly Options Boot Camp with Price Headley

1 × $15.00

Weekly Options Boot Camp with Price Headley

1 × $15.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

SE ELITE COURSE with SE TRADINGX

1 × $5.00

SE ELITE COURSE with SE TRADINGX

1 × $5.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

Set and Forget with Alex Gonzalez - Swing Trading Lab

1 × $5.00

Set and Forget with Alex Gonzalez - Swing Trading Lab

1 × $5.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Money Management

1 × $6.00

Money Management

1 × $6.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Handbook on the Knowledge Economy with David Rooney

1 × $6.00

Handbook on the Knowledge Economy with David Rooney

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

Investing for the Long Term with Peter Bernstein

1 × $6.00

Investing for the Long Term with Peter Bernstein

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

Latent Curve Models with Kenneth Bollen

1 × $6.00

Latent Curve Models with Kenneth Bollen

1 × $6.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Trading Floor Training

1 × $6.00

Trading Floor Training

1 × $6.00 -

×

Trading Forex Exchange with Clifford Bennett

1 × $6.00

Trading Forex Exchange with Clifford Bennett

1 × $6.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

The Heart Friendly Butterfly Options Trading System Four Part Video Series with Seth Freudberg

1 × $78.00

The Heart Friendly Butterfly Options Trading System Four Part Video Series with Seth Freudberg

1 × $78.00 -

×

The Ten Most Powerful Option Trading Secrets with Bernie Schaeffer

1 × $6.00

The Ten Most Powerful Option Trading Secrets with Bernie Schaeffer

1 × $6.00 -

×

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

The 13-Week Cash Flow Model

1 × $15.00

The 13-Week Cash Flow Model

1 × $15.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Greatest Trading Tools with Michael Parsons

1 × $6.00

Greatest Trading Tools with Michael Parsons

1 × $6.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

Super CD Companion for Metastock with Martin Pring

1 × $6.00

Super CD Companion for Metastock with Martin Pring

1 × $6.00 -

×

Indicator Companion for Metastock with Martin Pring

1 × $6.00

Indicator Companion for Metastock with Martin Pring

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

Elliott Flat Waves CD with David Elliott

1 × $6.00

Elliott Flat Waves CD with David Elliott

1 × $6.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

All Access Online Trading Course with Steve Luke

1 × $6.00

All Access Online Trading Course with Steve Luke

1 × $6.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

The Stock Selector System with Michael Sheimo

1 × $6.00

The Stock Selector System with Michael Sheimo

1 × $6.00 -

×

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Read the Greed – LIVE!: Vol. II with Mike Reed

1 × $6.00

Read the Greed – LIVE!: Vol. II with Mike Reed

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

ApexFX Pro

1 × $5.00

ApexFX Pro

1 × $5.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00 -

×

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

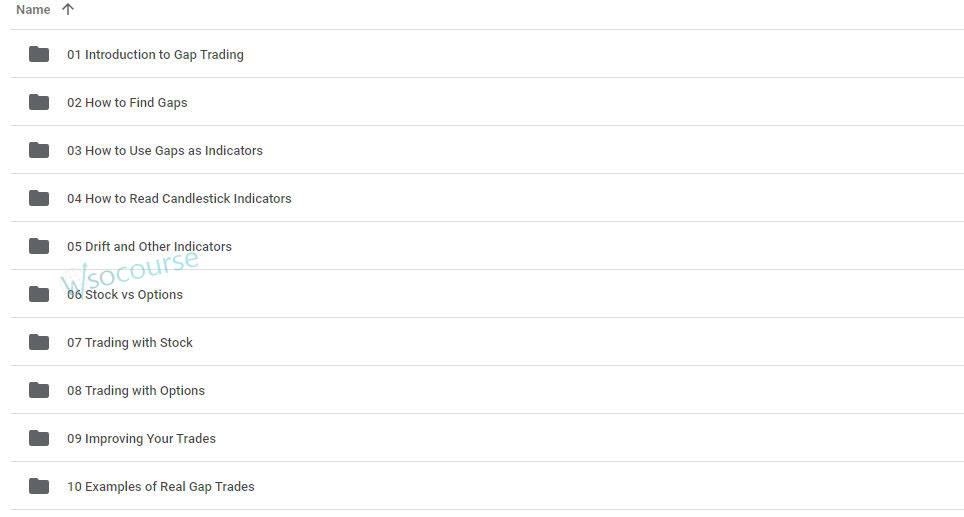

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.